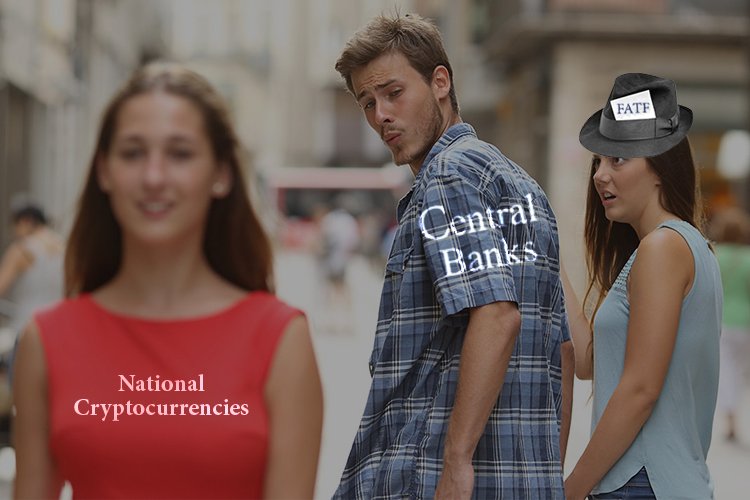

15 Central Banks Want To Get Into Crypto But FATF Won’t Let Them

According to the International Monetary Fund, at least 15 Central Banks are ready to introduce national digital currencies. According to IMF experts, new financial instruments can reduce, and subsequently replace, the turnover of cash. However, cryptocurrencies remain under suspicion among other international organizations. Officials, in particular, are concerned that they can be used to launder money and finance illegal military formations. The Financial Action Task Force (FATF) regularly issues recommendations and warnings regarding virtual assets. Moreover, earlier, such documents were non-binding, since the status of the organization did not imply any authority. Everything changed after September 11, 2001: a group of experts turned into an influential transnational economic institute controlling the financial transparency of the entire global market. The IT and the blockchain security expert Martin JANDA told Bitnewstoday.com whether FATF actions contribute to the development of the digital economy:

BNT: The role of international financial institutions in the economy is increasing every year. And even the status of a public organization such as that of the FATF is no longer an obstacle to the directive nature of the recommendations. Can we say that the national character of legal regulation gives place to the global one? Can FATF be called a new mega-regulator?

MY: No, I wouldn't say that. Currently, the Swiss Financial Market Supervisory Authority FINMA can be called the most active regulator of the digital asset market. It is especially active when this is so much the case of protecting the rights of investors. The German Financial Supervisory Authority is also active in this area, although not with such flexibility as the Swiss regulator.

FATF works more conceptually and tries to develop general guiding principles for combating money laundering and the financing of terrorism. Many countries with different legislative approaches to the crypto-market participate in the group’s work. For example, Japan, the member of FATF, adopted bitcoin as the official means of payment, and this did not bring out any negative emotions from international experts.

Maybe, these are double standards. How can one avoid them?

Here, it is important that FATF could apply sanctions only against those countries that do not comply with the agreed-upon rules. Moreover, only one measure is acceptable here: these states should be included in the list of countries that refuse to cooperate. In the past, getting shortlisted into the list of refusers motivated the authorities of many states to reconsider the legal basis of the financial market.

What are the drawbacks of the guiding principles of the regulation adopted in 2015 and concerning new digital currencies?

Generally, these are the rules that primarily affect payment service providers, such as stock exchanges. Regulated exchanges in the Member States must meet new requirements that ensure traceability of payment flows.

Contrary to the widespread belief, a cryptocurrency, such as bitcoin, is even more traceable than cash or electronic payments. For example, with electronic payments, the current account balance is always kept. After transferring funds from person A, two new account balances are created for person B. In the case of bitcoin transactions, not only the account balances become known, with Bitcoin, the transfer itself is saved. Everything else results from it, and traceability is easier in principle.

As for the new currencies, the developers are trying to eliminate their traceability. Such coins are more dangerous from the point of view of money laundering and financing of terrorism than bitcoin. Therefore, FATF has focused on the work of crypto exchanges, where mainly new virtual assets are turning, being converted either to bitcoin or to fiat currencies. It should be clear who works on the trading platforms, and whether payments are made for illegal purposes.

Can the work of FATF encourage or prevent the development of the digital market?

Such currencies as bitcoin are still waiting for mass adoption. But the high volatility of the crypto market discourages this process.

Another obstacle to institutionalization is the reputation of bitcoin as of a tool used by organized crime for their own purposes. This reputation is not justified, but it ensures that professional investors do not consider it as a reliable and clean asset. Of course, those who have at least a general idea of cryptocurrencies are not going to ban them, but in order to attract more attention from qualified users and large trading platforms, this sector of the economy needs to be regulated. Thus, the work of FATF will have a positive impact on the establishment of the digital market.

Virtual assets are still the platform for the so-called moonkids, speculators, and dreamers. But when bitcoin celebrates its “age of legal majority”, it will become noticeable for online stores too, and not just for the DarkNet. In the course time, we will see a lot of “signs of accepting bitcoin” at points of sale. Thus, civilized regulation will significantly improve the image of cryptocurrencies.