What is the Best Crypto Payment Gateway for Your Business?

As businesses continuously adapt to the evolving financial landscape, selecting the optimal crypto payment gateway becomes crucial. The increasing

prevalence of cryptocurrency transactions necessitates a meticulous exploration of available payment processing options. In the quest for identifying the best crypto payment gateway in 2023, several contenders emerge, each excelling in specific domains, ensuring diverse needs are met with precision and reliability.

To form an expert analysis, we’ve dived into the multifaceted realm of crypto payment gateways, dissecting the essential components of each provider to ascertain their prowess in various categories such as security, user experience, fees, and more.

Our opinions stem from an exhaustive analysis of each platform’s offerings, security protocols, user-friendliness, and overall reliability, to present you with a comprehensive overview that can guide you to make an informed decision that aligns with your business objectives.

A quick look at the best crypto payment gateways:

-

Best all-rounder: CoinsPaid

-

Best for accepting multiple currencies: Coinbase Commerce

-

Best for licensing and compliance with relevant regulation: Binance Pay

-

Best by integration and technical compatibility: Crypto.com

-

Best for security: Blockchain.com

-

Best for fiat settlements: Spectrocoin

-

Best by scalability and reliability: ALFAcoins

-

Best for merchant fees: Paystand

Q: What is a Crypto Payment Processor?

A: “A crypto payment processor is a tool or service that enables businesses to accept payments in cryptocurrency, such as Bitcoin. It converts the cryptocurrency payment into the local currency, if desired by the merchant, and facilitates the transaction, making it smoother and more secure for both the buyer and the seller...”

How does one choose the best crypto payment gateway?

When evaluating crypto payment gateways we considered a number of factors, including:

-

Ease of integration into existing sales channels

-

Transaction fees

-

Settlement options

-

Volatility protections

-

Number of coins supported

-

Additional features

While these options provide an easy, low-risk way to explore crypto as a payment method, you should consider this list a starting point for your own research.

Comparison of the best crypto payment gateways

|

Accepted Cryptocurrency Types |

Merchant Fees |

Licensing and compliance with relevant regulation |

End-user experience |

Integration and technical compatibility |

|

|

Coinspaid |

Comprehensive, with over 30 cryptocurrencies supported. |

As low as 0.8%. |

Licensed by the Financial Intelligence Unit of Estonia. |

Enhanced by user-friendly interface and 24/7 support. |

Extensive, customizable and tailored to individual business needs. |

|

Coinbase Commerce |

Multiple, including Bitcoin and major altcoins. |

1%. |

San Francisco — SEC regulated. |

A focus on convenience when it comes to withdrawals and deposits. |

Offers extensive integrations with e-commerce platforms. |

|

Binance Pay |

Multiple, including Bitcoin and major altcoins. |

Single transaction fee starting at $0.5. |

Holding company is based in the Cayman Islands, employs AML. |

User-friendly interface, smooth and intuitive experience. |

Compatible with various e-commerce platforms. |

|

Crypto.com |

Multiple, including Bitcoin and major altcoins. |

Zero transaction fees and 0.5% settlement fees. |

Based in Singapore, subject to MAS regulations. |

Well-designed interface, seamless navigation. |

Extensive integrations, compatible with Shopify and WooCommerce. |

|

Blockchain.com |

Primarily Bitcoin |

1% + $0.15 per transaction. |

FCA compliant, registered in the UK. |

A greater focus on security. |

Seamless integration experience, versatile for varied e-commerce platforms. |

|

Spectrocoin |

Multiple, including Bitcoin and Altcoins |

0% to 0.25% fee for each transaction. |

FCA compliant, registered in the UK. |

A focus on scalability, suitable for businesses of all sizes. |

Provides reliable services with features like auto-withdrawal and schedule options. |

|

ALFAcoins |

Multiple, including Bitcoin and Altcoins |

0.99% |

Registered in the Seychells, employs AML. |

Good customer-support with an intuitive and user-friendly interface. |

Easily integrates into websites or existing payment flow, with an API, widgets, and e-commerce plugins. |

|

Paystand |

Multiple, including Bitcoin and major altcoins. |

Zero-fee B2B payments platform |

FCA compliant, registered in the UK. |

Easy invoicing with good customer support. |

Compatible with a range of business tools: ERP, eCommerce, CRM, and accounting systems. |

Coinspaid: Best All-Rounded Cryptocurrency Payment Gateway

CoinsPaid stands out as the premier all-rounder in the crypto payment gateway sphere, blending versatility, security, user-friendliness, and regulatory compliance harmoniously. With over 8 years of experience, managing over €1 billion in monthly transaction volume, it supports over 30 cryptocurrencies and offers a competitive fee structure.

PROS and CONS

-

PROS:

-

Supports a wide array of cryptocurrencies.

-

Offers competitive fees as low as 0.8%.

-

User-friendly interface and 24/7 support.

-

Stringent security measures and adherence to regulations.

-

Extensive and customizable integrations.

-

CONS:

-

More suited for businesses looking for a comprehensive solution and may be overwhelming for those seeking simpler solutions.

Additional Info

Reputation: Established as the largest crypto processing gateway globally, with extensive experience and handling a monthly transaction volume of over €1 billion, showcasing widespread acceptance and utilisation.

Scalability and Reliability: Proven capability to handle a high volume of transactions, making it a scalable and reliable choice for businesses of all sizes looking to incorporate crypto payments.

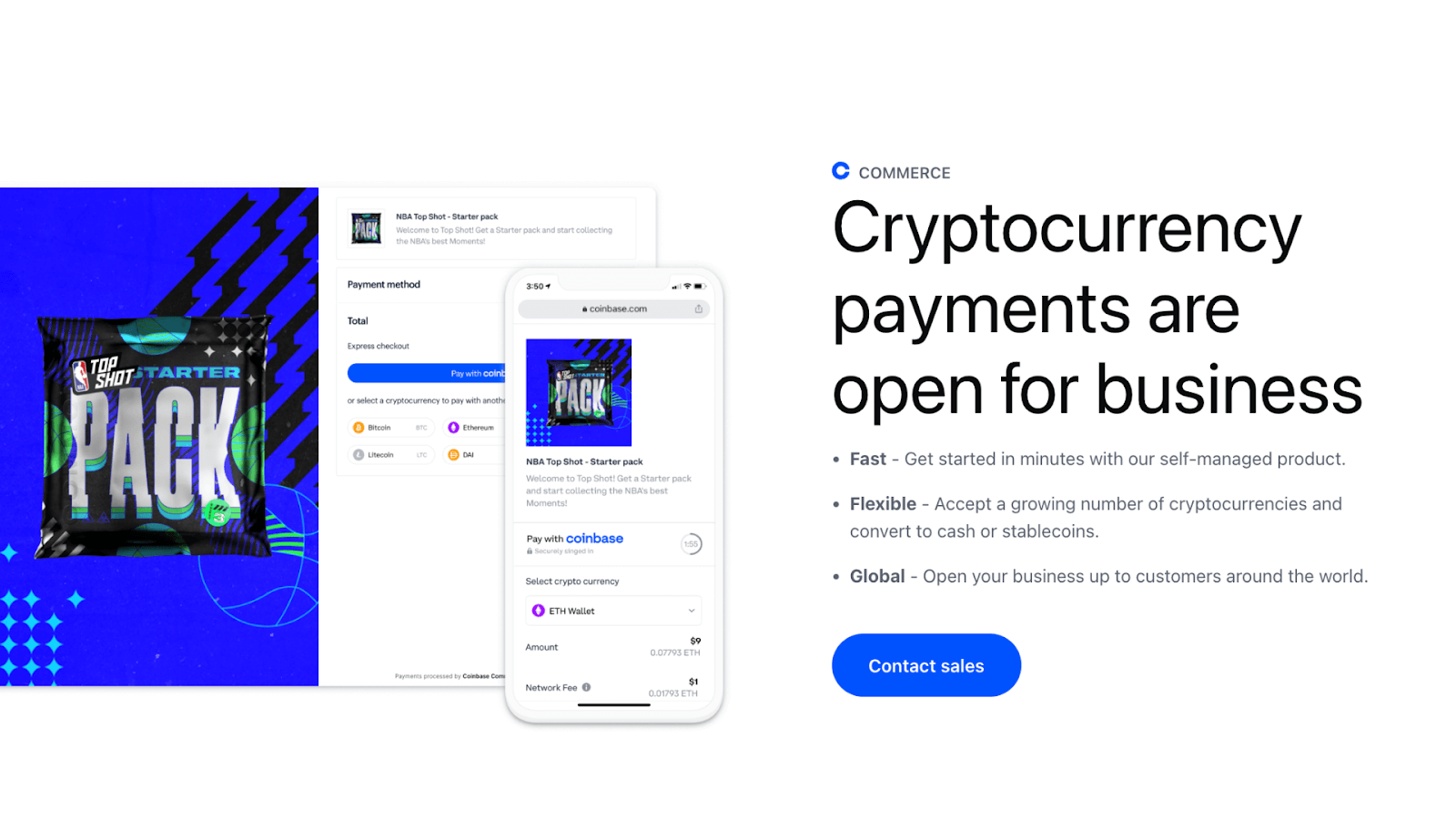

Coinbase Commerce: Best for Accepting Multiple Currency

Coinbase Commerce is a crypto payment gateway, backed by the renowned Coinbase exchange platform. It offers merchants the ability to accept multiple popular cryptocurrencies through an easy-to-use interface.

PROS and CONS:

-

PROS:

-

Broad Acceptance: Supports multiple popular cryptocurrencies.

-

User-Friendly Interface: Easy for both merchants and consumers.

-

Backed by Reputed Platform: Trust of being affiliated with Coinbase.

-

CONS:

-

Withdrawal Restrictions: Limited withdrawal flexibility in some regions.

-

Fees: Potential hidden costs.

-

Lack of Advanced Features: Suited mainly for basic e-commerce functions.

Coinbase Commerce Main features:

-

Supports multiple cryptocurrencies.

-

Intuitive user interface.

-

Backing of the established Coinbase exchange.

Additional interesting info: Despite its advantages, users should be wary of withdrawal restrictions and ensure clarity on any potential hidden fees.

Binance Pay: Best for Licensing and Compliance With Relevant Regulation

Binance Pay is integrated with the world’s largest crypto exchange, Binance, focusing on ensuring regulatory compliance across various jurisdictions while offering vast cryptocurrency support.

PROS and CONS:

-

PROS:

-

Regulatory Compliance: Adheres to standards in multiple areas.

-

Extensive Cryptocurrency Support: A wide range of cryptocurrency options.

-

Integrated With Binance Ecosystem: Smooth functionality.

-

CONS:

-

Regulatory Scrutiny: Binance has faced scrutiny in several countries.

-

Limited Merchant Adoption: Still expanding its merchant network.

-

Platform Changes: Regular updates can be perplexing to some.

Main features:

-

Comprehensive regulatory compliance.

-

Wide array of cryptocurrency support.

-

Integration with Binance, the global crypto giant.

Additional interesting info: The platform’s focus on compliance makes it a reliable choice, but users should be aware of the ongoing regulatory scrutiny Binance faces in some countries.

Crypto.com: Best by Integration and Technical Compatibility

Crypto.com provides a holistic platform that emphasizes easy integration and technical compatibility. It offers a versatile API, making it user-friendly for businesses looking to onboard crypto functionalities. The platform also features regular updates, introducing new tools and features for its user base.

PROS and CONS:

-

PROS:

-

Versatile API: Simplifies business integration.

-

Broad Ecosystem: Connects with various services, cards, and platforms.

-

Frequent Updates: Continual evolution and feature addition.

-

CONS:

-

Learning Curve: The initial setup can be somewhat intricate.

-

Fees: Transaction fees might be on the higher side.

-

Availability: The platform isn’t accessible in every jurisdiction.

Main features:

-

Flexible API for seamless integration.

-

Comprehensive ecosystem encompassing various services.

-

Regular and meaningful platform updates.

Additional interesting info: Though lauded for its integration capabilities, newcomers might find the initial setup challenging. Users should also be vigilant about potential fees.

Blockchain.com: Best for Security

Known for its robust security features, Blockchain.com is one of the crypto industry’s pioneers. The platform prioritizes encryption and top-tier security measures, ensuring user assets are safe from potential threats.

PROS and CONS:

-

PROS:

-

Advanced Security: Incorporates leading encryption and security protocols.

-

Reputation: Esteemed as one of the crypto world’s most trusted entities.

-

Transparent Operations: Open about their security measures and operational updates.

-

CONS:

-

User Interface: Might not be user-friendly for all.

-

Limited Support: Supports a narrower spectrum of cryptocurrencies.

-

Wallet Concerns: Past reports highlighted wallet-related issues.

Main features:

-

Superior encryption and security standards.

-

Stellar reputation built over the years.

-

Transparency in all operational aspects.

Additional interesting info: While Blockchain.com is heralded for its security, potential users should be aware of the platform’s limited crypto support and past wallet concerns.

Spectrocoin: Best for Fiat Settlements

Spectrocoin excels in providing swift conversions from cryptocurrency to fiat. With a focus on multi-currency support, it seamlessly integrates with bank cards, making fiat withdrawals straightforward for users.

PROS and CONS:

-

PROS:

-

Quick Fiat Conversions: Efficient crypto-to-fiat processes.

-

Multi-Currency Support: Broad support for both fiat and cryptocurrencies.

-

Bank Card Integration: Facilitates easy fiat withdrawals.

-

CONS:

-

Fees: Conversion and transaction fees can be steep.

-

Availability: Absent in certain countries.

-

User Experience: Some users pinpoint issues with platform UX.

Main features:

-

Rapid fiat conversion mechanisms.

-

Broad spectrum of fiat and cryptocurrency support.

-

Smooth bank card integrations for withdrawals.

Additional interesting info: While Spectrocoin is a go-to for fiat settlements, users should be prepared for potential high fees and check the platform’s availability in their respective countries.

ALFAcoins: Best by Scalability and Reliability

Prioritising reliability, ALFAcoins ensures a stable service with minimal interruptions. Tailored for businesses, it offers scalable solutions capable of handling significant transaction volumes, all while supporting a variety of popular cryptocurrencies.

PROS and CONS:

-

PROS:

-

Consistent Uptime: Highly reliable with little to no downtime.

-

Scalable Solutions: Accommodates large transaction volumes seamlessly.

-

Multi-Coin Support: Supports a variety of prominent cryptocurrencies.

-

CONS:

-

User Interface: Might seem outdated to some users.

-

Adoption: Less recognition compared to competitors.

-

Limited Additional Features: Mainly concentrates on core services.

Main features:

-

High uptime for consistent service.

-

Scalable transaction solutions.

-

Support for multiple popular cryptocurrencies.

Additional interesting info: While ALFAcoins stands out for its reliability and scalability, users should familiarise themselves with its interface and assess if the platform’s features align with their needs.

Paystand: Best for Merchant Fees

Paystand shines in the realm of merchant fees, boasting a competitive pricing structure. The platform emphasises easy integration with various e-commerce setups and provides flexibility in payment options, including traditional bank transfers.

PROS and CONS:

-

PROS:

-

Competitive Pricing: Attractive fee structures for merchants.

-

Seamless Integration: Smooth interfacing with different e-commerce systems.

-

Flexible Payment Options: A range of methods including bank transfers.

-

CONS:

-

Market Presence: Lesser-known in the broader crypto community.

-

Support: Limited support for diverse cryptocurrencies.

-

User Feedback: Some report challenges with customer service.

Main features:

-

Attractive merchant fee structures.

-

Effortless integration mechanisms.

-

A variety of payment options, including bank transfers.

Additional interesting info: While Paystand offers competitive fees, potential users should consider the platform’s limited cryptocurrency support and be prepared for possible customer service hiccups.

Final thoughts

In a rapidly advancing digital age, the imperative to integrate secure, efficient, and user-friendly crypto payment solutions is more pressing than ever. This article has endeavoured to provide an encompassing view of the prevailing top contenders in the crypto payment gateway sector, each excelling in distinct areas, be it integration, security, user experience, or scalability. CoinsPaid unmistakably stands out as a multifaceted all-rounder, merging economical fees with seamless utility and stringent security, providing a balanced, holistic solution for businesses.

However, the selection ultimately hinges on individual business needs, preferences, and the specific requisites of their operational models. It is paramount for businesses to weigh each option against their unique requirements, ensuring the chosen solution aligns seamlessly with their goals, operational ethos, and customer base. In this diverse and dynamic landscape, informed, and discerning choices will empower businesses to leverage the myriad benefits of cryptocurrencies, fostering growth, innovation, and financial inclusivity.