Third wheel

Anticipating the future

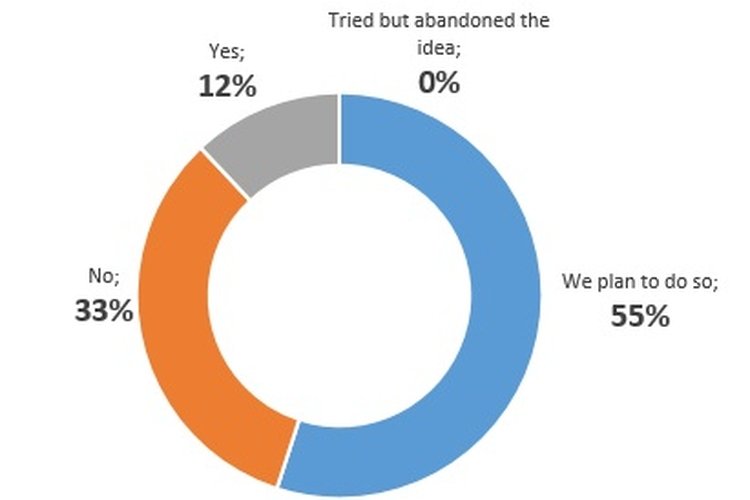

Almost 12% of the Russian finance companies interviewed by the Bitnewstoday.com analysts have noted that they are already implementing blockchain projects in their business. A bigger part – 55% of the respondents are only assessing the technology and plan to use it in the near future. And, lastly, 33% of the companies have not yet found where they can practically apply the DLT.

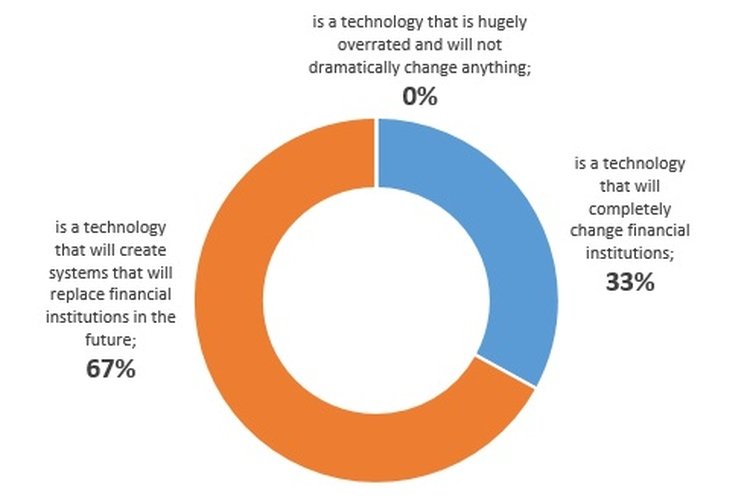

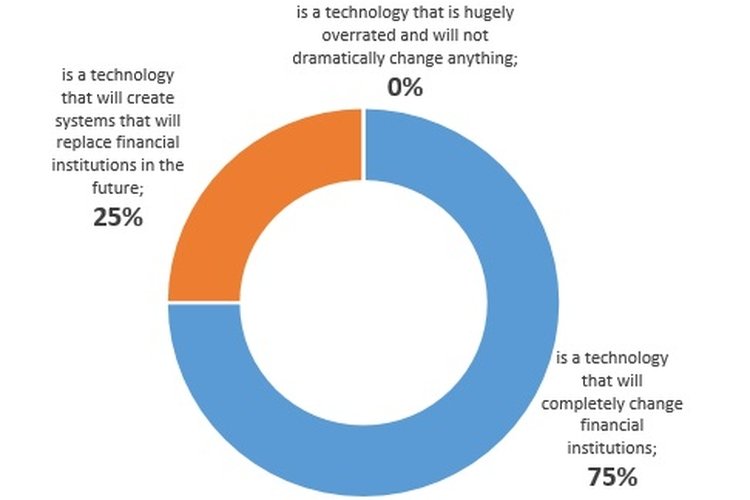

Of all interviewed financial organizations 67% believe that the blockchain is a technology that will allow to create systems that can replace financial companies in the future. However, only 25% of those who develop and implement blockchain projects share this view, mostly thinking that the DLT would accelerate the development and transformation of the banks, MFIs, insurance etc.

Expectations’ cost price

Today, all the efforts of developers and businessmen are focused on understanding the processes and ways for blockchain to change the picture. Head of Sberbank of Russia German Gref believes that this technology implementation in business processes would stimulate positive changes not only in separate sectors, but in the overall state economy as well. “Blockchain in NPFs will reduce the cost prices of internal processes, give an opportunity to reach more work transparency both for regulative bodies and insured parties, minimize risks of single points of failure, protect the data from unauthorized change or removal, from forgery, and ease the verification process. And there is more: the database will exist as long as at least one node exists,” explains board member of a non-governmental pension fund called Soglasiye, Andrey Neverov.

Experts note the importance of distributed ledgers in the clearing organization for banks. According to Mikhail Ezhov, who is a co-founder of the blockchain voice recognition and verification service titled Anryze, the blockchain tech can automatize the clearing process between banks and brokers, effectively cutting the middleman. “But nobody has been able to do this yet. Brokers and banks have different software written on different languages. The universal solution implementable everywhere at once is yet to be found,” the expert told.

Diagram 1 Distribution of the responses from the financial corporations to the question: “From your point of view, blockchain…”

Diagram 2 Distribution of the responses from the blockchain community participants to the question: “From your point of view, blockchain…”

Diagram 3 Distribution of the responses from the financial corporations to the question: “Have you already implemented blockchain in your line(s) of business?”

Effective implementation

When it comes to blockchain implementation in Russia, the pilot joint project of S7 and Alfa Bank on payment under the letter of credit with the use of the Smart Contracts technology is worth mentioning. The national settlement depository has created a prototype of electronic vote on the blockchain. The Russian association called Fintech is developing a Masterchain blockchain platform that stores financial data and provides means of its exchange. The Moscow Stock Exchange has become the participant of the international blockchain consortium called Hyperledger (headed by Linux Foundation). The Association of NPFs and the Vnesheconombank have signed an agreement, one of the terms of which is the joint development of technical blockchain application in individual pension funds.

However, there is yet not many examples of practical use of this technology, both in Russia and in the world. Dmitriy Lazarichev, co-founder of Wirex, connects this to the fact that blockchain is still very young – and it will take years to fully implement it in financial sphere. “One of the most advanced project is SBI Ripple Asia, in which the Japanese and South Korean banks use tokens for mutual accounting, that allows them to make a 30% saving on transaction costs. Other projects are still in the POC (proof-of-concept) stage, e.g. R3, IBM, Hyperledger,” the expert notes.

Specialists believe that the beginning of commercial exploitation of blockchain projects is not coming soon. Experts certain that the impetus for the blockchain development in the Russian banking sphere will be the expansion of the R3 blockchain consortium with its Corda platform to the Russian market. It should be reminded here that at the press time, only one Russian company is a member of this consortium – the QIWI payment system.

Most interviewed experts believe that almost all current Russian projects are pilot and so it’s too early to assess the results of these projects.

“Talks about the implementation of blockchain in the Russian financial sector are synonymic to the theme of sex in puberty – everybody heard about it and actively discuss it, but alas, there are no examples of real practical experience yet,” states official representative of AlfaStrakhovanie, Yury Nekhaichuk.

“Generally speaking, the implementation of blockchain in Russia and, in particular, in finance sphere, is being hampered by the lack of trust to the world’s or Western cryptographic algorithms, of legislation, of professionals in this field, by the finance company precariousness, and, I think, by the underdevelopment of the technology itself,” comments Alexander Azarov, Senior Vice President of Engineering in WaveAccess.

Philosophical aspect

However, many projects are unviable from the concept stage, experts believe, as developers try to use the blockchain to solve the problems which cannot be solved only by adding a distributed ledger. For instance, blockchain has disadvantages in comparison with other centralized solutions, with solutions that require high performance and with solutions that automatize production and integrate with external services/devices.

When we look at the failed financial blockchain projects, they all have the low quality of elaboration as a primary reason of project downfall. Those projects were often created by crypto enthusiasts who had very superficial knowledge of finances and economy. In addition, most lacked the big project management experience. Almost all interviewed experts believe that blockchain, as it develops more and more, would be able to fundamentally change the philosophy not only of financial corporations, but of the whole finance sector. The market members which will not be able to rebuild their business in line with the challenges of our time will eventually die out. Processes in which 3rd parties are involved will start to transform as well.