The Future of Financial Transactions: Trends in Crypto Security

Bitcoin, the first cryptocurrency, was created in 2009. Ever since, cryptocurrencies have exploded in popularity, so much that they are now worth over $1 trillion, collectively speaking. In over a decade, digital coins transformed from novelties to technologies with the potential to disrupt — and secure the financial system as we know it. Nowadays, the world seeks to capitalize on the technology that powers the crypto coins to secure their transactions.

To the proponents, cryptocurrencies are a force of decentralization, wresting the power of control and money creation. At the same time, regulations keep changing worldwide, with some governments already embracing the digital coin, while others are banning — or limiting their use.

In reality, digital currencies are gaining the upper hand over traditional coins thanks to the involvement of technology. With the rise of digital assets, keeping one’s investments secure is paramount. Seeing how the blockchain market is predicted to skyrocket to $164 billion by 2029, it’s about time to tackle the trends that are shaping up in crypto security, promising to protect your wealth.

Cryptocurrencies and FinTech: understanding the connection

The popularity of cryptocurrencies stems mostly from their nature — that is decentralization, of course. Crypto coins can be transferred anonymously, quickly, and securely, even across borders and without the need to involve financial institutions like banks.

Cryptocurrency is a decentralized currency that relies on cryptography and is entirely digital. It operates on blockchain technology, a transparent and decentralized ledger that records every transaction.

FinTech or financial technology, on the other hand, relates to anything that uses technology within the industry to take us away from the manual tasks and processes we traditionally used, allowing us to have our finances at our fingertips at all times.

FinTech includes everything from online banking to digital payments to blockchain-based solutions.

Crypto security trends in financial transactions: today and tomorrow

There are many crypto security trends in the making, but some are more prominent — and promising than others. With that in mind, here is how crypto security is paving its path into the financial world — and the trends that will affect it.

Anti-money laundering

Anti-money laundering is a collection of regulations and prevention concepts to monitor and more importantly, prevent financial crime. It is applicable both in fiat and cryptocurrency and is one of the biggest trends nowadays.

Also known as AML software, there are software solutions designed to help companies not only secure financial transactions but also meet all the legal requirements imposed on them. As you probably know already, the laws are changing every day, and the restrictions are becoming more serious and numerous than ever — with penalties that can easily break even the strongest of companies.

Important features of anti-money laundering include customer identification, compliance management, and the ability to monitor transactions. Today, AML software providers are increasingly popular in the form of compliance aid, especially in payments and fintech.

In short, AMLs assist users by telling them when a customer is lying, therefore preventing all kinds of risks that come with digital transactions.

Quantum-resistant cryptography

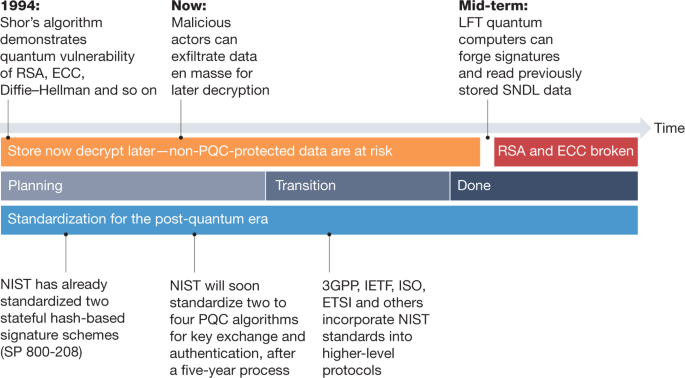

Quantum-resistant cryptography can protect data from threats. While this is a relatively new find in the field of computing, it has been gaining quite the momentum in recent years. Quantum-resistant cryptography dates back to the early 1980s and its main concern is the ability to break asymmetric public key cryptographic systems using a special algorithm (Shor’s). If done properly, this action can enable a computer to find prime factors faster than most other methods.

For the longest time, traditional methods and normal computers weren’t able to achieve this, making quantum-resistant cryptography one of the biggest trends of today.

In reality, there’s a fortune and tons of assets being invested into quantum computing, but we aren’t very close to seeing such computers in use shortly. Even so, the US Department of Commerce’s National Institute of Standards and Technology, or NIST has already selected the first group of encryption tools designed to withstand the assault of one such computer. The idea is to see if the computer can crack the security used to protect privacy in our daily digital system, more specifically the most high-risk systems such as banking or email software.

“Thanks to NIST’s expertise and commitment to cutting-edge technology, we are able to take the necessary steps to secure electronic information so U.S. businesses can continue innovating while maintaining the trust and confidence of their customers.” — said Secretary of Commerce Gina Raimondo during the announcement.

Enhanced smart contract auditing

The digital age has brought us amazing options, especially when it comes to financial transactions. Connectivity and speed have never been more accessible, but there is a dark side to this growth, too — the threat of cybercrime. Regardless of how hard financial institutions and companies try to defend themselves, criminals always seem to find a way to target them. According to recent reports, cybercrime will cost our world $10.5 trillion annually by next year.

At this point, many are highly reliant on smart contracts as efficient and transparent ways to do business. However, smart contracts might be easy to implement, but they come with tons of vulnerabilities that cybercriminals just love to exploit!

With that in mind, one of the major trends in financial transactions and cryptocurrency is smart contract auditing. The idea is to prevent criminals who take advantage of loopholes and bugs in smart contracts from ruining one’s reputation or stealing their money.

Smart contract auditing is the health check of digital agreements, carried out by experts that root out any bugs or other potential weaknesses in the code. This meticulous process is becoming more popular with every passing minute, seeing how it is the best way to boost blockchain security and build trust among investors, consumers, and regulators.

Biometric authentication

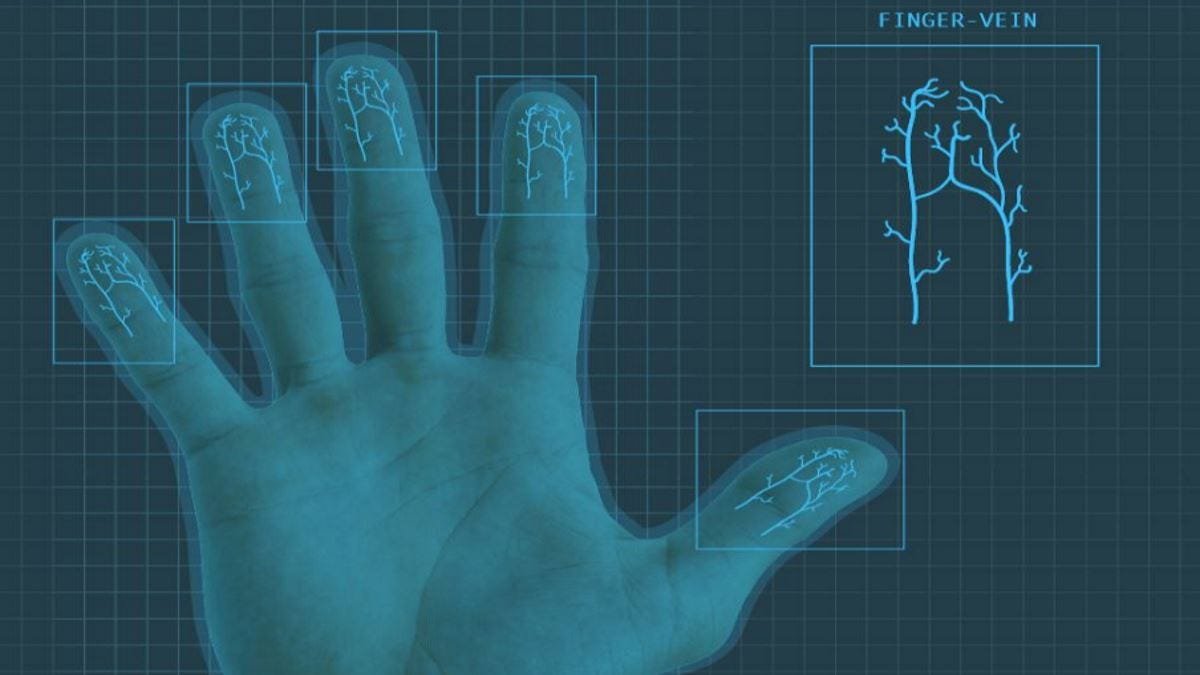

Biometric authentication is a cybersecurity process where we verify the user’s identity using biological traits. The biometrics used today can include everything from a fingerprint to a retina scan to a voice scan to other facial features. The systems for biometric authentication store the information and use it to identify the user’s identity when someone tries to access the account.

This type of authentication stands right beside multi-factor authentication, which the world has practiced for some time now. Some argue that it is a more advanced, more secure option. Biometric authentication has developed so far today, that there are different types of authentication methods used to beat cybercrime.

Today, not only do we have facial recognition or fingerprint recognition. We also have gait recognition, referring to the way that someone walks. This can be used to identify a person seeing how each person has a unique walk.

Another novelty is vein recognition, which uses the pattern of blood vessels in the person’s finger or hand for identification. This method has proven itself to be more accurate than retina recognition.

Another trend in this field is multimodal biometric authentication. Just like two-factor authentication requires more than one piece of data to access information, this form of biometric authentication verifies more than one distinct characteristic.

For instance, if a hacker finds a person’s photo online, they can use it to trick a facial recognition system. But, if the system uses a multimodal biometric authentication instead of an unimodal one, the hacker will need to provide an additional authentication, adding an extra layer of security.

Improved interoperability

The lack of compatibility and interoperability between different crypto networks is a significant challenge and addressing it has become the focus of many professionals today. Experts are now working on improving interoperability i.e. the ability of different cryptocurrency networks to transact and communicate with each other. Lack of such operability hinders the free flow of data and assets and limits the potential of these networks.

Some of the methods currently tried and tested to improve interoperability include:

-

Cross-chain bridge protocols that use cryptographic techniques to ensure the integrity and security of transferred assets

-

Atomic swaps which ensure decentralization and reduce the risk of hacks.

Conclusion

The growth of crypto is undoubtedly on the rise and is most likely to continue to progress. Companies are already witnessing the adoption of this modern technology at scale. Today, we are witnessing a rise in companies that experiment with novelties like ‘tokenization’ to encrypt their digital assets and secure their transactions, though it is still early to talk about the results.

This doesn’t end here, though. Banks are now using blockchain for universal customer identification and fingerprinting, all thanks to its decentralized nature. Blockchain is slowly included in the process of verifying firmware updates or preventing attempts to install malware.

While the future of crypto in the financial industry is uncertain, one thing is clear — the trends are here to stay.

Author bio:

Nadica Metuleva is a senior content writer with experience of over eight years in the freelance market. Her specialty is blog posts, listicles, and articles in the business, SaaS, gambling, and lifestyle niches. Over the years, Nadica has deepened her understanding of SEO strategies and developed a passion for storytelling. She holds a Master’s Degree in English Literature and Teaching and speaks four languages. You can find her on LinkedIn.