Triffin Dilemma Or Why US Is Resisting Virtual Currencies

Virtual assets threaten the dollar. This thought does not seem new. Not least because the problems of the world reserve currency are topics of hype for economists and political analysts of different qualifications from many socio-political strata. If we listen to them, everything threatens the dollar. Digital money as well. And yet...

Those who have ever been involved in global finance are familiar with the phenomenon of the Triffin Dilemma. That is: the US Federal Reserve System is forced to supply the Central Banks of other countries with dollars in order to provide it with the status of a world reserve currency. At the same time, they cannot print more money than the US GDP allows since the dollar is also a national means of payment. Consequently, by providing other countries with its own monetary units, the United States is experiencing a constant deficit balance of payments. Which, in turn, brings discredit to the dollar and stimulates inflation.

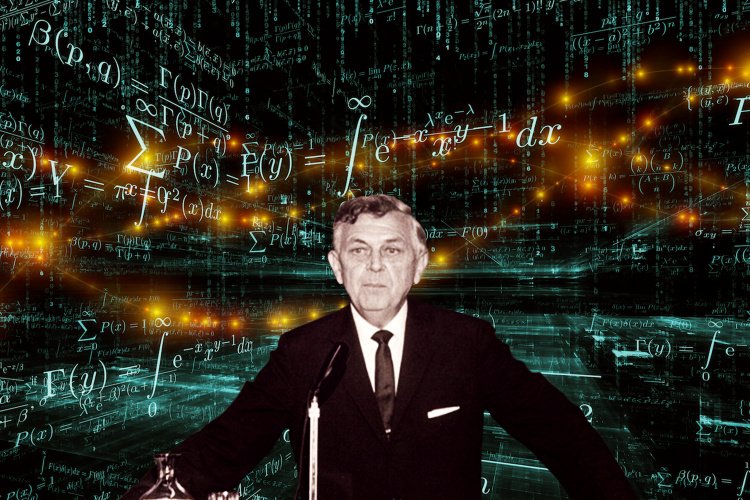

For the first time, this economic phenomenon was described by the American economist, Yale University professor Robert Triffin in the early 60s last century and named after him. Since then, the monetary authorities around the world have been trying to solve it.

The fact that the dollar is the world's reserve currency has been determined by the Bretton Woods Agreement. The whole of today's global financial system is based on it. At the same time, from 2001 to 2017, the purchasing power of the American currency decreased by 30%. And it continues to fall. Despite the relatively low level of inflation, an average of 2-3% per year. The credibility of the national currency inside the country is shattered. At the same time, the government continues to pump up other economies with its money. The deficit balance of payments within the country reached $123,3 billion last year.

But the external market, with the development of the economy, is also experiencing the deficit of dollar liquidity. Again, last year, the value of the cross-currency basis for the dollar was -25.9 points. This means that the American money is not enough for reserves. Moreover, the runoff of the US currency from the global financial system has only increased. And the liquidity ratios in 2018 are likely to be even worse. Experts associate this with the tax reform of Donald TRUMP, who wished to return the investments to the US economy. It is assumed that the White House initiative will bring more than $2,5 trillion.

It is easy to understand the US president. Trump was raised in a large but still national business, not transnational one. Naturally, he aims at protecting the economy of his country because he experienced the cash deficit in the home economy first-hand. But what about the rest of the world?

Economists foresaw this development. In 1969, the International Monetary Fund issued its own supranational payment unit “Special Drawing Rights” (SDR). It is a prototype of digital coins. By the way, this financial instrument still exists. But all the authority of the IMF could not give it the value. Only 14 international organizations, including the IMF, keep scores in the SDR, and only three countries anchored their national currencies to this asset.

At the same time, China was the first who suggested pumping SDR with liquidity and replacing the dollar with it. It happened at the very beginning of 2009. Then, nobody supported the memorandum of the Central Bank of the Celestial Empire. And by a strange coincidence, at the same time, the first digital currency appeared on the market. December 31, 2008, was declared the official birthday of Bitcoin.

It can be considered a coincidence or a conspiration - the essence does not change. In the global economy, there is a demand for a supranational non-state asset that has a natural value. Digital currency could become such a tool. And this is a direct macroeconomic threat to the dollar.

It seems that since then the US has been doing everything possible to ensure that virtual assets remain in the marginal economic space. Hence the far-fetched suppositions made by the representatives of American and world regulators about the possibility of financing terrorism and laundering of proceeds gained by illegal means using digital coins. Never mind, in the vast majority of cases, both occur in fiat money, dollars or euros in particular.

Here, you can argue that the digital market is too small to compete with the world reserve currency. Only a little more than $200 billion. But here, it is not its amount that is dangerous, but the idea and technology itself. As soon as there is even the slightest opportunity for virtual money to become a reserve asset, their liquidity will be pumped up within a matter of months. And America will, probably, have only to recognize the collapse of the Bretton Woods system.

That is why the United States is fighting for digital markets. More precisely, for the fact that they will not exist.

The transformation of virtual money into a reserve asset can happen only in one case - with the accumulation of social capital, the growth of institutionalization, and the qualitative value leap. In other words, if digital coins are used by at least a billion people on the planet, if large supranational and transnational structures and companies use them, it will be impossible to stop their attack on the dollar economy.

So, 50 years later, the Triffin Dilemma makes the most technological power in the world resist the technological progress. Thinkers say the truth: one paradox, as a rule, gives rise to the next. But this is the secret of development. According to the theory of Charles Darwin in the modern interpretation: all evolutionary changes were the result of mutations, and only useful ones were preserved and gave rise to new species. It appears that this law is applicable to the economy too.