The Philippines Ushers in Crypto Innovation With New Regulatory Framework

Cryptocurrencies have taken the global economy by storm, with governments grappling with whether to issue their own digital currencies or ban the risky assets altogether. In February, the bitcoin price attained a new all-time high of more than $52,000, while the market capitalization of the broader cryptocurrency market has now exceeded $1 trillion, which has caught the attention of institutional investors and government officials alike.

And while the United States has been accused of sticking its head in the proverbial sands about crypto regulation, the Philippines is tackling the issue head-on, with the country’s central bank, Bangko Sentral ng Pilipinas (BSP) having crafted a regulatory framework for companies operating in this space. The BSP along with the country’s Securities and Exchange Commission (SEC) are responsible for the oversight of cryptocurrencies. Meanwhile, despite the rapid adoption of digital currencies in the Philippines, some experts argue that the advancements made in the Southeast Asian country do not make it a case study in bitcoin.

The new rules widen the activities that require the relevant licensing by the central bank from only entities that support the exchange of fiat currencies and virtual assets to additional business models and activities. With the update, more activities are now subject to the same central bank standards for licensing and regulation surrounding anti-money laundering and counter-terrorism requirements, including the following:

- “exchange between one or more forms of virtual assets”

- “transfer of virtual assets”

- “safekeeping and/or administration of virtual assets or instruments enabling control over virtual assets”

The BSP maintains that these standards are in line with the Financial Action Task Force (FATF), which is a terror/finance watchdog. The idea is so that there is no weak link in the chain of virtual asset transactions because all of the parties will be subject to regulation, according to BSP Governor Benjamin E. Diokno.

In addition, cryptocurrency service providers who are registered with the BSP to operate in the space, which incidentally is not an easy task to achieve, must also comply with other regulations designed for money service business, including the following:

- Outsourcing

- Liquidity risk management

- Operational risk management

- IT risk management

- Financial consumer protection

One Step Forward, Two Steps Back

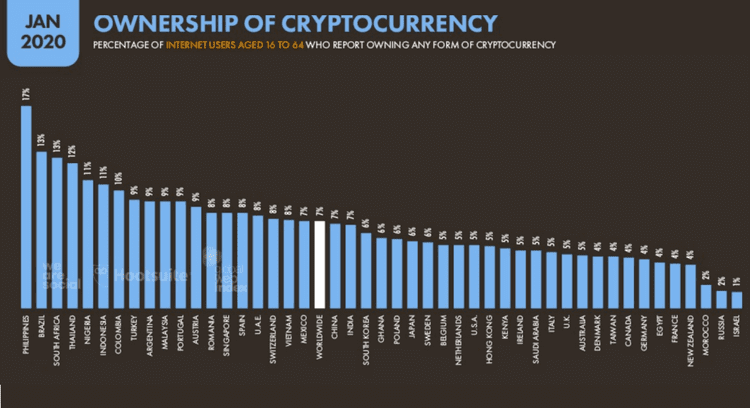

Cryptocurrency ownership is extremely prevalent in the Philippines. In fact, no other country in the world has higher ownership of digital currencies than the Philippines, which according to research firm Messari is a function of the country’s strong dependence on global remittances. Rather than using the market for speculation, the segment of the Filipino population that has turned to cryptocurrencies largely comprises people living in urban regions, wealthy professionals and people who use the blockchain to send money transfers.

While remittances represent 10% of GDP in the nation, roughly three-quarters of the population are without a bank account. Blockchain technologies and cryptocurrencies have helped to fill this gap, with the average remittance fees for cryptocurrency exchanges hovering at 30-50 basis points.

Source: Messari

Meanwhile, the cryptocurrency market remains a nascent industry despite the fact that it has grown hand over fist of late. As a result, companies and projects across the ecosystem are still working out some of the kinks that come with an emerging technology and the Philippines is no exception.

In February, cryptocurrency exchange PDAX, which caters to Filipinos, experienced a technical glitch that saw the trading platform sell bitcoin at a steep discount at about $6,000 when the flagship cryptocurrency was actually trading at $48,000 at the time. The exchange blamed an “unprecedented surge in transactions” in recent months, which caused the exchange to experience maintenance issues that led to the discrepancy in the price. The exchange determined that most of the transactions that occurred during this period were invalid, which has many of its users crying foul.

Food-Security Crisis

The Philippines is in the middle of a food-security crisis and has the dubious title as having the most “food insecure” population in the Southeast Asian region. According to CNN Philippines, millions of households in the country can’t afford healthy meals. There is a gap in the pork supply, which is a staple in the Filipino diet, as farmers lack the necessary support to help end hunger in the country.

Meltem Demirors, chief strategy officer at digital asset investing firm CoinShares, in a recent tweet said that countries like the Philippines as well as Venezuela and Turkey can’t be used as a “case study for bitcoin.” She pointed to “economic crisis, political turmoil, food security and other humanitarian issues” as the reason.

Source: Twitter

Conclusion

The crypto regulations in the Philippines are meant to nurture innovation. Asia is already a hotbed for crypto activity, and the decision by the BSP to provide further regulatory clarity to blockchain startups could attract more talent and create more jobs in the Philippines, whether or not it’s a case study for the rest of the world to emulate.