Mining in Venezuela: Huge profits with the risk of being arrested

Today’s mining hardware has evolved so much that ASICs farms are needed in order to gain a decent profit from bitcoin mining. With these developments, the electricity that is necessary to mine has exploded in a similar fashion to bitcoin’s price.

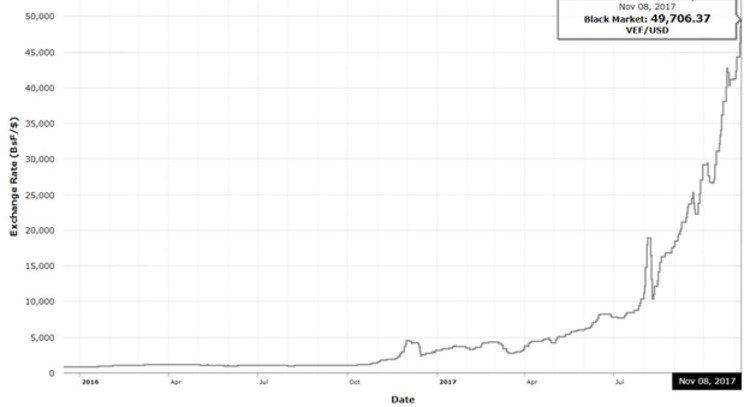

Mr. M came to Venezuela to build a mining farm when news about the wonders of cryptocurrency hadn’t reached the Caribbean country. It started with a couple of GPU rigs Mr. M kept in his office, and it developed into a whole farm he now has to maintain in the middle of nowhere (for a reason you will find out below). Initially, this seemed like an incredible idea. Electricity prices in Venezuela are very cheap, gasoline prices are even cheaper (Fig.1), and the exchange rate for the Venezuelan Bolivar against any other currency, is even more unbelievable (Fig.2).

| Price in Bs.F | Price in $* | |

|

Electricity (200 kWh residential) |

Bs.F 101.49 | $0.002 |

|

Electricity (200 kWh commercial) |

Bs.F 151.88 | $0.003 |

| 91 oct. fuel (10 lt.) | Bs.F 10.00 | $0.0002 |

| 95 oct. fuel (10 lt.) | Bs.F 60.00 | $0.001 |

Fig. 1

*11/Nov/17 rate

Fig. 2

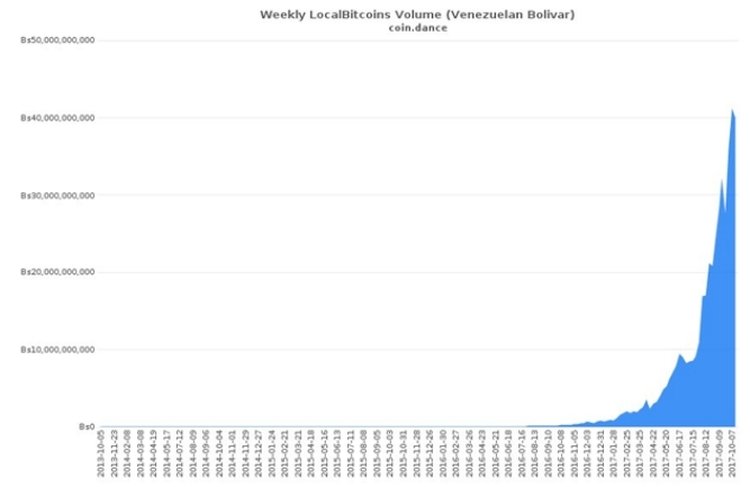

The problem arose when crypto hype finally got the attention of his compatriots. To this day, bitcoin adoption in Venezuela continues to rise at an incredible pace. From June to September this year, the trading volume in LocalBitcoins Venezuela has quadrupled, from around 9 billion Bs.F to 40 billion Bs.F (Fig. 3). Cryptocurrencies have become a safe and lucrative investment in an economy ravaged by a so-called socialist revolution. The rapid devaluation and hyperinflation of the Venezuelan Bolivar have made cryptocurrencies one of the main stores of value for Venezuelans looking to hedge their losses in an economy that is suffering from a tragic nose-dive with no clear signs of recovery. But this has also made crypto mining operations and crypto owners a very vulnerable victim for corrupted government officials and security forces in a country characterized by an almost complete lack of rule of law. This is the reason Mr. M now keeps his mining hardware as hidden as he can.

Fig. 3

There have been numerous cases of miners that have gone to jail because of fake charges against them. Mr. T and his two associates are a striking example. They ran a decent mining operation in the second biggest city in Venezuela; they were all young Economics students from middle-class families. One day the Bolivarian National Intelligence Service (SEBIN) appeared in the small warehouse where they kept their hardware, took away all their miners charged them with money laundering and violation the exchange control laws.

Picture sent by the author of the article

There was no criminal proceeding or court case after this. Mr. T was able to flee the country in time to escape arrest but his two associates weren’t as lucky. I personally saw their equipment and know the source of their initial capital. They all asked their hard-working families for loans in order to buy the equipment that was illegally taken from them.

There are no laws regulating crypto markets or mining in Venezuela, nonetheless, the Bolivarian Intelligence Service (SEBIN) and the Body of Scientific, Penal and Criminal Investigations (CICPC) keep a close eye to spikes in electricity consumption in the electrical grid in order to track mining operations. Then, they proceed to either extort the owners or make charges against the owners in order to receive money in exchange for their freedom or the mining hardware itself. Mr. M hid his equipment in a rural area of the country after SEBIN officials went to his office demanding him to pay 25.000.000 Bs.F. (around $500) and to tell them if he knew any other miners in the area if he wanted to be left alone. He paid and took away his operation.

These government and security officials rarely know anything about technologies in the crypto world, so they hire “geeks” to run their stolen mining hardware. Mr. L is one of these hired “geeks”. One day a CICPC officer came to him with a few AntMiner L3+’s. He told him that he knew Mr. L had several mining rigs in his office, which was true. Mr.L makes a living by selling his services as a crypto “geek” to rich people that want to get settled in a completely unknown world for them. For a small monthly fee, he maintains their equipment. The CICPC officer told him he would make sure his operation was safe as long as Mr. L maintained his L3+’s. To this day, Mr. L sends the CICPC officer his monthly earnings.

This year we witnessed one of the biggest crackdowns against crypto miners when CICPC officials "dismantled" a BTC mine with 11.000 pieces of equipment. A few months later, the Minister of agriculture praised bitcoin as a “tool of economic liberation”. However, as some lawyers believe while bitcoin mining is legal in Venezuela, which does not have cryptocurrency laws, those who practice it are often liable to arrest by the police for energy theft, AFP warns.

As with any investment, there is a fixed relationship of risk/reward. Here in Venezuela there is an opportunity to take advantage of the low electricity or gas prices which can give miners a great reward, but as we can see, this also carries a great risk.

This letter was sent to our editorial board and we publish it, however opinion expressed in this article may not reflect our position. Bitnewstoday.com is not responsible for the reliability of information.