Investigating Black Fintech: Regulators' Verdict

Let's be honest - denying criminal past of the crypto is weird, since after the very beginning of the crypto criminals saw a big opportunity in the system that was pretty much unknown to the law enforcement agencies. Selling of the illicit substances, payments for the services of dubious kind, and stolen information trade used to be “all the rage.” Also, let us not forget that SilkRoad, Chinese and Asian money laundering schemes, or hitmen and hackers that were being paid in bitcoin were on the front pages for a long, long time. But now all major actors in the cryptocurrencies business are putting as much distance as they possibly can into separating the industry from that sector of the economy. But is it in the past for real?

Crypto had grown up, and from a geek’s toy turned into the serious financial tool that became a dream of institutional investors and serves as the basis for exchanges and multi-million trades and IPOs. So - crimes are no longer about drugs or guns; we are talking about international offenses.

And the institutionalization of the crypto industry played a significant role in it. A lot of substantial crypto exchanges are under suspicion because of the fake trade volumes that pass through their wallets. So perhaps, this is nothing but innocent PR trick to lure more people on the market, if we forget about a decent chance that this is the way how exchanges are used to launder “dirty” money.

According to the market analysis performed by an Argentinian trader that goes by the name Alex KRÜGER, Bithumb, one of the biggest exchanges in the world and currently the most popular one in South Korea is not without sin. According to his analysis, each morning at 11 o’clock (IANA time zone) Bithumb allows a group of traders to create a fake trading volume to the tune of $250 million-plus a day on the exchange’s order books. Perhaps this means nothing but a PR stunt to make Bithumb seem more lucrative and exciting for the new people in trade. And probably - these are so-called wash trades. And facts like this, that are pretty much endemic in the world of crypto, are troublesome enough. They attract the attention of the regulators that are almost traditionally skeptical when it comes to crypto.

This is the case in Italy. The Financial Intelligence Unit of Italy (FIU), which performs the functions of financial intelligence remains vigilant when it comes to crypto. According to its report, cryptocurrencies as an asset class are "susceptible to illegal and criminal use, and also expose users to a significant risk of fraud and loss of value.” According to the same report, it also plays a big role in the new organized crime trend - "the use of cryptocurrency for the introduction of proceeds from crime into the legal economy."

The same report mentions cases of blackmail, notes cases of extortion online, fraud and the construction of financial pyramid schemes. Besides, more complicated schemes of illegal financial transactions using cryptocurrency were disclosed, in particular, "using state funds, possibly connected with organized crime and offshore." But the local regulator hasn't followed an antiquated idea that is pretty well summed up in a phrase “Ban everything!”, or restrict and tighten the regulation that doesn't work as intended to end up being just another non-imposable law.

Instead of this pointless (and expensive) measure, Claudio CLEMENTE, the Head of the Italian Financial Information Unit proposed another way to guide the dubious crypto “on the light side.” Instead of bans and restrictions he offers to implement the regulation, that is going to start from registration of all financial operators in the sphere of cryptocurrency circulation.

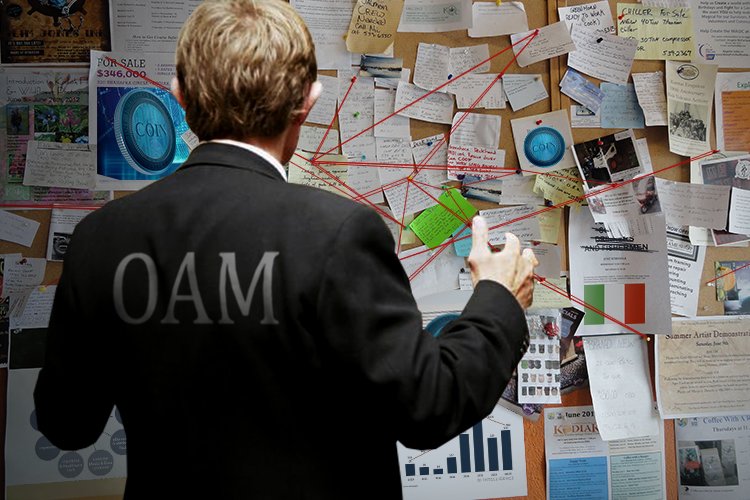

The Ministry of Economy and Finance of Italy (MEF) is going to create a special register, in which all operators offering services in the field of cryptocurrency will be required to pass mandatory registration. However, this is just a preliminary measure, the purpose of which is to enumerate operators and estimate the volume of transactions with cryptocurrencies. The next step will be the mandatory inclusion of all operators in the Board of Agents and Mediators (OAM).

The Ministry of Economy and Finance of Italy (MEF) will be responsible for the timely transmission of data and information about all operators offering services in the field of virtual currencies, not only those registered in the ministerial registry, but also those whose data for some reason was not inserted in the register.

This step is logical due to the fact that FIU received around 200 reports of suspicious transactions with cryptocurrencies. However, it’s worth mentioning that people signaled an alleged breach of financial discipline considered suspicious the opacity of operations with cryptocurrencies, and not the clearly expressed illegality of a financial transaction.

So, we come to the question if this measure is going to be effective or not. We do not have an answer - only the time will tell if it’s going to give the Italian government the desired level of transparency or we are to hear another report about regulator’s concerns about markets shifting into the shadows and illegal trading market growing. Sure enough there is a visible progress, because not so long ago lawmakers used to react in a manner best described by a phrase “If don’t understand it - ban it”. Which almost always worsened the situation.

Sure, someone will follow his principles and is going to be a vigilant watchdog, standing with a big red “BANNED” stamp saying when it comes to crypto-related documents. And some, like the Maltese government, will think the other way around - “If you can’t beat something, then you should lead it.”