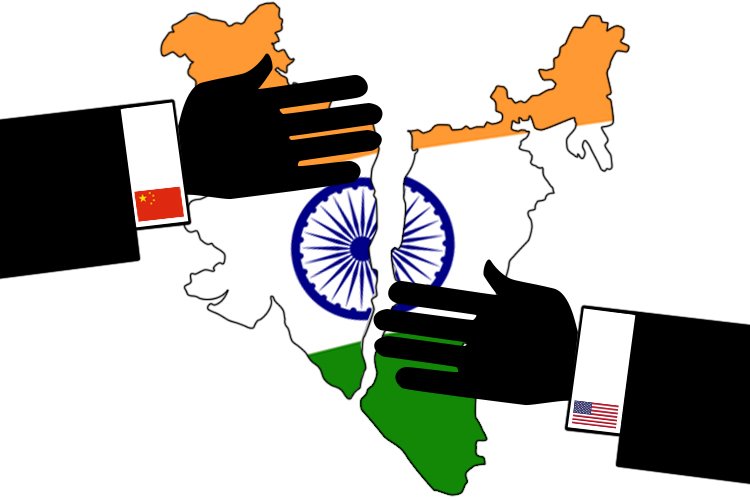

India becomes an epic battleground for the USA and China. Again. For crypto market now

One of the world's largest crypto instruments is the Chinese Huobi. It launches a peer-to-peer P2P platform for trading various cryptocurrencies for rupees without commission in India. And this is against the background of how all the country's crypto community is waiting for the verdict of the Supreme Court about the future of the virtual currency. By the way, the court does not hurry to make a decision, and the entire digital economy of India has been in limbo for 3 months already. In general, today India is one of the main newsmakers of the crypto market. So many events are not happening in any country of the world. What is the intrigue? Maybe the 200 years-old story is repeating?

The increased interest of representatives of the digital industry in the Indian market is due to several factors.

The second largest country on the planet (1.3 billion people) is in short supply. The real economy and the financial system are not keeping pace with explosive growth of the population. The cryptocurrency is trying to fill this economic gap. At the same time, a relatively high level of education (72.2% of the country's population) creates a huge pool of users of modern digital technologies. As a comparison, in neighboring Pakistan, it barely reaches 50%.

Another important factor is the size of the economy itself. Today, India occupies the 7th place in the world in terms of GDP - $ 2.6 trillion, between Britain and Italy. Again, as a comparison: the USA’s GDP is $ 19 trillion; Russia's GDP is $ 1.3 trillion. In India, of course, there is a solvent demand for cryptocurrencies. Moreover, with high inflation, this market becomes super-attractive for various digital companies.

The third factor is the peculiarities of legislative regulation. All countries from the TOP-10 world economies have already adjusted the turnover of the cryptocurrency one way or another. For example,Japan, that is the 3rd economy of the world, has allowed. China, the second line of the rating,has banned, but invests huge amounts of money in the development of the crypto industry. The USA, the leaders, have marked the boundaries: what happens in the crypto is the matter of crypto, and fiat is tightly controlled. Only India has not decided yet. Large players will try to squeeze the maximum profit from this "suspended" market for the remaining time.

The situation may change so that transactions with the cryptocurrency will not be banned, but only pushed out of the banking sector. The whole trading volume in this case will go to crypto exchanges.

Chinese management Huobi, apparently, is counting on such development of events and is preparing for it. At least now every registered user will be able to go to the localized site of the crypto exchange and make all the necessary operations with the digital currency for the fiat.

There is also the fourth geo-economic factor that inflates the "crypto fire" in the Indian market. It seems that the Hindustan peninsula has once again become a place of collision between the two worlds. 200 years ago there was a conservative East and progressive Britain. Today there is a respectable Western world under the control of London and Washington, operating with the usual economic models and military and political influence, and a new one, the virtual one headed by China, which does not give weight to the power influence and is in a "different digital dimension." So the Supreme Court of India took a three-month pause to solve the "cryptocurrency problem". Apparently, under the Kashmir carpet there is a serious battle between the "bulldogs" of two different economies.

For the USA, the captain of the currency system, the Indian market is important, because it’s necessary to sell weapons, energy products and technologies and get metal, fertilizers, labor for real dollars. The more the Indian economy is dollarized, the stronger the influence of the United States is in the Asian region. So far, they are losing out a lot in this indicator to China and even to Russia. But in the classical Bretton Woods financial model, influence is money. The spread of crypto as a payment prevents the dollar from strengthening its positions.

The "digital" business has its own interests. For large crypto companies, India can become both a base and a model region for expansion into the South Asian market. After all, there’s also 200 million Pakistan, 170 million Bangladesh, 80 million Iran. It is a huge reservoir of human capital that is the main provision of cryptocurrency. The more people will be involved in the circulation of the crypto, the higher its value and liquidity is. The revenues of its creators and users directly depend on this combination.

Who will win this war? The near future will show. Today only thing is clear - the cradle of European civilization will surprise us.