Holes? Don't Worry, These Are The Best Swiss Traditions! TOON #13

Switzerland suddenly found itself in the “catching-up” role. The habit of being an internationally recognized leader in the field of finance and everything related to this industry did some kind of a disservice. Relying on reputation, the Swiss later discovered that they started losing attractiveness for blockchain projects. In 2018, the country unexpectedly rapidly lost its leadership in the ranking of states and territories where ICOs are most often held and raised capital.

First of all, the projects left or bypassed Switzerland because of holes in the regulatory sphere. Banks refused to work with crypto assets or ICOs, not wanting to expose themselves to risks. Later, when the regulators received the statistics with decreasing performance, they realized what a terrible blunder occurred. After that, a series of statements and amendments’ announcements immediately followed. The issuance of licenses, the launch of new projects and the rapid collaboration of banks and crypto startups have started.

Holes were patched and are being patched so far with rapid speed: Switzerland doesn't want to lose the title of a “Crypto Nation”. Probably, the regulators and financial institutions understand the mistake they allowed to happen, and thus some precious time was lost. Until the changes are implemented, the “bugs” in the legal framework are to be presented as “features”.

TOON by Maxim Smagin

Swiss FDF to propose blockchain policies options at the end of 2018

Switzerland has proven to become one of the best jurisdictions for crypto business and ICO for the last years so far. Bitnewstoday.com made a recent report on key milestones of crypto industry development in the Swiss lands. It looks almost like a perfect picture from the outside, but does it look so cloudless and shiny from the inside? Every initiative sooner or later faces the barriers. How you deal with barriers will determine how far you advance (read more)

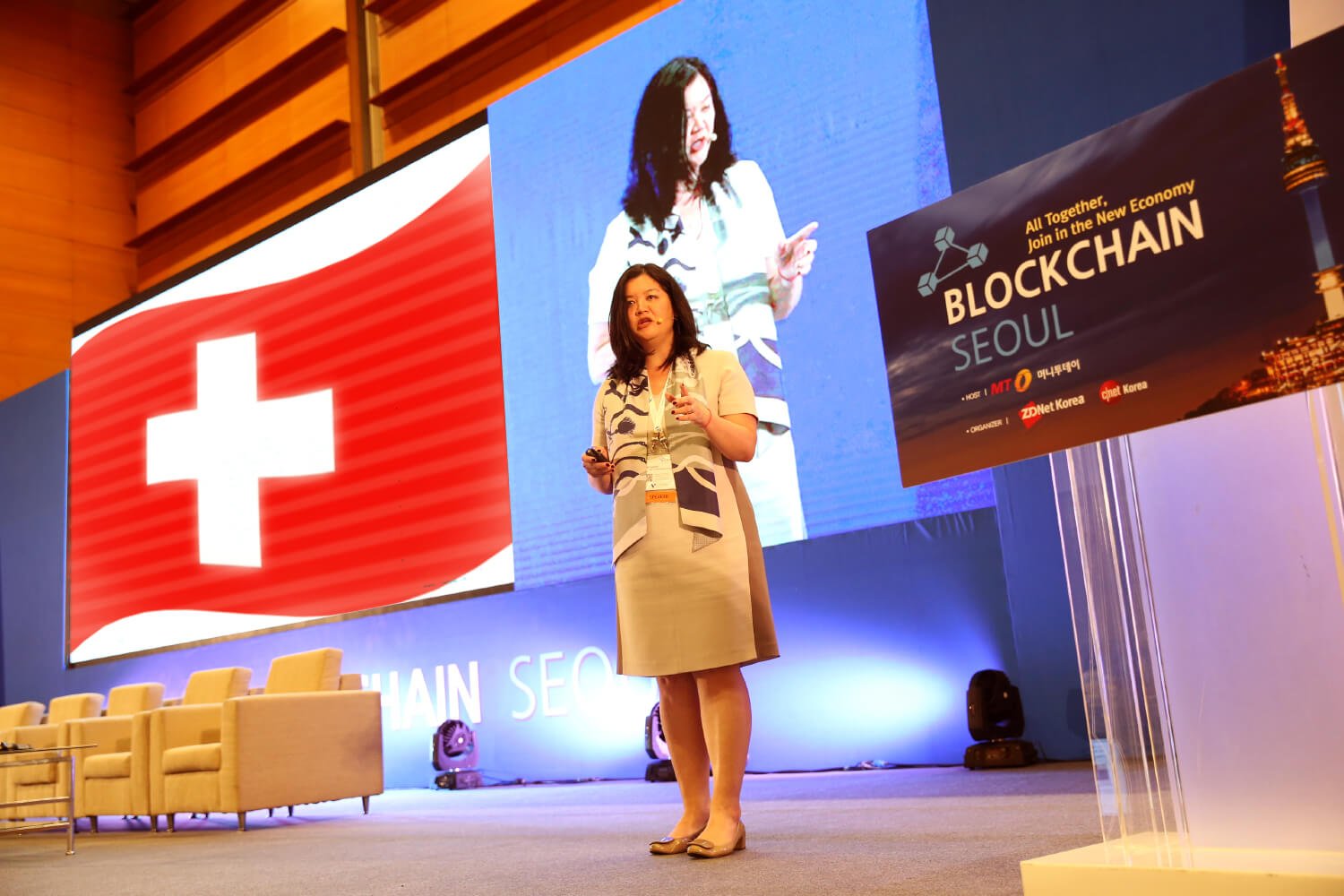

Follow My Lead: Philippines And South Korea To Adopt The Swiss Standards of Regulation

The success of Switzerland in regulating blockchain is disputed and hardly overestimated. Earlier, we presented the reasons for it as well as the barriers the state regulators are facing right now. The information from ‘behind the scenes’ was kindly provided by Cecilia MUELLER CHEN, Member of Crypto Valley Regulatory Policy Working Group at the Blockchain Seoul Summit this September. Apart from the words about the success of Switzerland, the presentation also contained essential theme concerning the experience sharing. As it has been presented by Cecilia, in August and September, the Philippines SEC have drafted ICO and Exchange regulations and policy measures based upon standards adopted in Switzerland. As a result of collaboration with the representative of Swiss regulatory policy working group, the Philippines SEC has issued draft ICO regulations based upon the ones adopted by FINMA. Another document, concerning the regulations of exchanges, is on its way (read more)

Switzerland Teams Up With Liechtenstein To Show $44 Bln Crypto Market Valuation

Swiss Financial Market Supervisory Authority (FINMA) has recently issued the first-of-its-kind license to a crypto investment fund, allowing it to provide cryptocurrency asset management. This step is yet another measure of creating and developing an enabling environment for the crypto startups in the country, as it was described by Cecilia Mueller CHEN, Member of Crypto Valley Regulatory Policy Working Group, in her interview with Bitnewstoday.com The issued license allows the company to offer a collective investment products which include cryptocurrencies, as well as providing consultancy services for institutional investors. Obtaining such permission makes the company almost equal to the traditional Swiss asset management groups (read more)