For Certain Solutions, You Need To Change The Blindfold. TOON #9

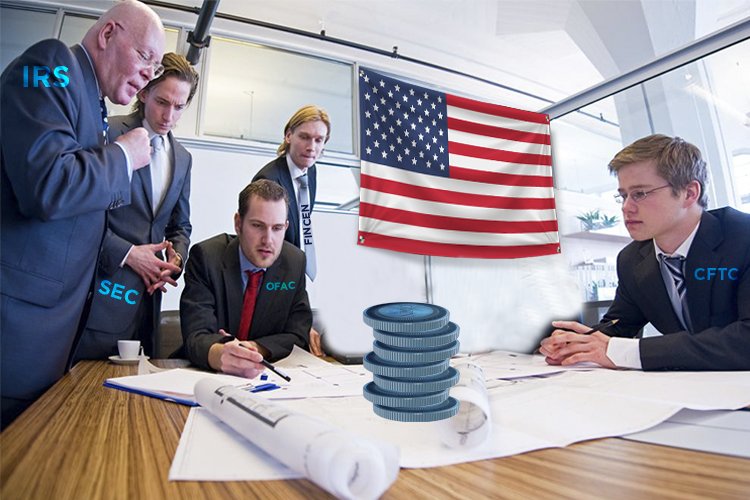

The American Themis is confused about how to perceive virtual assets. Courts are reaching contradictory verdicts, regulators are clashing in hopes to win another piece of authority, lawyers are making millions on the growing numbers of cases. And all this reminds a panopticon, where the SEC, CFTC, scammers, offering digital coins with gold and diamonds, Russian spies are all mixed up... And what about the market?

It lives its life, looking for ways to circumvent inconvenient laws, coming up with self-regulation and learning to run by its own rules.

And the main mistake the US has made is that ICO, blockchain, digital coins and the law appeared to be on different bowls of weights: the law as the embodiment of tradition and the new financial technologies as a synonym of progress. But the truth is that these things do not contradict each other, antagonism thrives only in the minds of politicians. They are the ones who create confusion in the digital reality.

TOON by Maxim Smagin

Americans Can Lose $3 Bln in Dubious ICOs. FinCEN Has Drowned In Delations

According to American instructions, more than 70% of transactions conducted in the virtual market can be considered suspicious. Firstly, anonymous transactions automatically fall within the SAR. They do not use ID at all, and this is already a formal reason for contacting the competent authorities. Secondly, the problem is in the assessment of the transactions value. The price of crypto assets can vary not by cents, like fiat, but by hundreds of dollars within a day. Accordingly, a critical financial threshold can be passed in a very short time regardless of the will of the transaction parties, which, of course, does not make it illegal. (read more)

Diamond Tokens To Become The Motivation for The US Legislative Activity

The Court of New York accepted that the current laws and rules regulating the market of securities to be applicable to cryptocurrencies. Especially if it is about prosecuting scammers.

The judge Raymond DEARIE came to this decision during the trial of the

“diamond” coins, which the Russian-born Maxim ZASLAVSKY was accused of.

This is a reminder that during the ICO the entrepreneur promised to the potential buyers of his cryptocurrency RECoin that digital coins would be secured by diamonds and real estate. However, during the months the project had existed, Zaslavsky’s company did absolutely nothing. It did not purchase any real estate and did not present any precious gems to the society.

By the way, the New York court made a decision not without reason. In 2014, the Internal Revenue Service (IRS) of the USA equated bitcoin to the property together with the stocks of high tech companies and other intangible property. The tax department decided that all the participants in crypto transactions had to pay taxes on the realized capital gain – from 15 to 35% per year – and keep records of the profit from the investment activity. (read more)

USA: Why An Undeveloped Digital Market Is Beneficial For Regulators

In the United States, there is still no clear position on digital money, so every government agency treats virtual money in its own way. Such ambiguity creates difficulties for traders and ICO creators, who have to adjust to the rules of all regulatory institutions at once, even if their provisions contradict each other.

Financial expert and blockchain adviser Andrew ROSENBAUM explained: when the court finally approves the status of virtual assets as a commodity, it will not be the final decision on the regulation of the digital market. The fact is that other agencies will continue to focus exclusively on their regulation rules. That is, the status of bitcoin as a commodity in the CFTC will not affect the status of bitcoin as a security in the SEC. (read more)

SEC vs CFTC: How The Crypto Market Will Avoid The Judicial System Tensions

The federal Judge Rey ZOBEL rejected the petition of My Big Coin Pay Company and its chief manager Randall CARTER against the United States Commodity Futures Trading Commission (CFTC). According to the lawyers of CARTER, the accusation of My Big Coin of fraud amounting to $6 million is illegal, since the regulation of the virtual assets turnover is beyond the competence of the CFTC because digital coins cannot be a commodity. But the court decided in a different way.

“As both My Big Coin and Bitcoin can be generally classified as virtual currencies, Bitcoin futures are currently traded on US exchanges,” Rey ZOBEL emphasized. “Therefore, My Big Coin coins can be considered a commodity asset.”

Let’s recall, this is important: the company attracted investors' money for the release of a digital currency supposedly backed by gold. At the same time, about two months ago, the District Court of Brooklyn, New York, made a completely different decision in a similar case. (read more)