Cryptocurrency Tax Guide: How To Prepare Your Bitcoin Tax Filing?

Cryptocurrencies have gained significant clout in the past year. Their value continues to rise and people purchase bitcoin and sell it for profit on a daily basis.

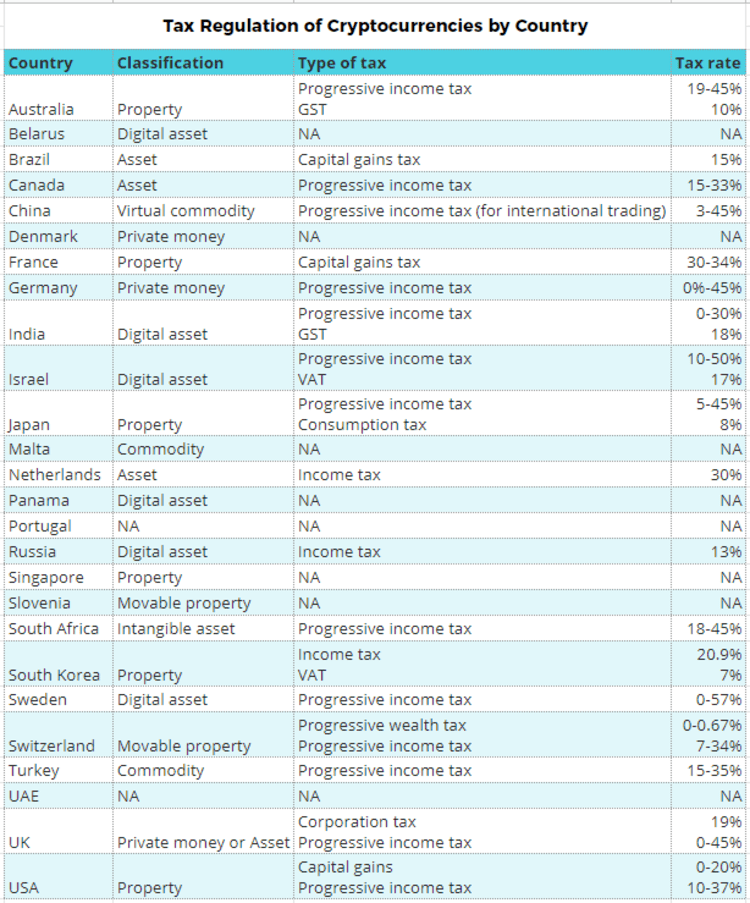

Governments all around the world have been working on regulating profits generated from trading and holding cryptocurrencies. Most jurisdictions require businesses and individuals to declare their cryptocurrency profits. Failing to do so can be met with hefty fines and even prison sentences in some countries.

That said, regulations and rules differ greatly from one country to another and it can be difficult to find the information you need to file your crypto taxes. For this reason, we created this short cryptocurrency tax guide. After reading this article, you should have a good idea of what to do concerning your tax declaration regarding cryptocurrencies.

Let’s get started by checking out some overlapping events that are considered taxable across the globe.

General Regulations

Generally, the following events are considered taxable in most countries:

- Selling cryptocurrency for fiat currency.

- Trading cryptocurrency for another cryptocurrency.

- Using cryptocurrencies to buy goods or services.

- Receiving cryptocurrency from mining, forks, or airdrops.

However, as we previously mentioned countries tend to view cryptocurrencies differently. Here’s how major countries regulate tax on cryptocurrencies.

USA

Hence, cryptocurrency holders are supposed to take note of their transactions and notify the IRS of any capital gains or losses during the fiscal year. Miners, on the other hand, have to pay taxes on annual gross income.

European Union

In the EU, things get a bit more complicated, as there isn’t a single tax regulator for all of the countries in the Union. Instead, each country has its own view on how they classify cryptocurrencies. For example:

- Germany

The German tax agency classifies crypto as a foreign currency. So no tax is applicable when exchanging or trading them. The only time crypto is taxable is when the investor holds cryptocurrency for just a few months and then sells it at a profit. If this period exceeds 1 year, profits remain tax-free.

- France

In France, cryptocurrencies are considered property and fall under a capital gains tax plan. Mining falls under a special regime and is currently taxed as a non-commercial profit.

- The Netherlands

The Netherlands was the first EU country to allow salaries to be paid in cryptocurrencies. As such, when receiving or mining crypto, the country considers it an income and is taxed accordingly (30%). Furthermore, Dutch authorities consider crypto an asset, and therefore, you must pay a tax on the total value of all cryptocurrencies that you own.

Canada

Switzerland

In Switzerland, crypto is considered movable property, similar to cash. Thus, they are subject to wealth taxation plans. Additionally, when cryptocurrencies are used in a professional context, they are subject to income tax, and losses can be used for a tax deduction.

Australia

The Australian government considers cryptocurrencies as property similar to real estate or shares. All crypto holdings that exceed the $10.000 AUD threshold are taxed as properties.

Transactions using Bitcoin and other virtual currencies are classified as barter arrangements and businesses must declare them as ordinary income.

United Kingdom

China

Cryptocurrency exchanges were banned from operating within the Chinese borders in 2018. As a result, many traders switched to foreign exchanges. The People’s Bank of China then issued a statement that all profit from trading cryptocurrencies shall be subject to income tax.

India

There’s been quite a turmoil in the Indian legislature concerning cryptocurrencies. The Reserve Bank of India had banned commercial banks from servicing crypto traders and exchanges in 2018. Despite this, the government decided that paying tax for crypto investors was inevitable. Crypto is classified on par with software products. Consequently, a goods and service tax of 18% is applied to all cryptocurrency transactions.

Wrapping up

The process can be complicated, as countries have various classifications for cryptocurrencies and apply different taxation methods. To make things easier, you can use this website to find some detailed guides on how to file your crypto taxes in your country.

Image from Ivan on Tech