Swiss FDF to propose blockchain policies options at the end of 2018

Switzerland has proven to become one of the best jurisdictions for crypto business and ICO for the last years so far. Bitnewstoday.com made a recent report on key milestones of crypto industry development in the Swiss lands. It looks almost like a perfect picture from the outside, but does it look so cloudless and shiny from the inside? Every initiative sooner or later faces the barriers. How you deal with barriers will determine how far you advance.

The reasons for Crypto Valley’s success

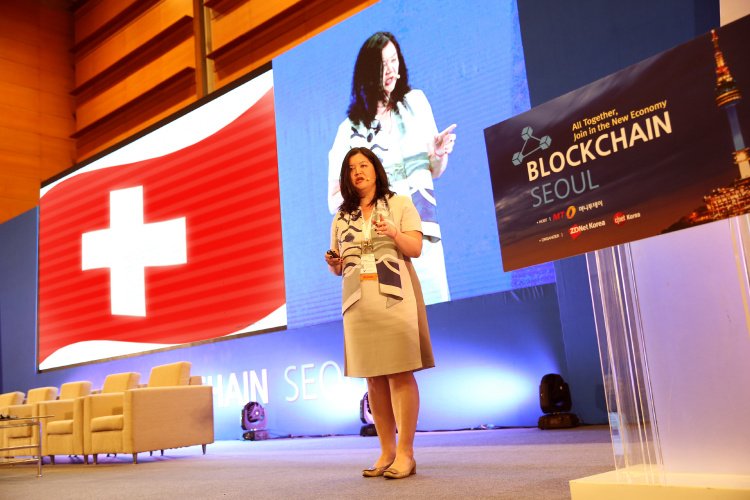

The experience of Switzerland is inspiring, as this model is attractive for the blockchain hubs in other other nations. Bitnewstoday.com managed to speak to Cecilia MUELLER CHEN, Member of Crypto Valley Regulatory Policy Working Group, to take a peek behind the curtain of the success story, to learn more about the hard work in finding a right way in a new and earlier unknown field of blockchain and crypto. The story is quite amazing: according to Cecilia, there are approximately three hundred startups based in Crypto Valley, which are currently creating a new digital ecosystem. These startups seek to solve various business problems and are innovative. One of such use cases is voting through the blockchain. The symbiotic work and the creation of totally new environment is the best proof of Switzerland’s attractiveness.

Besides that, Cecilia MUELLER CHEN gladly shared her own vision on the reasons for Switzerland being one of the best jurisdictions for blockchain companies so far.

Advanced Regulation. Strong financial expertise background helps the country in adopting new ideas. The regulators and authorities are innovation-friendly, positive to FinTech and have adopted a pragmatic approach.

Taxation Certainty. Terms and rulings accommodate blockchain startups.

Talents. Swiss labour force consists of highly qualified and skilled staff who are self-starters . Switzerland’s leading technical universities are conducting research in decentralized computing departments.

Networks in Funding. Established deep financial networks between Zurich, London, New York, and given that Switzerland has been the centre of private banking. Family offices and financial institutions trust Switzerland and are eager to fund projects.

Global Community. Great local community with connections to other international centers of blockchain innovation.

Don’t stop at the top: FINMA to announce more updates on regulation by the end of 2018

Despite the successful approach, there are still some policy gaps in the regulation of the digital world in Switzerland. Some issues are still uncertain; Cecilia brings forward an example of one: “When can actual transfer of assets be legally valid through the blockchain? Especially when you have tokenized assets like securities? Right now, just because a token is ‘mirrored’ or ‘captured’ in a distributed ledger, doesn’t ensure it is legally enforceable or that the rights are actually have been transferred through the blockchain. It’s just one issue. There are more.”

According to Cecilia MUELLER CHEN, legal assessment is not consistent so far; there are no specific laws or court precedents — so it’s a point of growth, as the legal and regulatory community discusses these questions. Meanwhile, the consultation process includes the following questions:

-

Civil law qualification of tokens and rights transfer in the blockchain;

-

Handling tokens in case of bankruptcy proceedings;

-

AML obligations in cases where there are non-custodial wallets and segregated client accounts;

-

Financial market infrastructure.

The Swiss Report by the Federal Government by the end of 2018 will bring more clarity. Up to now, the collaboration of the regulator and the Crypto Valley working group proceeds.