Military coup or endless economic instability: what drove bitcoin to sky-high rate in Zimbabwe?

From twitter

Growing appetite for cryptocurrencies

Although the country continues to enjoy a stable macro-economic environment, liquidity constraints weigh down economic activity.

Getting money out of Zimbabwe has been a challenge. Banks and financial institutions have put in place restrictions capping the amount one can transact. Others even ask customers to pre-fund their account with US dollars.

In Zimbabwe as a net importer there is need for physical cash to restock supplies. To find it, businesses are turning to the ever-diminishing black market to stay afloat. The situation got even worse when banks announced that they wouldn’t issue forex to non-exporters. Adding to the demand is individuals who want to meet basic needs and students looking to pay for education. This extreme measures force businesses and individuals to use alternative means to cater to the needs.

Although not all merchants accept cryptocurrency as means of payment, most Zimbabweans believe cryptocurrencies make it easier to move money out of the country. With this, people are motivated to find ways to convert bitcoin into fiat and pay for goods and services.

The cryptocurrency community in Zimbabwe is quite small but nonetheless vibrant. However, a growing number is using cryptocurrencies as a saving tool. Those buying Bitcoins want to store value as Zimbabwe slowly trails back to the 2008 inflation. As money loses purchasing power, people store value in something that can overcome such challenges.

Dwindling confidence in the parallel "bond note" currency coupled with fears of a repeat of the desperate days is the driving force for the new appetite.

The idea of majority consensus and the limited number of bitcoins act as guards against inflation. Hyperinflation paralyzed the country’s economy. Therefore, Bitcoins are a reassurance for many Zimbabweans.

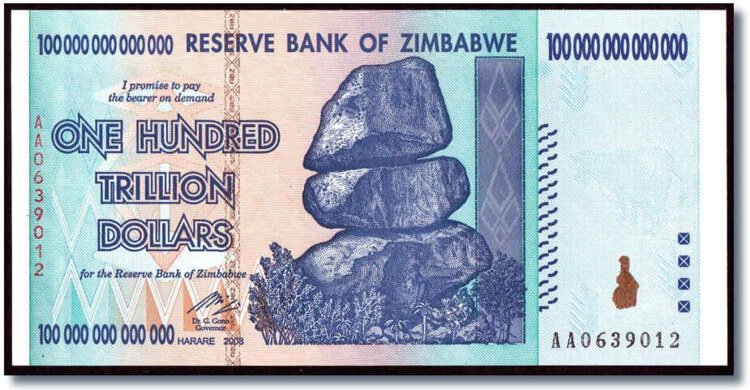

Ghost of Inflation

Inflation continues to cripple businesses and wealth creation. Much of the financial woe in developing countries, especially in Africa, comes from inflation. Zimbabwe is no exception.

Zimbabwe's hyperinflation of 2008 was the second worst in history. The last economic crisis of the this type took place in Hungary in 1946. The inflation in the African country was a mind boggling 13.6 quadrillion percent per month. Prices doubled every 15 minutes. The country that ranks 154 in the human development index experienced an inflation rate of 79 billion percent. During this period, a loaf of bread was sold at 35 million Zimbabwean dollars. This forced the country to ditch their currency in April 2009 and use the US dollar and South African rand.

Many factors contributed to the hyperinflation in the once breadbasket of Africa, but the land reform program and fiscal mismanagement topped the list.

From twitter

Regulations on cryptocurrencies

Admittedly, Bitcoin is not on the list of official legal tender in Zimbabwe. However, it is not against the law to have bitcoins in your possession. There are no official regulations that specifically deal with Bitcoin. Much of it are cautionary statements.

However, the latest statement from the Central Bank of Zimbabwe, says trade and usage of bitcoin for transactions in the country are not legal. The Central bank claims that it is still carrying out studies into the cryptocurrency emphasizing that until legal and regulatory framework is established bitcoin remains forbidden.

Anticipating lash back from the government, Golix had already started to tighten oversight on large volume transactions. Higher value transactions would require verification of identifications for the traders.

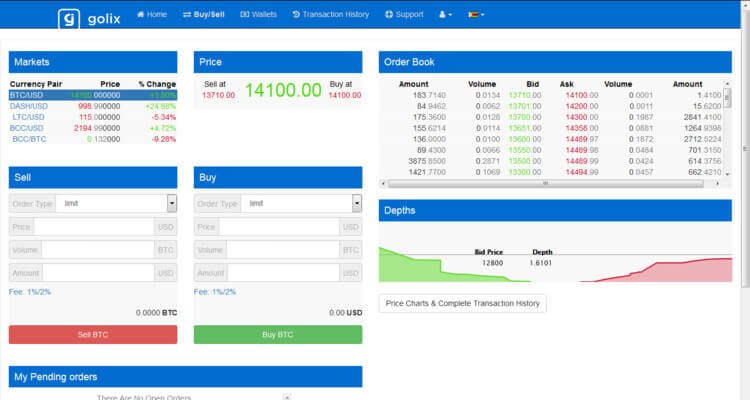

Outlandish prices

Paying $14000 for one bitcoin seems madness. However, Zimbabweans are not new to such high markups - US Dollar, and South African rand trade at twice the normal price. Therefore, bitcoin price is within normal parameters. In a country where bond notes are traded on the black market, bitcoin- even with 100% markup – is still a safer option.

The good thing is that Bitcoin is divisible to eight decimal place, allowing investment in small units of the digital currency.

Enjoying monopoly

Golix, Zimbabwe’s only exchange has handled over $1million in transactions in the past 30 days. This is a tenfold increase from the 2016 transactions. The exchange that recently changed names from Bitcoin finance announced that they are now profitable.

Golix also says they are receiving steady transactions of over 20,000. From the website, there has been an increase for both buys and sells on their order book.

LocalBitcoin serves as an alternative but since payment is through online platforms and banks, it is not available for many Zimbabweans. People want hard cash and Golix provides this. This allows them to have such high pricing. The demand for physical cash drives the price further up.

From twitter

High-cost of power

Electricity is the paramount economic driver whose cost has a ripple effect on the socio-economic lives of people. The current power tariffs in Zimbabwe are 9.83 cents per kiloWatt-hour. The average electricity cost in Southern African region is 14 cents/kWh. Compared to the 12 cents per kiloWatt-hour in such a developed country as the USA, this is quite expensive. High electricity costs make it difficult for countries to compete on a global scale. Moreover, the cost becomes burdensome for ordinary people already struggling to make ends meet.

Such high electricity prices cannot facilitate mining of cryptocurrencies, which require monstrous amounts of electricity.

From twitter

Future possibilities

As of now, there is no cryptocurrency mining in Zimbabwe. This is due to the high cost of infrastructure and electricity as well a gap in knowledge in cryptocurrencies.

Zimbabwe has three underdeveloped power projects. These include Hwange expansion, which could generate 900MW, Batoka Hydro a Zimbabwe, Zambia joint venture project 1 200MW and Kariba South Expansion 300MW. Their development could lower the cost of electricity and ease conditions for cryptocurrency mining.

With the new government, there are expectations for better economic policies. This could potentially lower the demand for bitcoin and its price in the country. Another possibility is the government banning the use of bitcoins to enforce use of the bond notes. Although Bitcoin and altcoins are decentralized, the government can lock out bitcoin exchanges.