Cryptocurrency Market Responds to Global Economic Shocks

10 March 2020 06:44, UTC

Correction occurred when the DOW, S&P 500 and oil futures plummeted. Investor concerns about the economic impact of coronavirus continue to intensify. The drop in oil futures is due to the growing confrontation between Saudi Arabia and Russia: OPEC members argue about whether oil production should be regulated as global demand weakens. Investors fear that there will be a protracted price war — many are predicting a drop in oil prices to $20 per barrel.

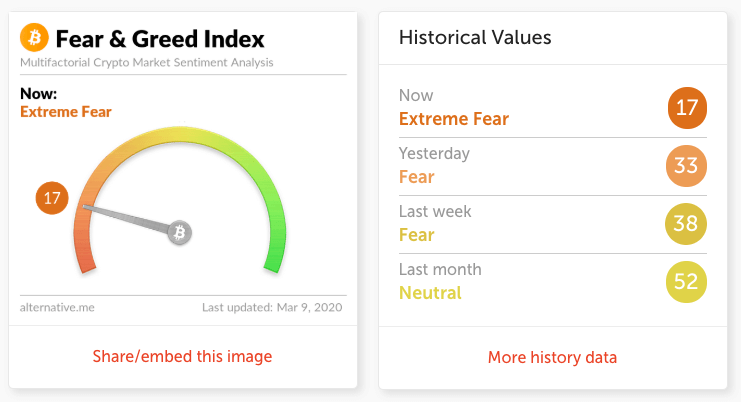

Earlier, analysts warned that a fall below critical support at $9,400 would lead to a strong downward movement. Skew data shows that $92 million positions were liquidated, and the Fear & Greed Index shows a level of fear of 17 points that has not been observed since December 18, 2019.

Altcoins also suffered heavy losses. Ethereum (ETH) corrected 13.67% and fell below $200, Bitcoin Cash (BCH) fell by 17.67%, and XRP lost 12.17% of its value.

Image courtesy of Money Crashers