BCH: 7 Days That Shook The Crypto World

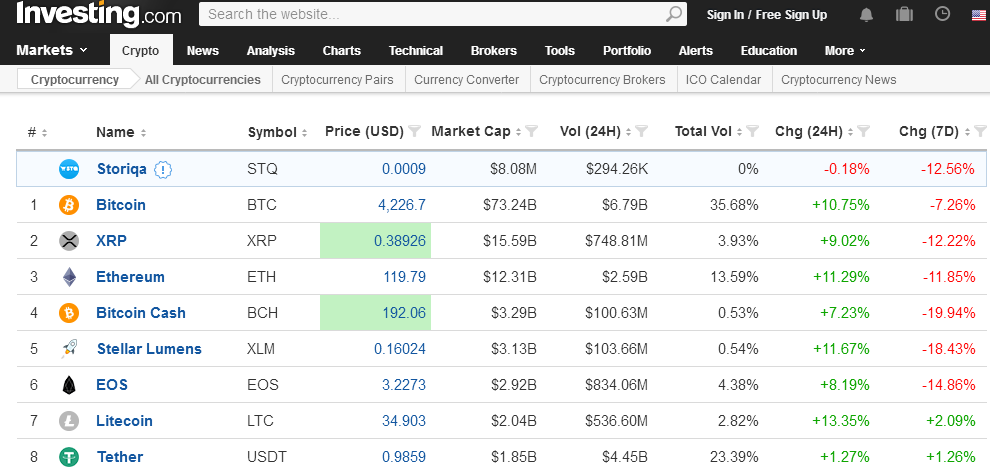

Since last Monday cryptocurrency market was slow but steady at its crawling out of the big slump. As off the writing this article (28.11.18) it got back at the $132 market cap, and that made the traders rejoice because just within the previous week “crypto” lost whopping $50 bln. Currencies were rolling down the hill, and one of the top dogs in losing its value was bitcoin cash, that lost around 50% of its price. Since the start of the week, this process stopped too — every price actions stopped looking that spastic and became somewhat predictable: BTC started to grow, dynamics of the market showed slightly positive growth and perhaps not everything as bad as it seemed at the start, or at least the price action would probably move sideways. XRP, Ethereum, and Stellar managed to find their support levels or could get a firm footing in the negative trends. But that's not true about BCH. It keeps going down and according to some experts — unless it tests level of $150 and bounce up to breach $285 and keep growing, it will continue its descend into oblivion below $130.

So basically — if BCH is growing, then it’s worse than the other crypto. If it’s falling — it’s doing it way faster than other top cryptos in the list.

The recent hardfork can explain this instability: a couple of most prominent people within the network failed to reach the consensus about BCH future, and that led to the full-blown war for the hashpower. However, that’s nothing but details. The important stuff is — this led to a massive drop in value for the bitcoin cash itself.

Just a day before the hardfork, many traders started to dump their Bitcoin to get some liquidity in hope of scoring on the upcoming ride. However, that plan kinda backfired — a lot of people knew about this preplanned hardfork and as a result just far too many people were doing this and that led to the point where BTC crashed from $6,345 to $3,746 and that apparently made people “ecstatic” and provoked the panic that can be explained by headlines like “Bitcoin’s slump below $5,000 is the end of the crypto dream!”. But that was only the starters — even more, traders involved in the BCH started to drop it as if it were hot since they decided to play it safe. And they were the only people who made the right call — on the very day of hardfork BCH value dropped by a hundred dollars. Some of the people that were late to the party decided to buy into BCH and enjoy the show: with their help, the price started to go up on 15th of November. However, everything came to a usual pace, that was no longer true — the currency dived head first into the market bottom, losing another $100 from its price.

In theory that should’ve been a moment of rejoicing and happiness among the community — “Biggest scamcoin in history is going down” and stuff. However, there was no celebration or lavish poolside party with lambos and spaceships. No one was happy about it in fact and they had good reasons: first of all — it showed how fragile every agreement and “rule” in the network is, when two people within the network managed to turn this “medicinal” hardfork that has been used to solve some of the issues into the outright “poison” for the whole cryptocurrency ecosystem.

And the end of the “hash war” within the BCH led to nowhere. Nothing, except for the unexplainable pump of Bitcoin SV that rolled it up 300% and led to nowhere did nothing for the network. Furthermore, their overall market cap is lower that it used to be: at the moment (of publishing) brainchild of fakeToshi is $1.68 bln, and ABC has a bit more than $3 bln which is okay if you can forget the fact that their price before “finest hour” was around $9 bln.

And finally — their epic struggle, that literally cost millions, was utterly pointless. The consensus of the community and cryptocurrency holders decides the fate of the crypto. And this time they sided with the Roger Ver and his Bitcoin ABC and not with the Satoshi's vision (or fakeToshi opinion). ABC camp can celebrate and rejoice since they are victorious, granted if this can be called a victory.

Basically, bigwigs of the BCH set themselves up and up being uninteresting for the market that tries to self-regulate. Bitcoin continues to be the top dog in the cryptocurrency kennel with strong 53.4% percent of the market is cool with the bitcoin crash of 2018: since 2013 till 2015 cryptocurrency number one has lost like 85.4% of its value. And that wasn’t the worst moment for the king of the crypto jungle: in 2011 and 2010 Bitcoin lost 93.8% and 94.1% of its value. And one of the most important things — institutional interest in crypto stayed the same, despite the slump and reports from Deloitte that investors are worried because of the “bad news from the market”.

Once again, the ETF, a thing that was a bit forgotten but stayed very relevant: SEC will make a decision regarding the VanEck SolidX Bitcoin ETF at the beginning of 2019. Its user-friendliness and ease of use will guarantee that the market will get a massive surge of liquidity it desperately needs. Bakkt’s launch on 24th of January and start of the bitcoin futures sales by Nasdaq have good chances to propel the market to the sky-high levels, which is the thing that market desperately needs.

One of our commentaries, Martin JANDA, an expert in Blockchain und Cryptomining field, thinks that there is no real reason to be worried about the market. “The bull market of 2017 was followed by a bear market. It may also extend into the first quarter of 2019. But that is pure speculation. After that, the Brexit is on the agenda. This event has the potential to shift capital towards the cryptos. Blockchain startups should not appear on the list. The hypeword blockchain may lose weight, but most Blockchain business models have nothing to do with cryptocurrencies. The success of this new niche will continue or is yet to come.”