Why is bitcoin falling now and when it will recover?

The end of last year saw bitcoin skyrocketing at the record pace but in the beginning of 2018 the whole cryptocurrency market stumbled and its free fall began.

In the first days of February, the BTC dropped to almost 6,000 dollars. Then the coin “revived” and in the first days of March it reached 11,000 dollars. On March 7, the bitcoin rate began to fall again and went down to 9,000 dollars.

What were the reasons behind it, why bitcoin fell so fast and what level may be considered the bottom of this major correction, read in the article of Bitnewstoday.

The new triggers of bitcoin drop

Analysts believe that the last correction of bitcoin cost is related to the negative news background.

The first trigger for the fall of the exchange rate was the message concerning Nobuaki Kobayashi, a competent person of the hacked and bankrupt exchange Mt. Gox. Since September, he’d been selling bitcoins for $ 400 million, and now about $ 1.7 billion (in BTC) is at his disposal.

The hacking of the Binance exchange in order to inflate the value of the Viacoin coin, moreover, has influenced the rate of bitcoin.

Secondly, the bitcoin rate has been turned down by the strict statements of regulators. The SEC (Securities and Exchange Commission of the United States) said that online crypto sites misrepresented themselves as exchanges, although they were not. In addition, they were regulated as ordinary exchanges. The Financial Services Agency of Japan (FSA) reported the closure of two exchanges in the country. The others, including the recently stolen Coincheck, had been ordered to improve their risk management.

"There are fewer and fewer convinced bulls or" hodlers" in crypto community with every rate correction. Every new statement by regulators in the US and Japan initiates a chain reaction of sales, bringing to nought the optimism of the first wave of correction. After regular reports of hacking, investors came to understand that the market needs rules and transparency, as it has become the most desirable target for hackers around the world, and there is no assurance in safeguard of assets, "said Alexander Kuptsekevich, a financial analyst at FxPro.

This is far from the biggest crash of bitcoin

When talking about why bitcoin exchange rate is going down, experts not that the recent correction of cryptocurrency market is not something "out of the ordinary" and the current decline in value follows the pattern that has been established in the cryptosphere.

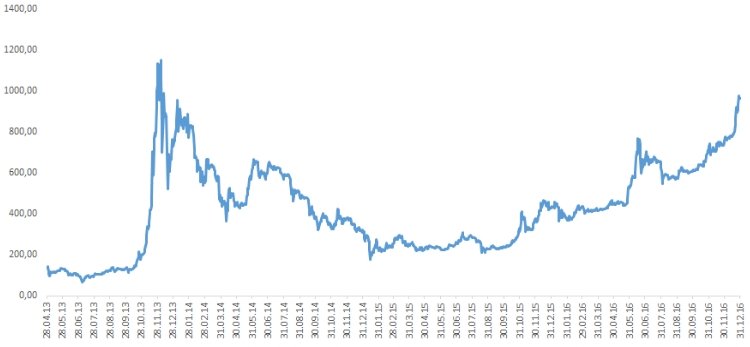

The first major crash took place in 2011 when after reaching $35 bitcoin price fell to 2 dollars marking a drop of 90%. In 2013 after passing the historic milestone of $1000 and reaching $1100, the price of BTC was driven back to $200 - that drop amounted to 80%. And, finally, during the last two months of the last year bitcoin soared to 19 thousand dollars, and then rolled back to 7000 dollars - a fall of 60%. "You can see that each subsequent correction is less severe than the previous one. Bitcoin is now less volatile than in the past," notes Amanda B. Johnson, a spokesperson for DASH.

The chart below shows the dynamics of bitcoin price until 2017 to better see the ups and downs of the first cryptocurrency.

Chart 1. Dynamics of bitcoin price in 2013-2016.

Source: coinmarketcap.com

Previous bitcoin corrections after New Year could be explained by the Chinese New Year, which forced a number of investors to withdraw their cryptocurrency savings into fiat, but this year bitcoin is affected by a number of other factors. Let's analyze why bitcoin is falling today.

FUD rumors and unreasonable statements by regulators brought panic to the market - this is primarily what caused bitcoin crash.

It all began in South Korea, when the local authorities expressed their intention to ban the work of cryptocurrency exchanges on its territory. The next blow was a rumor from India. It was a misinterpretation of the statement made by the Indian regulator about the "ban on cryptocurrency". "In fact, it was about the regulator's strict position towards illegal activities that can be associated with cryptocurrencies, but this rumor was enough to give the market a new reason for panic," comments Alexander Kitchenko, cryptocurrency researcher, investor, member of Bitcoin Foundation.

As it always happens panic launched a domino effect, stop-loss orders began to get triggered. However, the bad news did not end there. Facebook announced a ban on the advertising of ICO and cryptocurrencies. Analysts believe that although this news did not increase panic, but made new players think twice before entering the market.

The news of the investigation against Tether and Bitfinex added fuel to the panic. It started with concerns about whether Tether actually has the funds to back all of their USDT tokens. And then Bitfinex and Tether were accused of allegedly "pumping" bitcoin price by 20%. However, for those who closely followed the news, experts note, the story with Tether was not a surprise, the inquiries from the Securities Commission were known back in December. But this story was brought into the limelight only in the end of January and this added more negative to the news background.

The second reason. There are no buyers ready to buy expensive bitcoin

"If we want bitcoin to grow it needs the next buyer who will buy it for higher and higher prices. And the next big buyer can only live in the East and South-East. And if the Chinese authorities squeeze out the miners quietly, the Indian finance minister spoke very harshly, saying that for India, cryptocurrencies can become a catastrophe, and that there is no need for circulation of cryptocurrency in this country," said Leonid Delitsyn, an analyst at Finam.

In addition, the price of Bitcoin is currently falling in late February due to speculators leaving this market, says Rodion Popkov, the operating director of the VISO crypto and smart payment system. "The volume of the cryptocurrency market is still extremely small relative to the size of the speculative capital market, which leads to the volatility of the exchange rate in a very wide range," the expert added.

The third reason. Negative on global markets

According to experts, the active sale of bitcoins in February was caused, in part, by the negative dynamics on global markets. Most of the profitable assets were put under pressure due to investors' awareness that the market climbed too high and too quickly.

What will be the bottom of bitcoin this time? It’s difficult to say. Experts note that if in the near future the market will no longer be shaken by loud negative statements coming from regulators, as well as if there won't be new scandals in the cryptosphere bitcoin will definitely go up.