Why do altcoins become cheaper following Bitcoin?

Dynamics of the market

At the time of opening trades on Monday, the capitalization of all coins was $ 280.1 billion, almost 40% of this amount accounted for the total value of all BTC. Compared to the beginning of last week, the share of Bitcoin increased by 0.66 pp.

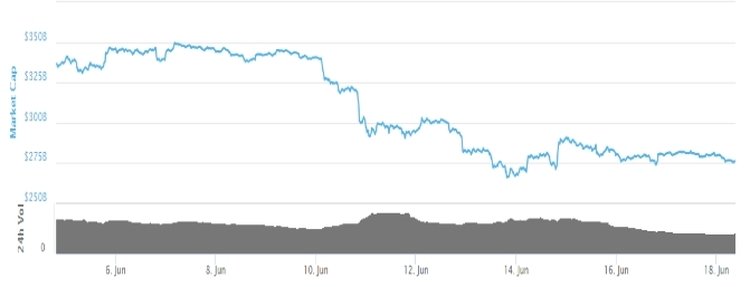

Picture 1. Dynamics of cryptocurrency market capitalization

Source: Coinmarketcap

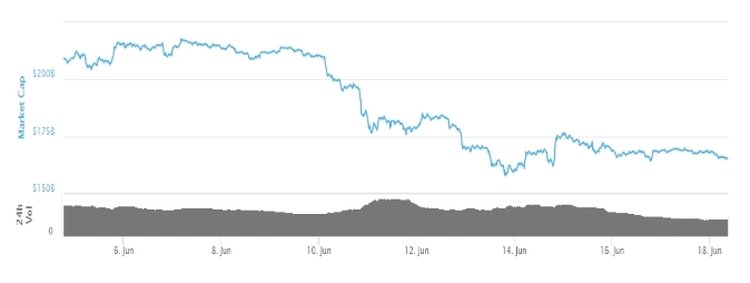

Despite the fact that the share of BTC slightly increased, the capitalization of Bitcoin fell by 3.7%. At the same time, altcoins lost more than 6% over the past week.

Picture 2. Dynamics of altcoins market capitalization

Source: Coinmarketcap

If you look at picture 1 and picture 2, you will see that since June 16, there has been no essential change in value. The capitalization of all cryptocoins with Bitcoin fluctuated in the range of $ 281-279 billion. Cryptocurrency reached its maximum aggregated value on June 12, when the figure was $ 302.8 billion. The minimum value of cryptocurrency market capitalization was fixed on June 14 — $ 266.6 billion.

It will be recalled that on Sunday, June 10, cryptomarket lost 50 billion dollars immediately. Experts called this day a "Bloody Sunday".

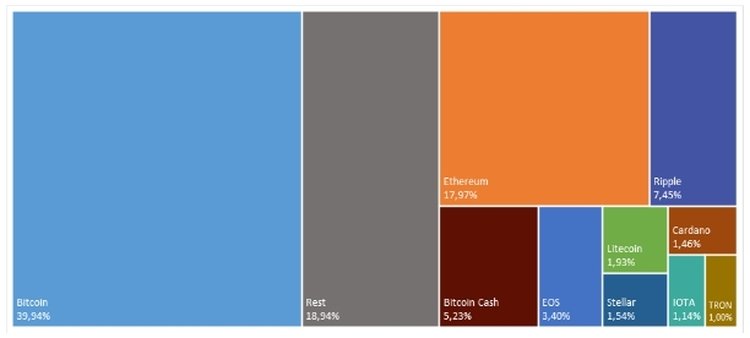

Market structure

As mentioned above, the Bitcoin share at the time of opening trades on Monday was about 40%. Nine altcoins out of TOP-10 cryptocurrencies, account for more than 41% of the aggregate value of all cryptocoins. As a result, TOP-10 cryptocurrencies takes more than 80% share of the market.

Over the past week, in addition to Bitcoin, only Ethereum increased its share (by 0.24 pp). Ripple lost 0.20 bp, Bitcoin Cash — 0.24 ppt, Litecoin — 0.12 ppt, Stellar — 0.01 ppt, Cardano — 0.08 ppt, IOTA — 0,14 pp, TRON — 0,04 pp. The share of EOS has not changed.

Picture 3. The structure of cryptocurrencies market

Source: calculations by Bitnewstoday according to Coinmarketcap

How much have the TOP altcoins become cheaper?

The cost of Ethereum decreased from $ 524.86 to $ 500.45 (minus 4.7%). Ripple lost almost 10% (the price fell from 0.586198 dollars to 0.528216 dollars). The cost of Bitcoin Cash decreased from 937.63 dollars to 852.10 dollars (minus 10%), and the cost of EOS fell by 7.8%.

Following Bitcoin, smaller altcoins also lost in their price. Experts believe that altcoins “copy” Bitcoin movements in general, except for those rare cases when the coin comes out with positive news that provides local short-term support. Nevertheless, at the "long distance", the influence of Bitcoin on cryptomarket will still prevail.

Experts believe that hacker attacks and thefts of investors' funds, a ban on the purchase of Bitcoins from Wells Fargo credit cards, potential disruptions in the work of crypto exchanges, which may be revealed by the CFTC — all these factors naturally put pressure on the market. Even the news that India lifted the ban on cryptocurrencies has not supported the market yet. At the same time, such news could cause a wave of positive mood and affect the quotations positively earlier.

"The last drop in the market capitalization of cryptocurrencies can be safely associated with the successful conclusion of the meeting of US leaders Trump and DPRK Kim Jong-un. Risk reduction causes a decrease of interest in defensive assets. As a result, we can see increased speculation with risky currencies (currencies of developing countries), stock indexes, shares, and altcoins," says Maria Salnikova, a leading analyst of Expert Plus LLC. The expert believes that the current level of cryptocurrencies can be called a defensive asset along with the US dollar, gold, the Swiss franc and the yen.

Reduction of cryptocurrencies cost is a good chance for those who wanted to buy them at relatively low prices. "However, purchases at current price levels are appropriate only for investors who are fully aware of the risk and considering long-term strategies in the prospect of 1-3 years," comments Olga Prokhorova, an expert of the International Financial Center.

"Predicting the time of a new growth rate is extremely problematic. However, if Bitcoin remains true to itself this year and follows the dynamics of previous years, then the last quarter of 2018 will cheer investors — but in case of objective reasons for optimism, of course," said Mikhail Mashchenko, an analyst of the social network for eToro investors in Russia and the CIS.

Bitnewstoday will monitor all the developments on crypto exchanges. Stay tuned!

All materials presented on this site are provided to you for informational purposes only