The Year of Stablecoins. Reasons for Development and Consequences for Markets

Brief chronology of events

From September 2019 to March 2020, the capitalization of stablecoins remained unchanged at about $ 5 billion. Over the next 2 months, by May-June, this volume doubled and reached $10 bln. From July to October, capitalization doubled again to $20 bln, and at the end of December, it has already exceeded $28 bln. Why is the demand for a risky crypto dollar growing among investors and speculators? Read it in the following analysis, with expert comments.

Stablecoins appeared on the cryptocurrency market much later than the first ICOs and were not in demand at first. Who needs to spend a dollar to end up with the same dollar minus commissions? But times when almost all tokens grew after listing have passed, and stablecoins have taken their niche.

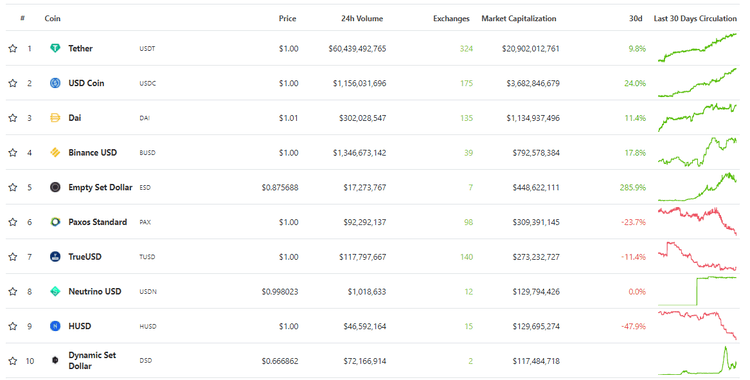

The screenshot below shows the top 10 stablecoins by market capitalization at the end of 2020. The first three of the list have already surpassed the volume of $1 bln, and the most popular Tether (USDT) has reached a volume of $20.9 bln and has a share of 74%.

In the next graph, the growth in stablecoin volumes over the past 4 months. The leaders are Binance USD (BUSD).

The growth in popularity of stablecoins continues for the following reasons:

- Hedging the risks of financial assets, including stock market instruments and top cryptocurrencies. This was special during the first wave of COVID-19, as well as during one-time dips of individual assets such as oil. For example, the March dips of the Bitcoin price coincided with the first leap in capitalization of stablecoins, at the same time there was a maximum fall in the S&P 500 and other indices like stock market indicators.

- Falling rates of individual cryptocurrencies. In particular, the aforementioned drop in the price of Bitcoin and altcoins. This hypothesis is plausible and explains the short-term rise in interest in stablecoins in the spring, but nothing more. In terms of fees, it is cheaper to sell BTC for USDT and keep it there for a difficult period than withdraw it to fiat. On some exchanges, it is not possible to convert cryptocurrency into fiat money, so there are few options for maneuvering.

- Not only the fall, but also the growth of Bitcoin provokes interest in stablecoins. Phillip Hamnett, CTO of the crypto startup chintai.io says the following:

"With the price of bitcoin rising to all time highs in the last month, lots of new fiat money is entering the cryptocurrency systems. There will also be lots of bitcoin holders who will want to lock in their gains and try to buy the dip if the price of BTC falls."

- DeFi projects have further spurred demand for stablecoins, which are often part of decentralized finance protocols.

The consequences of such an increase in the capitalization of stablecoins will depend on the actions of the authorities. On December 23, a document of the working group on the regulation of stablecoins was placed on the US government website. It is planned to introduce KYC and obligations to issuers to comply with sanctions requirements. There's an opinion among experts that the growth of capitalization will lead not only to increased attention of the authorities, but also to increased confidence. BetWorthy LLC co-founder Scott Hasting expressed the opinion:

"The rise of the stablecoins market cap will lead to regulatory confidence in cryptocurrencies. I can see central banks, in the future, issuing their own stablecoins because of growing market interest and financial institutions owning a large chunk of them for trading purposes. With apps such as Robinhood or Paypal allowing users to own and trade cryptocurrencies on their phone, it's not a long-shot to say that cryptocurrencies are here to stay. And stablecoins provide governments and users the confidence to exercise them in a safe manner."

Ultimately, volatility remains the most important factor that stablecoins hedge against. Even if Bitcoin and altcoins are growing every day, there still needs to be a way to get out of a potentially risky asset. This can be compared to regular currency, without which the normal functioning of a regular brokerage account is impossible.

Even if the market is growing, you still need to have currency in your account, for example, to rebalance your portfolio. Or in order to buy a newly emerged asset. Therefore, the more popular cryptocurrencies are, the greater the capitalization of stablecoins will be.

Image by Nairametrics