The Question of The ROI: How Much Can An ICO Pay You Back

ROI and ICO: Top-10 ICO with biggest ROI in history

When selecting potential projects for investment one of the important reason to invest is the return on investment (ROI). Considering that more than 300 new projects enter the market every month and some of them will not achieve their minimum goals, while others will seriously lose in price after being placed on the exchange, the choice becomes more difficult. At the same time, there are real diamonds, having invested in them at the token sale stage, you can ensure a good revenue.

According to SSRN report, average ICO ROI is 82%. These conclusions were made on the basis of an analysis of 4000 projects, of which successful projects got the result of 172% ROI (the initial token sale price to the first day’s listed market price on an exchange, if an average lock-up period is 16 days) and unsuccessful projects that failed to list tokens on an exchange within 60 days got -100% ROI.

Today we will look at the most successful and unsuccessful projects in history in terms of the rise in the token price and ROI.

Biggest ROI Winners

(Source: https://www.icomarketdata.com/stats)

TOP ICO with biggest ROI

-

NXT ICO was launched in September 2013 and ended with a result of $16,800 worth of Bitcoin, one bln tokens distributed. So, the NXT token’s value during its ICO was $0.0000168. In September 2018, the token was trading for $0.071364, generating astronomical profits for its early investors and making it the most profitable ICO token ever at today’s market valuations.

-

Ethereum is so widely well-known that there is even no need to introduce it. It’s a public, open-source distributed ledger platform, which enables its users to create and run dApps and use smart contracts. Ethereum ICO was held in the summer of 2014 raising $15.5 million, selling 50 mln tokens at the price of $0.311 per token. Today, Ethereum trades at $231.01.

-

NEO is a “China’s Ethereum”, a platform for dApps, but also with decentralized commerce, digitized assets, and identification feature. The project was backed by Microsoft and Alibaba. Their ICO held in October 2015 was a big success, raising $556,500. A year later, in September 2016, Neo had a second crowd sale raising $4.5 mln. The original ICO price of the Neo token was $0.032 and today NEO is trading at $20.15.

-

IOTA is a transaction settlement and data transfer layer for the Internet of Things. IOTA successfully raised over $400,000 in 2015 with price for 1 token less than $0.001 and trades today at around $0.58.

-

Spectrecoin is a cryptocurrency platform that prioritizes privacy and anonymity above everything else, combining Blockchain with a tokenized ring signature scheme. The project uses the Tor network in order to increase the network-level privacy. All the nodes communicate through Tor, that makes transactions untraceable. Spectrecoin ICO closed in January 2017 raised $15,500 with token price $0.001 and today trades for $0.25.

-

Stratis is a platform for dApps development, testing, and deployment, fully compatible with .NET and C#. With Microsoft as a partner (Microsoft added Stratis Blockchain-as-a-service (BaaS) to its Azure cloud service) they were bound to succeed. They raised $610,000 during the ICO. The tokens were sold for $0.007, while today they cost $1.62

-

Ark is a dApp platform with a mechanism to bridge together blockchains into ARK Core where any blockchains can send and receive notices and data. The project ICO raised $950,000 in November-December 2016 and the token is currently traded for $0.74.

-

Lisk is another dApp platform with mainchain and sidechains which are like personal blockchains can be easily tailored with Lisk’s tools. Lisk apps can be built on Javascript. Held in 2016, their ICO was incredibly successful raising $5.7 mln. The token was sold for $0.076, and it is now worth $3.46.

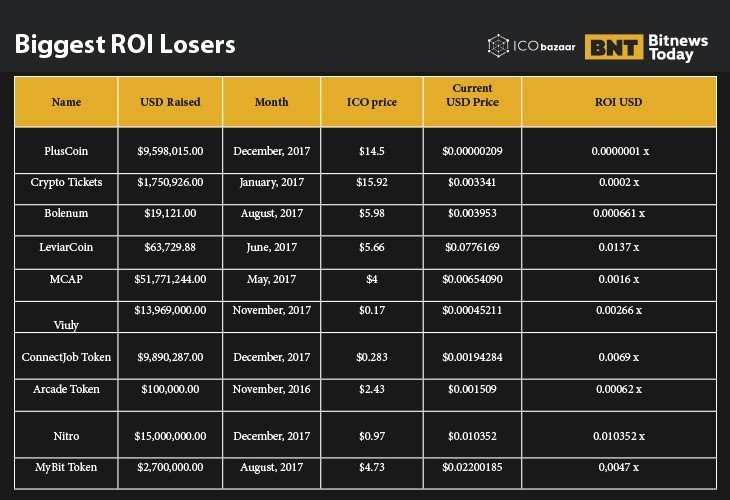

Biggest ROI Losers

(Source: https://coinmarketcap.com)

Conclusion

As we see, early contributors get higher results due to less competition and more time for development. Modern projects no longer have such an odds and for them ROI from 3 x to 10 x will be quite successful. You also need to have in mind that not always lots of media hype and successful token sale guarantee the successful development of the project. That is why it is impossible to make a decision on investments in the blockchain without weighing all the pros and cons.