The Changes on the Crypto Exchange Market Within Two Years. Should We Trust the Stats?

2019 is over, it's time to review the results. One of the trends of the year is the criticism of cryptocurrency exchanges, which is considerably justified. Exchanges got hooked for theft of assets, fake trade volumes and commissions cheats. Some violated obligations to execute applications for the money and tokens withdrawal, arbitrarily closed orders and blocked funds, and could not cope with technical support.

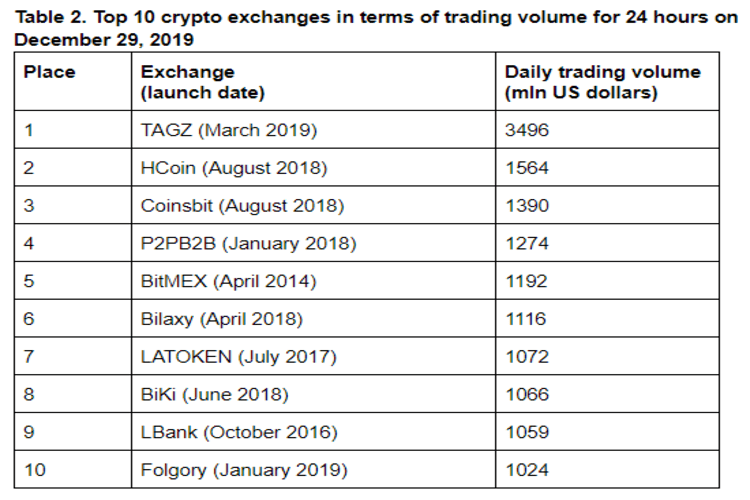

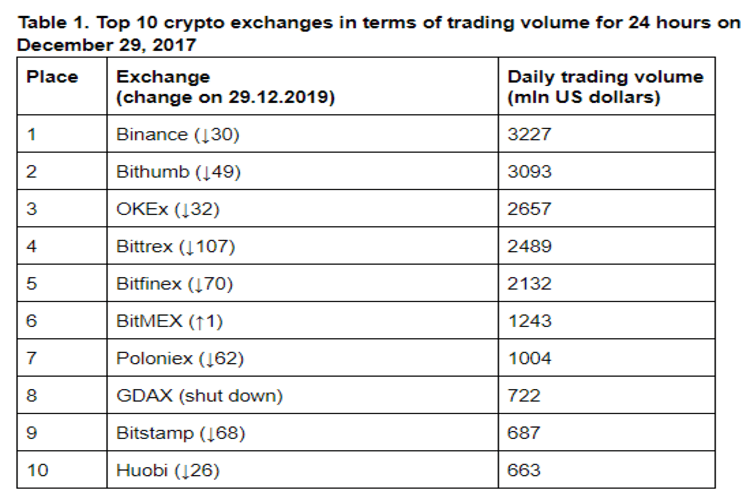

As you can see, the majority of the participants in the top of 2017 by the current moment have significantly “sank”. Only BitMEX remains in the top ten. For comparison, below is a similar top at the end of the year, namely on December 29, 2019.

Of the top ten, seven exchanges launched less than two years ago. In the ranking for 2017, they simply didn’t exist. This situation is very different from the situation in the TOP 20 cryptocurrencies by capitalization from the previous Bitnewstoday ranking. Then half of the coins migrated from 2017 to 2019. In this rating, there is only one exchange out of ten.

Trading volumes have changed, but not significantly. The total daily trade of the top ten exchanges in terms of 2017 amounted to $17.9 bln, compared to $14.3 bln two years later. Trading volumes are very unsteady every day so one should not focus on this.

It is also interesting to track the number of exchanges in total. According to Coinmarketcap.com, there are twice as many of them — 181 at the end of 2017 and 306 nowadays. Moreover, centralized exchanges have appeared in crypto friendly countries.

Bitcoin's dominance has increased. Two years ago, only 5 out of 10 exchanges were leaders in terms of trading volume in a pair with bitcoin (to USD or to USDT); now it’s 9 out of 10 (except for HCoin).

In 2020, it will be interesting to observe which of the leaders will be able to stay in the top and who will find the resources to comply with new laws or to circumvent them.

Image courtesy of Livemint