Strategic portfolio investment in digital assets

14 September 2018 08:30, UTC

Anastasia Ermolaeva

Diversification of the investment portfolio is the most rational approach for crypto investors considering high volatility of digital currencies. The price drop of one coin can be offset by the growth of others, and the portfolio profitability appear to be positive.

Exchanges and crypto rating sites provide an overall picture of the market, so it takes time for a user to select information dedicated solely to purchased currencies and analyze it. Software developers offer investors and traders a variety of applications that not only aggregate required data, but also calculate income. We decided to analyze the effectiveness and benefits of diversified portfolio by testing such an application.

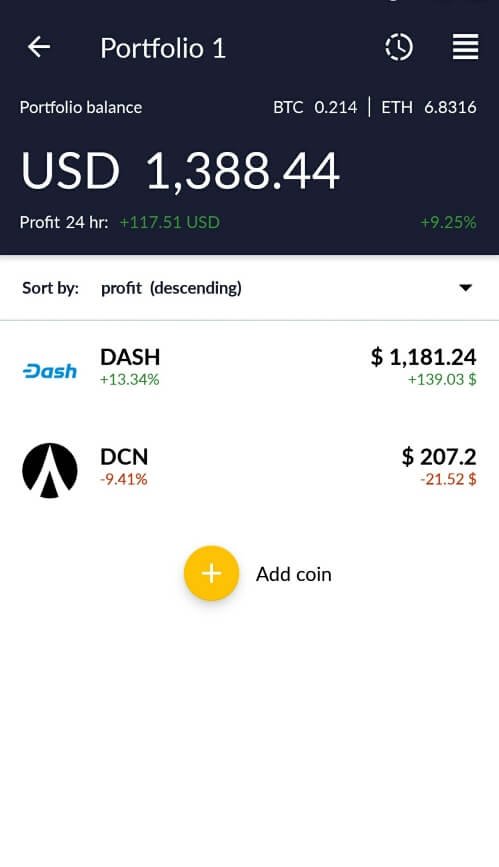

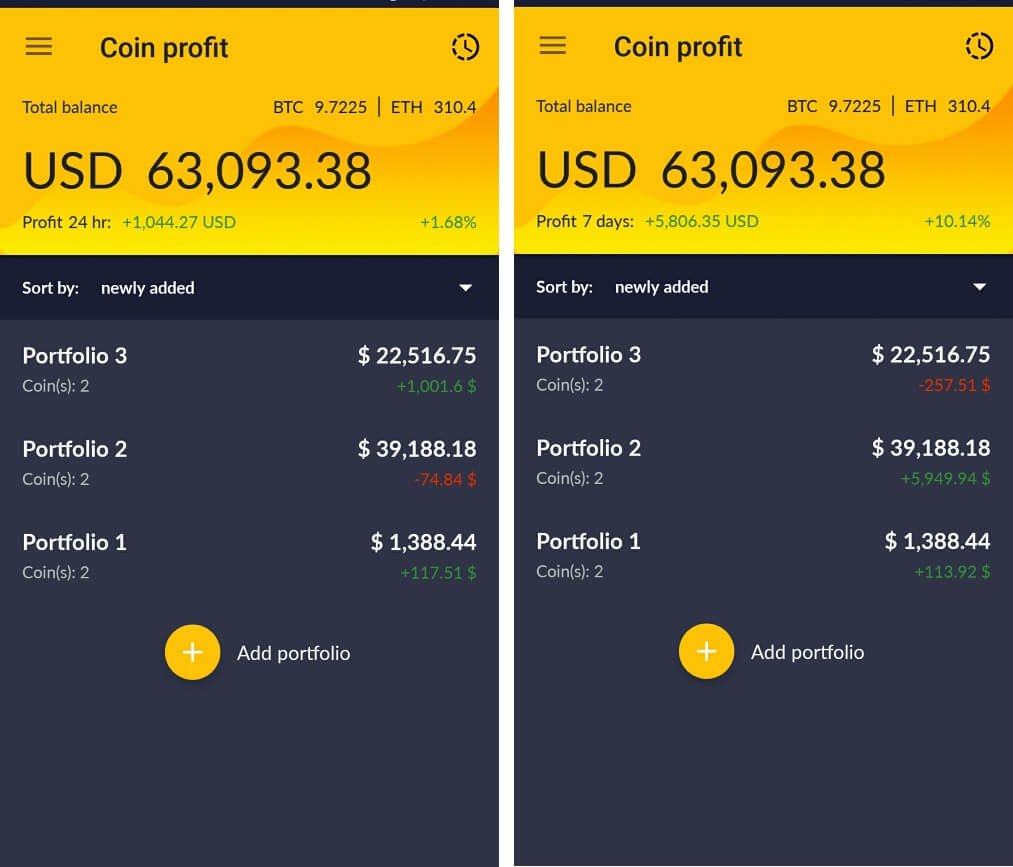

We have created several portfolios, each meets its objectives: making a fast money or a long-term investment. First we add coins, more than 1000 of which are available in the application. Portfolio 1 includes Dentacoin and Dash. We see that on the 13th of September (the date we prepared the article) DCN fell by 9.41% while DASH increased by 13.34%. 6 DASH coins succeeded to cover the loss of 800 thsd DCN coins, resulting in a total yield of 9.25% or $117.51. However, it is worth noting that if the capital had been invested only in DCN, we would have lost $21.52.

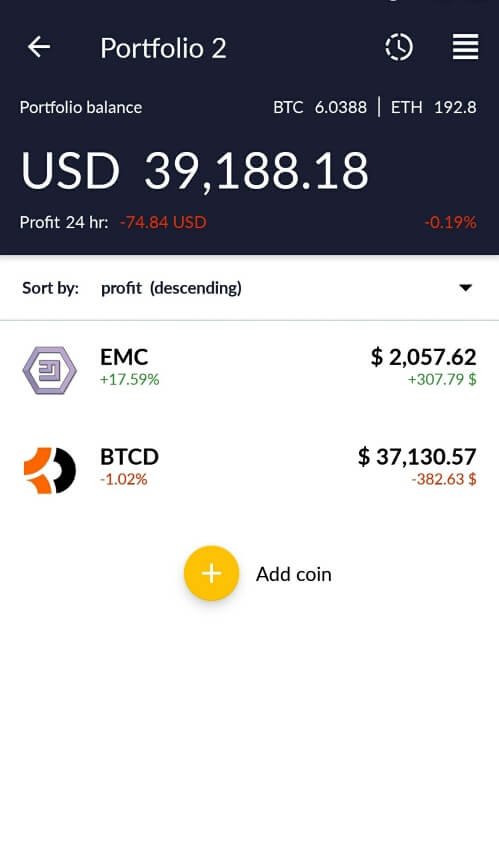

Portfolio 2 contains Bitcoin Dark and Emercoin and generated losses of $74.84 in 24 hours. The slight BTCD drop by 1.02% was not offset by the growth of EMC rate by 17.59% due to coins value and their weight ratio of the portfolio. 1500 coins of EMC failed to exceed the losses brought by 650 BCD units.

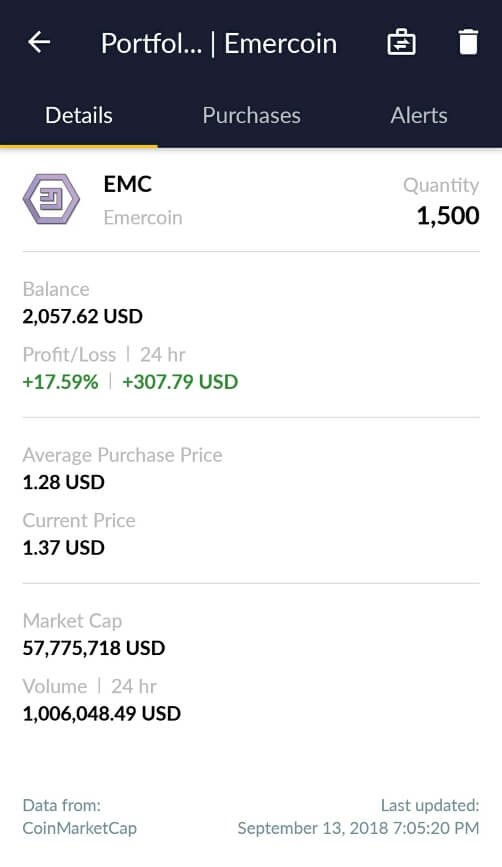

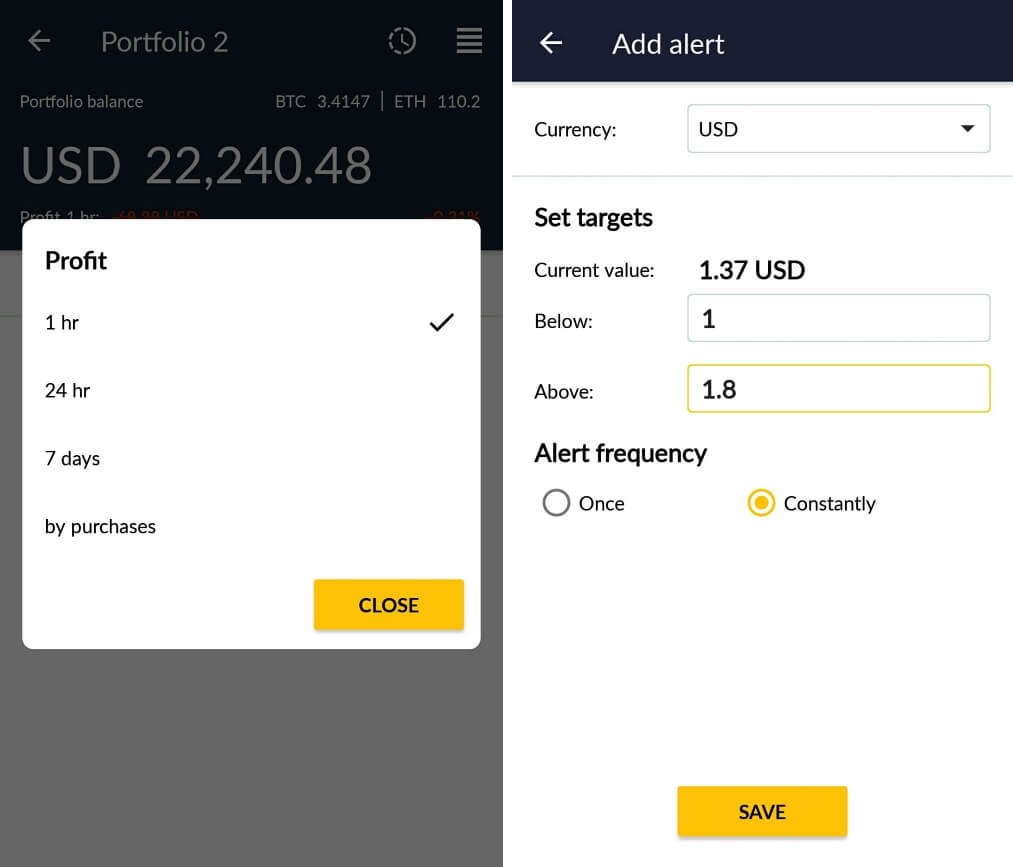

Important to note that EMC started the day with the rate of $1.17 and reached its maximum of $1.52 to 7:34 am (UTC+0). However in the middle of the day the price went down to the point of $1.37, which is 10% less than the maximum. Sharp fluctuations performed by such low-cost assets with a relatively low turnover (91st place in the Coinmarketcap rating) can indicate the event of pump - an artificial rate inflation by a group of traders to make a quick buck.

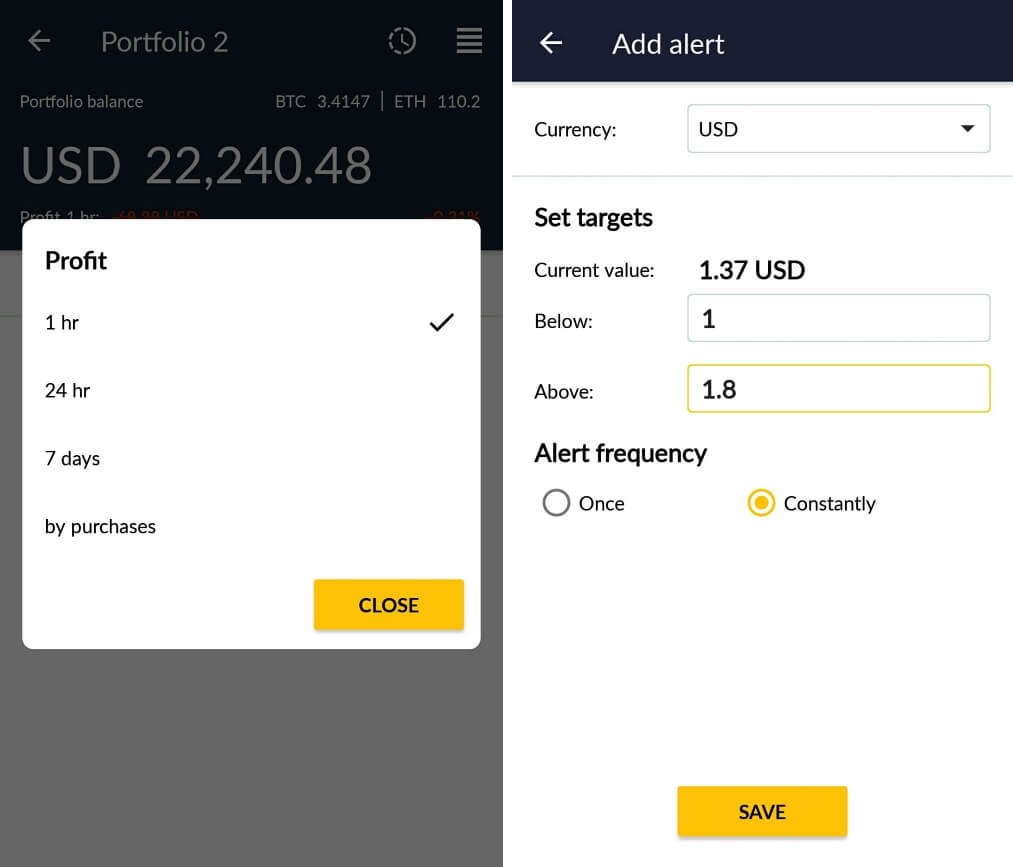

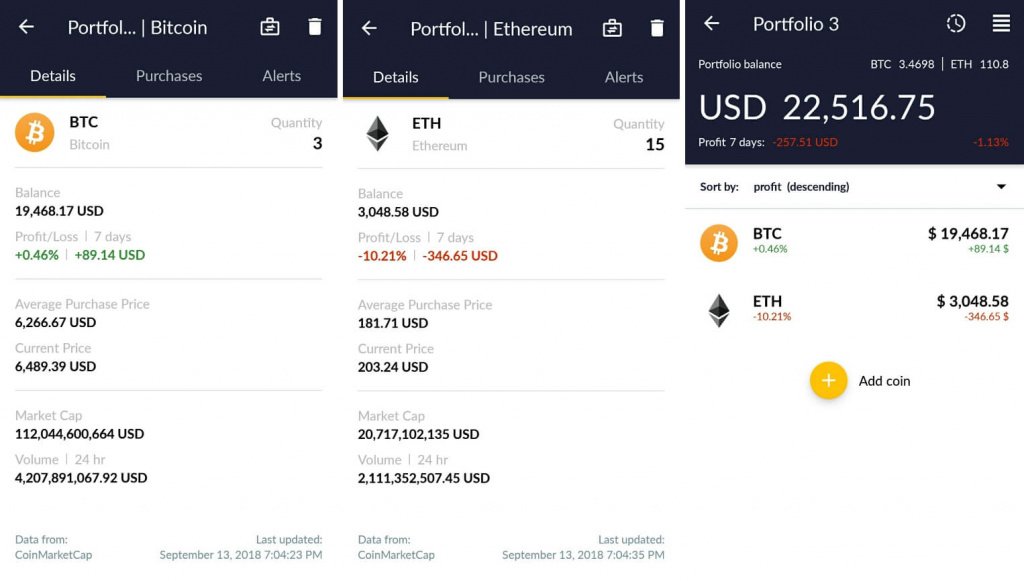

In order not to miss the pump moment, we can track the profit generated not only in 24 hours, but also in the last hour, while it makes sense to assess long-term investments by the return made in 7 days. To be 100% sure we add and set alerts about rate changes as we determine the acceptable range of fluctuations. If the currency goes beyond the specified maximum or minimum we will sell the assets to make big profit and avoid large losses respectively.

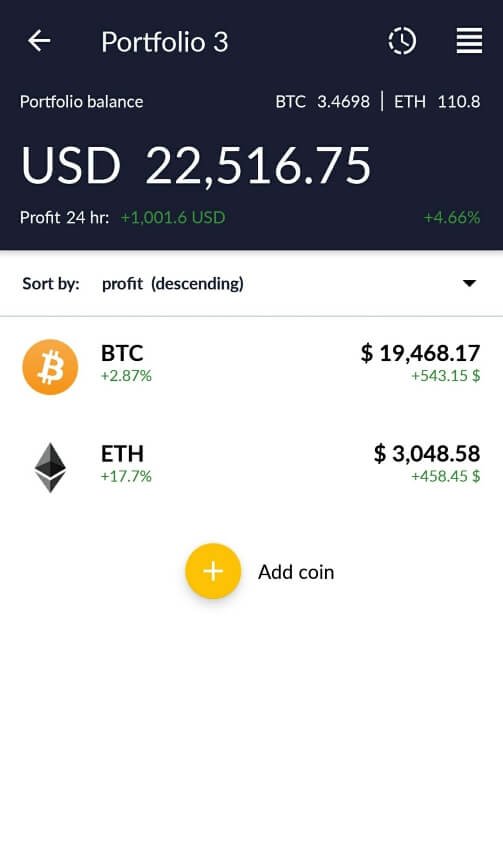

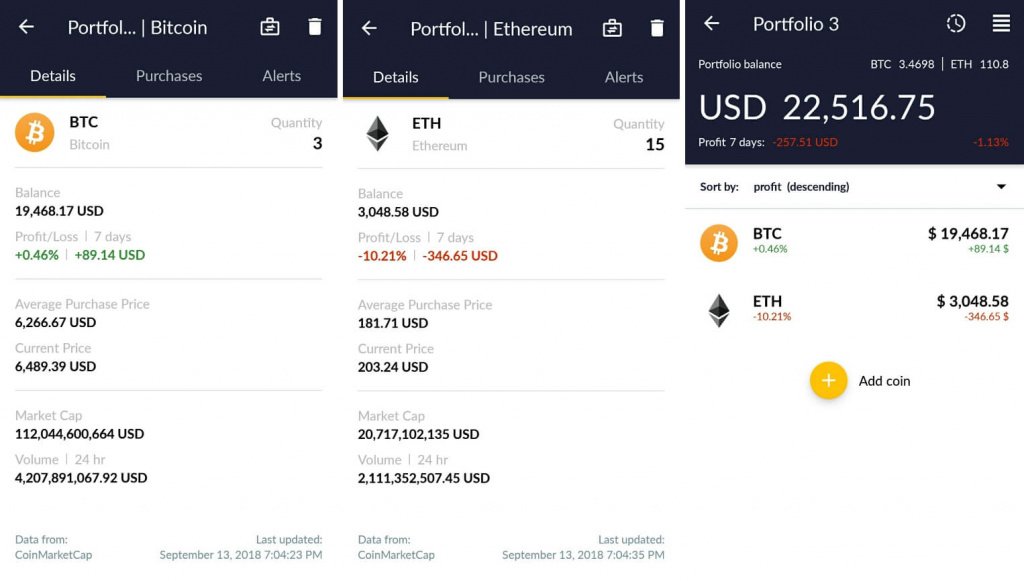

Portfolio 3 comprises Bitcoin and Ethereum, and it showed the best results: both assets gave a positive return, since their rates had a positive trend.

It is worth pointing both assets are valuable due to their high liquidity — they are leaders in terms of trading volume and market capitalization. Therefore, holders will able to sell these cryptocurrencies faster than any other digital asset whenever they will have a need to, for instance, in case of fiat requirements. In general, investments in these cryptocurrencies are long-term, so the revenues performed on one particular day are not indicative and significant. If we have a look at the longer period of 7 days, we see the negative return made by ETH assets that led to the portfolio value reduction by 1,13%.

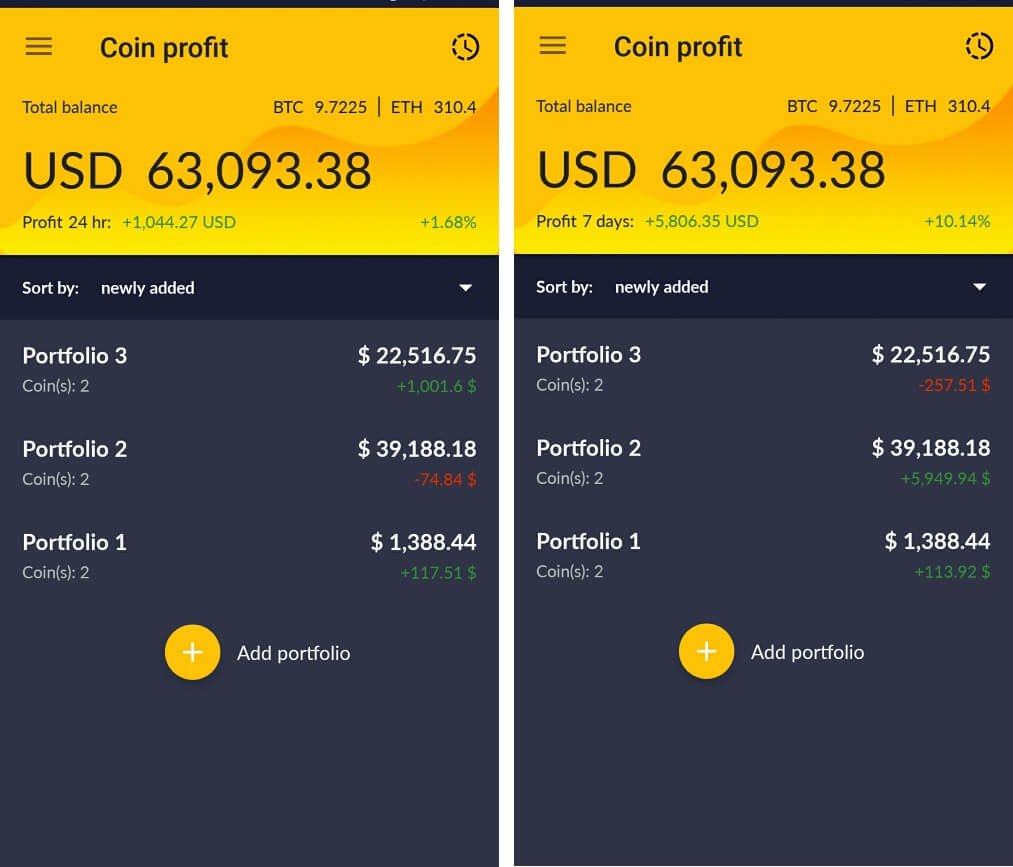

Moreover, the application calculates not only the yield each portfolio of assets and a certain currency make, but also gives an opportunity to monitor and control the total return on all investments. Three analyzed portfolios together brought us to a plus of 1.68% or $1044.27 in one day, regardless one of the three being unprofitable on the 13th of September. The same picture we have analyzing 7-day period - revenues generated by two portfolios exceeded the losses of the third one.

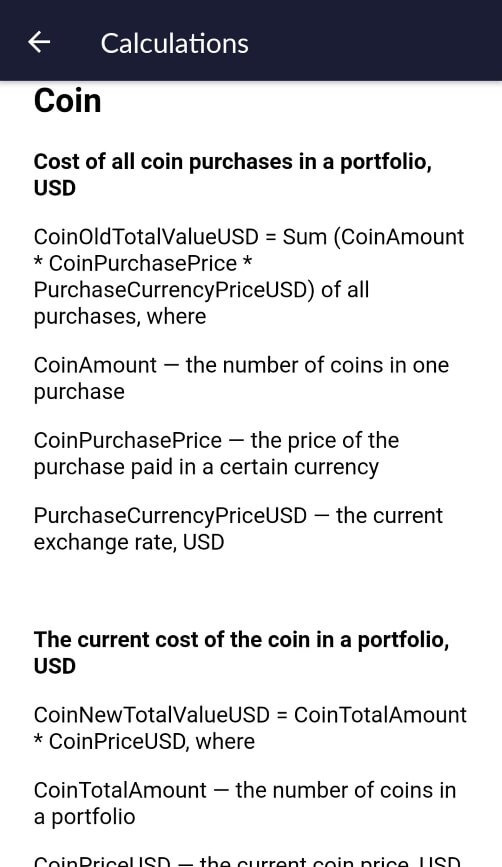

The correctness of the application calculations can be verified in the “Calculations” section, where the formulas are given.

If you want to repeat our feat, download the app here.