Report: Number of STOs Surged By 130% In Q1 2019

Security token offerings! If you’re familiar with the Crypto space then you’ve come across STOs — they’re all the rage now. With the strong negative sentiment around ICOs as a fundraising tool, primarily due to the bad actors in the space, regulatory complaint STOs took the limelight as the next significant market trend. And it appears that the security token is here to stay.

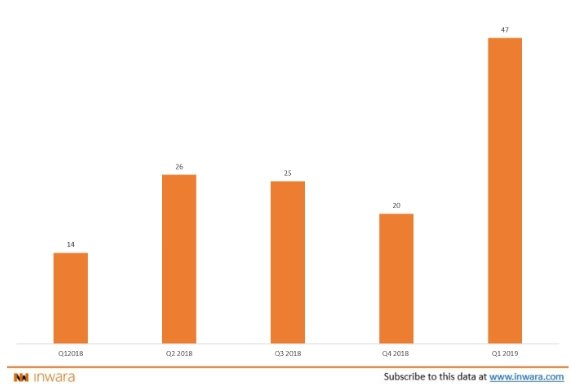

During Q1 2019, the number of STOs surged by over 130% when compared to the previous quarter. 47 STOs were reported to have occurred in Q1 2019 the highest in history, according to a report by InWara.

Number of STOs : quarter-wise

Security Tokens: What exactly are they?

STO investors are, by law, granted the ownership rights over a portion of the company’s assets bequeathed in the token. STOs are subject to federal securities laws based on jurisdiction as they satisfy the Howey test guaranteeing investor protection against fraudulent actors.

Security token landscape: What’s happening now?

Security Token Offerings could quickly overtake Initial Coin Offerings as the go-to method of fundraising, given the opposite paths they seem to be taking — STOs flying high while ICOs are tanking.

During Q1 2019, the number of ICOs crashed by over 50% when compared to the previous quarter (Q4, 2018) while the number of STOs grew by 130%, clearly demonstrating the market’s sentiment between ICOs and STOs.

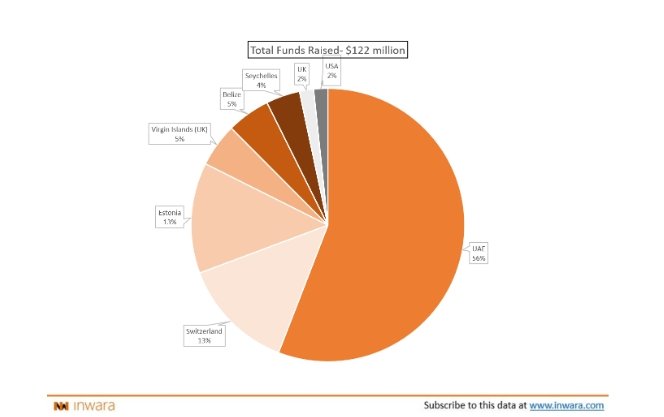

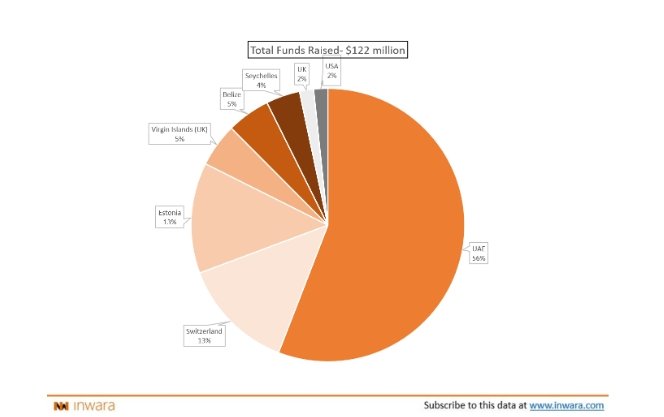

Funds Raised ($MM): Country-wise

A study of the STO landscape reveals two things. First, a majority of the STOs launched during this quarter were by US based companies, making the United States of America the undeniable leader in terms of number of STOs. But these STOs were collectively only able to raise $2 mln which represents less than 2% of the total funds raised indicating that investors are still circumspect about the space.

Security token offerings: What’s the reason behind the growth spurt?

- Enhanced compliance with jurisdictional regulation: Security tokens could help alleviate the risk of running into problems with regulators as they are by definition compliant with regulatory norms. This would mean a larger cost to launch an STO but lesser risk of a Cease & Desist notice from the SEC!

- Larger outreach and investor pool: As security token offerings often allow investors from around the globe to invest in their project, STOs provide a huge opportunity for issuers to gain access to an international pool of capital. Given the strong sentiment to the space in various portions across the globe, a compliant token could be received warmly by crypto skeptics.

- Increased liquidity for certain illiquid assets: Liquidity is defined as the quantitative discount a seller has to accept in order to liquidate their assets. Certain assets like Real estate and fine art have been traditionally been low-liquid assets owing to the limited demand or accessibility. A tokenized form of these assets could allow for faster liquidation and potentially create value!

Image courtesy of Visiofy