Raise The Stakes: 2018 Brings More Antes To The ICO Table

ICOs have been gaining popularity during the last few years, and both the amount being raised and the number of ICOs have been growing rapidly. Today, it is extremely challenging for ICOs to stand out among competition and attract the attention of investors. The latter are starting to demand more from the founders, seeking key business differentiators and unique value proposition.

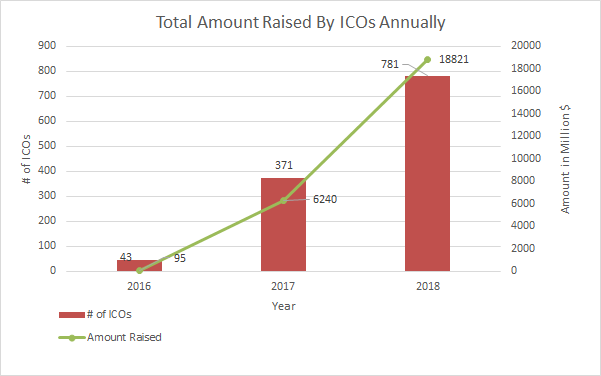

As we can see from the graph below, the number of ICOs has exploded from only 43 in 2016 to nearly 800 during the first 3 quarters of 2018, while the total amount raised in 2016 was only $95 mln compared to a staggering $18.82 bln for the first 3 quarters of 2018.

The good news is that there are new and interesting projects getting into the market almost on daily basis, as well as more investors are joining the crypto funding trend. The worse news is that now ICOs must have most of the elements of traditional start-up, mainly a functioning prototype, an existing development team, a short history behind the ICO and prospect customers showing willingness to purchase the product or use the service.

The reasons behind the changes

According to a recent report by Satis Group “over 70% of ICO funding (by $ volume) to-date went to higher quality projects, although over 80% of projects (by # share) were identified as scams”. According to another report by Wall Street Journal, almost $1 bln has already been lost to scam ICOs. Such reliable publications combined with spreading FUD, create a lot of justifiable uncertainty and concerns for investors. Combining the fear of getting scammed with the exponential growth in the number of ICOs and increasing competition to snatch a bigger share of the cake, naturally raises the bar for ICO founders to come up with key business differentiators and unique value proposition to gain the trust of investors.

Indeed, the majority seem to be scam or at least suspicious, but at the positive side, more than 80% of all raised funds were invested in legitimate projects. This indicates that investors are becoming more aware of how to spot scam ICOs and how to differentiate the legitimate ones. Scammers will fade away over time, due to the higher expectations of investors from ICO founders. They already can’t afford having a high quality WP with a detailed solution architecture and well set-up business plan, combined with an experienced development team and a functioning prototype. Actually, if they come with a great business idea and turn it into actual startup with prospect customers, it will be much more profitable to run an actual business than escaping with the raised funds.

Lastly but not least, regulators get more involved and put higher focus on ICOs. Although it was thought initially that regulations could harm ICOs and blockchain startups, the truth is that regulation just made it more difficult for scammers to co-exist and hide among the thousands of projects out there.

Modern ICOs. Where do the investments go?

Calculating the budget for an ICO is much harder than the one for a traditional startup. For the latter case, markets have a long history of reliable and verifiable data to count on, while for ICOs the data varies widely from one country to another, from one sector to another and even from one year to the next. During 2016 and 2017 you could run an ICO for as little as few $10,000, while during 2018 most of the successful ICOs report spendings of at least few $100,000. Most of initial funds are spent on marketing: paid press releases, advertising, community building, corporate communication, paid ICO listings, websites, content & digital production, etc. This cost must be solely covered by the founders or money raised by people who trust them.

Once the ICO is complete and the minimum required funds has been raised (the softcap), the founders have to follow the traditional way of allocating the available budget to various project activities. Usually the following five areas must be taken into consideration:

Product Development: Usually, this part consumes the biggest share of the budget, ranging from 30% to 50%.

PR, Marketing & Sales: Once the product is ready, it’s time to market it. Most of the projects allocate 25% to 35% of the budgeting for marketing activities.

Operations: Operational costs vary widely from one project to another, depending on the nature of the solution and the way it is implemented. Allocations range from as little as 10% to slightly over one third of the budget.

Legal: Although legal might get the smallest allocation, it could actually be the most significant. Without having a fully legally compliant solution the founders and executives could face criminal charges. Most of the ICOs allocate around 5% of the budget for legal services.

Others: For all ICOs, there will surely be one thing in common, which is unexpected expenses. Although this is true for all start-ups, it is more frequent in ICOs due to the lack of history and benchmarks based on which founders can rely.

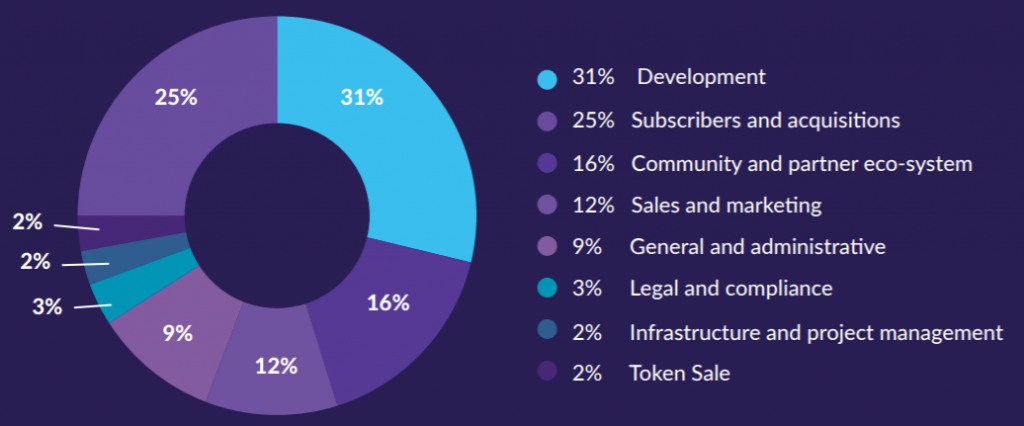

We have an example with diverse coverage from an ICO startup, which is created to decentralize the healthcare ecosystem at a global scale:

As we can see from this example, around 30% is dedicated for development, the reason to fall within the minimum range is that this platform is user & partnership intensive. The following three categories are all somehow related to marketing and business acceleration. Combined together, they form around half of the overall budget. This makes a lot of sense for such an ecosystem. Without high user base, integration of famous and trustworthy partners, and a strategic marketing plan, the platform may not yield its full potential. Administration is usually around 5% or lower; however, in this case, they have included “General” within the same category, which we have referred to as “others” previously.

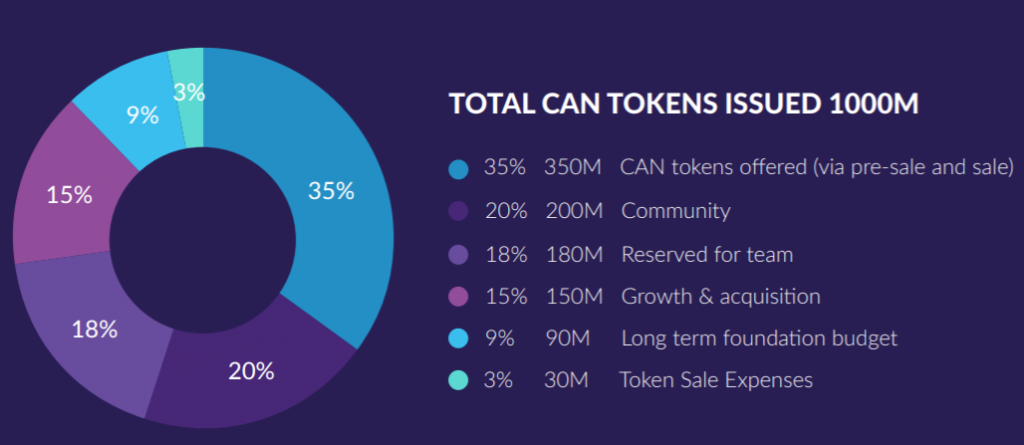

If we look at their token distribution model, we will see the following:

The project is offering only 35% of all tokens for sale, usually this is at the minimum range. The reason for this is that they have decided to pay the team and cover operational costs more in tokens than from the proceeds of raised funds. That's why we see 18% & 9% allocated for the team and long term budget accordingly. Since this ecosystem is user & partnership intensive, 20% and 15% have been allocated to the community and “growth & acquisitions” accordingly.

How to calculate the expenses properly to avoid running out of budget

ICOs have two major phases: fundraising and plan execution. For fundraising, many parties are involved, including but not limited to CxOs, Developers, Advisers, Influencers, ICO listing sites, PR & Marketing, paid advertisements & promotions, conferences & events, investing on an MVP, social media and corporate communication channels, bounty and airdrop campaigns, and a big army of people to work jointly to sell the ICO to a global market. The cost of fundraising highly depends whether you decide to hire a local in-house team or outsource to a third party.

Realistically, the starting cost is surely a 6-digit number nowadays, and is around $100,000 to $400,000, depending on whether the founders and their core team are performing actual work on the prototype and willing to be paid in tokens only instead of fiat currency and whether the same core team are experienced marketers. Even if 100% of the work is done in-house and for tokens only, the founders can’t escape the costs of paid advertisement. Taking the lengthy period of ICOs, which could easily last six months, modest advertising and paid promotions budget can easily exceed the $100,000 for such a period.

Once the ICO is over, it will be time to redistribute the collected funds. The majority of the genuine ICOs prioritize the delivery of what has been promised in the WP, therefore most of the raised funds get immediately allocated to R&D to release the first milestone according to the project roadmap. Right before the release of the first working version, founders start preparing for marketing campaigns to increase the user base, hire the operational team to maintain the availability of the software solution and get the support team in place to address user’s issues.

How to be more transparent and explain the ICO budget to the team and investors

What most ICOs miss in their whitepaper, is the calculation of the percents of token distribution and allocation of raised funds. Most of the ICOs come up with such figures, but it’s a rare thing for a whitepaper to explain why the product development needs 50% of raised funds and not 60% or 40%; or why only 35% of all issued tokens has been allocated to public sale and not 60% of them.

A lot of ICOs miss a whole sensitive topic, which is the tokenomics or token economics. Although the title might be there, the content does not really cover the details. It is hardly possible to find an ICO which has a dedicated document for the tokenomics of the ecosystem, describing in details how the tokens will be distributed, why this distribution is the ideal to drive the value appreciation of the token, and how funds will be used and based on what assumptions such allocations has been made.

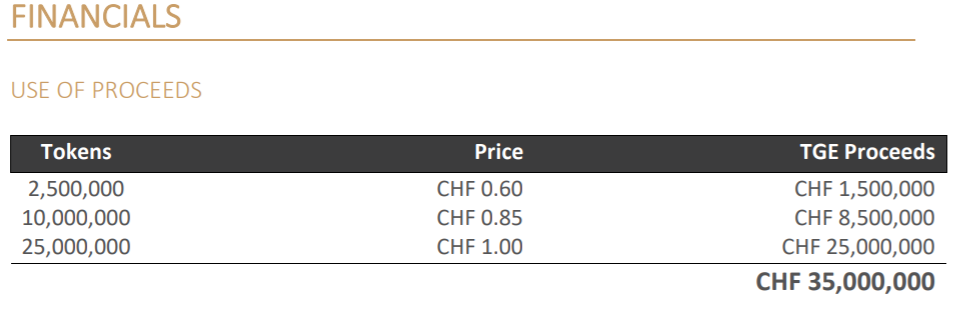

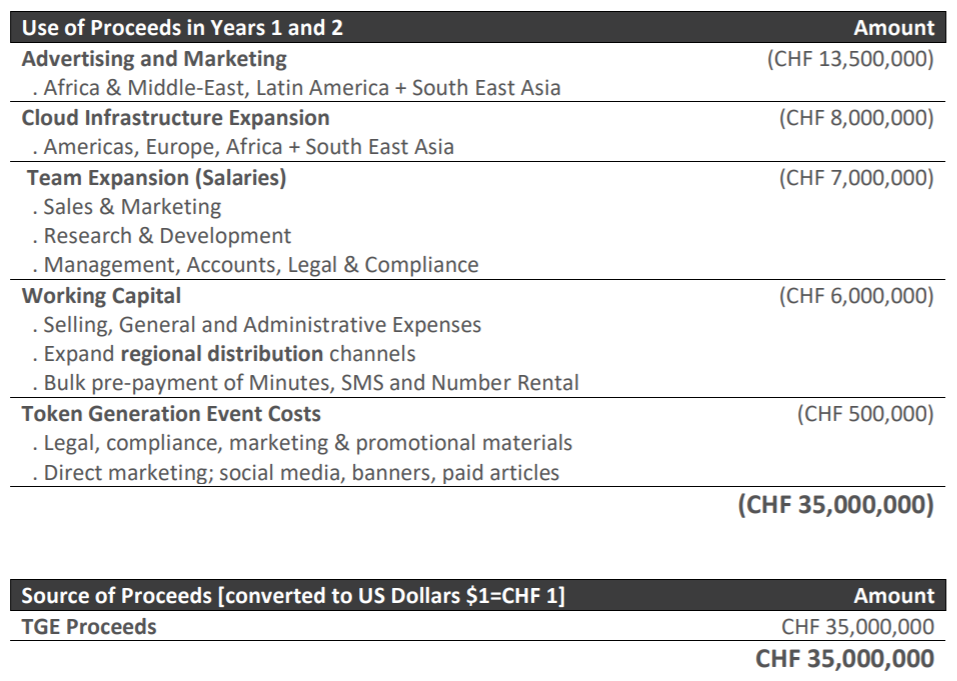

Simple elements like the estimated number of man hours required to deliver each milestone is missing from the majority of WPs; such elements must be taken into consideration to be able to reach to accurate estimates. ICO founders must be fully transparent of how they reached the figures they are presenting in the whitepaper as well as have enough details of the efforts needed to deliver each major milestone of the project. Here is a good example for a transparent ICO with detailed explanation about the proceeds distribution and spending.

“The project plans to acquire 500,000 subscribers in the first full year of operations and a further 750,000 in our second year. We will create additional regional distribution channels for our service in emerging economies and expand our world-class telephony data-centre infrastructure to cater for our growing communications needs as on-board subscribers.”

Conclusion

The growth of expenses for bringing ICO to the markets is a natural process. The increasing number of projects make founders invest in distinguishment, better project presentation, prototype and MVP developments, etc. The markets and investors benefit from this process in recoiling scam projects away while receiving good ones instead. The stakes get higher, as the opportunities to get to a higher level are raising too.