NFT Mania: Where Does It Lead To?

Everyone knows that the use of cryptocurrency has surpassed the hype realm into a real transformative solution for industries; however, digital art — a computer-generated visual art is probably the most surprising benefactor of this trend. Its integration into cryptocurrency skyrocketed its value and adoption rate.

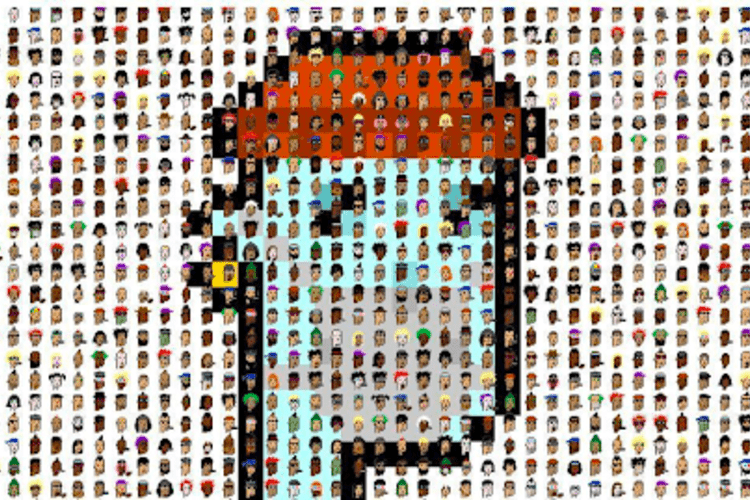

NFTs are here. With several companies and individuals embracing and investing millions of dollars in the trend, ranging from Steph Curry's endorsement to Beeple's incredible $70 million 'Everyday' artwork sale, it is fair to presume that this form of technology has gone mainstream. Factors such as cultural relevance, fun, visualization, and simplicity are arguably what put NFTs (especially art and collectibles) in everyone’s face.

Is this here to stay or just another buzz in the industry?

A report from Art Trade shows that more than 500,000 NFT artworks were sold in the first half of 2021 alone, totaling more than $6.8 billion in sales. The growth of NFTs allows artists to create a piece that can now be seen and appreciated globally. Art and collectibles were just a start. Now, from gaming to finance to real estate, NFTs could serve as a unique digital asset representing proof of ownership. Let's explore some interesting use cases.

- Collectibles

Whether via OpenSea—the largest marketplace for selling NFTs, Sorare, or Valuables, there’s a huge demand for digital collectibles. Jack Dorsey’s first tweet is a great example of NFT collectibles. In 2016, Dorsey made his first tweet, "just setting up my twttr." The tweet was auctioned for $2.9 million, and Sina Estavi, a Malaysian-based buyer, bought the tweet using the ether.

- Gaming

Other use-cases are gaming(Crypto kitties), finance, and real estate. For instance, Danny (Flying Falcon)— an NFT seller active in both Hashmasks and Crypopunks, sold some plots of land for $1.5 million via Axie Infinity(NFT marketplace for games).

Involvement of big crypto platform

Interestingly, the world's most renowned crypto platforms have shown a massive interest in NFT. Coinbase — the largest crypto exchange company in the US, announced its launching into NFT in Oct 2021:

"Today, we're announcing Coinbase NFT, a peer-to-peer marketplace that will make minting, purchasing, showcasing, and discovering NFTs easier than ever."

Likewise, Binance started its NFT marketplace in June, hosted alongside the base Binance platform.

Conclusion

NFTs first appeared in 2014 and didn't start hitting the limelight until the last few years. Its sustainability has not been proven. Short time in use means short time for problems to appear and experts to devise fixes. In a long enough time frame, most NFTs will likely go to zero; however, I believe that digital collectibles are here to stay.