ICO Investors Become Active Again. Global Analysis, August 2018

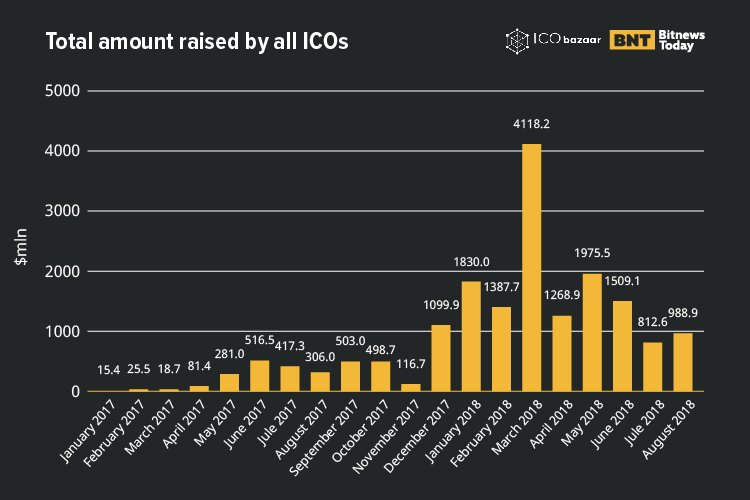

August did not introduce new ICO champions to the crypto community though. No project broke the record of the El Petro, for instance, that has already managed to raise $3,3 bln on ICO pre-sale according to the Venezuelan Government. However it should be noted that no auditor verified the information. Moreover, economic experts have big concerns about the real value of El Petro and consider it a waste of money. The Washington Post economic reporter Matt O’BRIEN points out: “In reality, the petro isn't a crypto, it isn't a currency, and it isn't backed by oil in any meaningful sense. It's just a way for Caracas to try to get around the sanctions against it while raising money from the only people more clueless than itself”.

Another ICO champs are Telegram that raised $1,7 bln during two stages of the TON token sale to private investors - $850 mln in February and $850 mln in March — and EOS that closed their ICO with the result of $4 bln at the end of May.

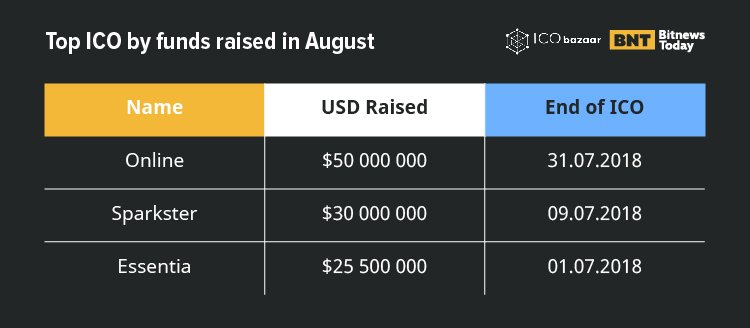

There were no ICO projects that managed to beat the previous records as the highest amount of funds raised in August per project turned out to be $50 mln maximum.

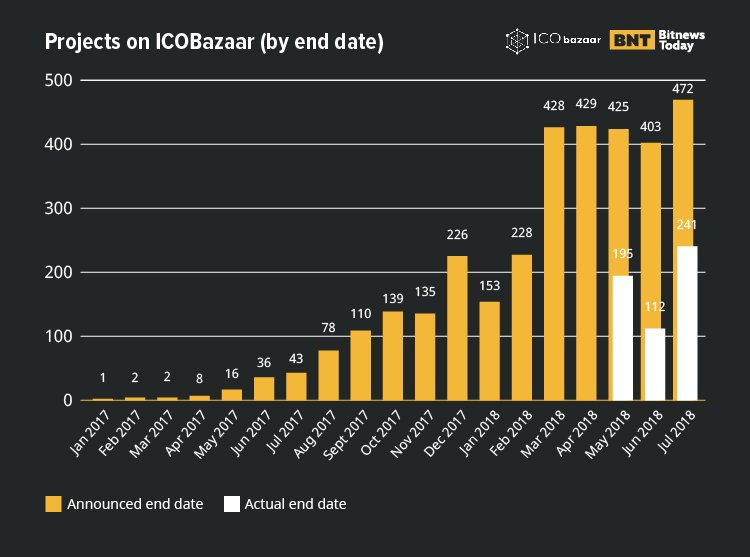

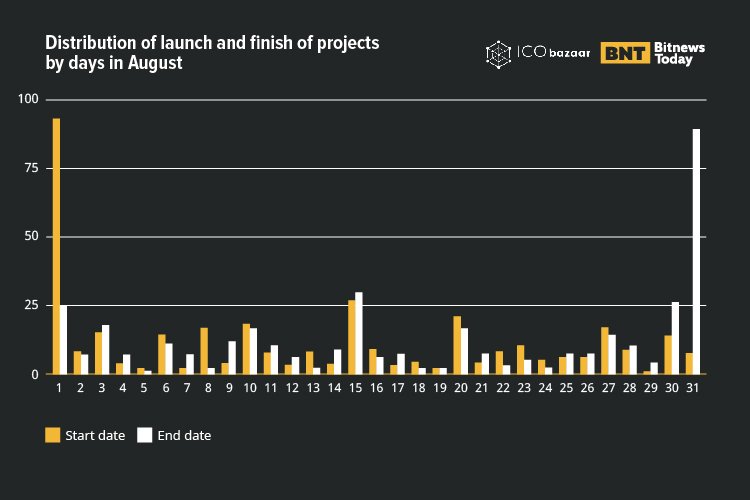

Analyzing the monthly reports we have noticed the continuous trend that project teams tend to to start ICOs on the first day of the month and close on the last day as it happened in both June market insights and July report. There may be a few reasons for this tendency. First of all, a month is a traditional period under report and therefore projects complete their ICOs in a month period due to accounting convenience. Moreover, investors, institutions in particular, operate within accounting periods.

They analyze their revenues and expenses on the monthly basis which gives them an idea of how much capital they can invest and how to allocate it via different assets. Finally, most teams are likely not to plan any specific start date but they have to determine it in order to fulfill the required ICO application for registration and the most logical decision is to connect the new beginning — the ICO launch — with the beginning of a month.

However the most rational way to prepare for an ICO is to analyze the competitors and investors behavior and conduct the market research to select the perfect moment for launch that may not match a month start.

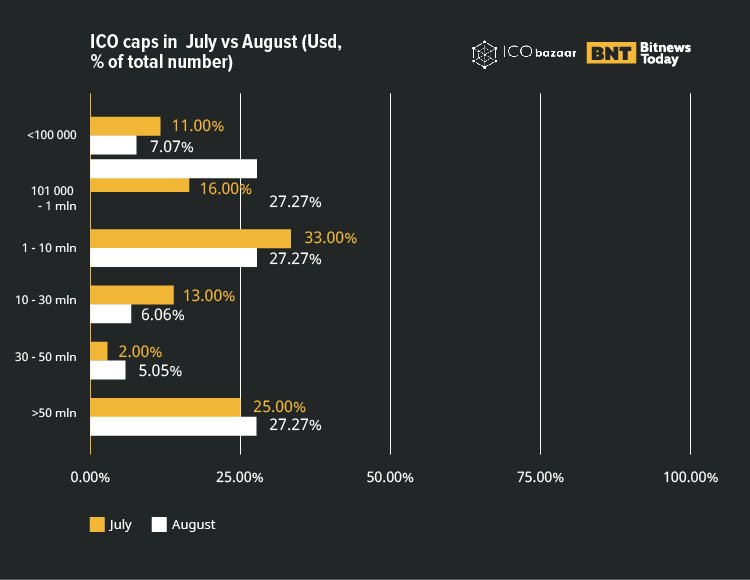

Smaller hardcaps — more trust

Projects complete in August tend to establish “less than $1 mln” hardcaps which represent the maximum investment goal that will cover all the project costs. Due to high competition and growing selectivity of investors more companies are entering the market with well-planned campaigns and a prepared scheme of funds distribution, understanding what financing will be required and claiming specifically for them.

Traditionally, moderate hardcaps are considered a good sign for an ICO and the projects seem to be aware of it trying to make a good impression on investors. Nevertheless, the average ICO goal has grown up to $5,1 mln in comparison with average hardcap indicators in June and July — $3.9 mln and $4.2 mln respectively. It is worth pointing out that anomalous caps above the billion USD are traditionally excluded from average calculations in order to provide the most realistic market picture.

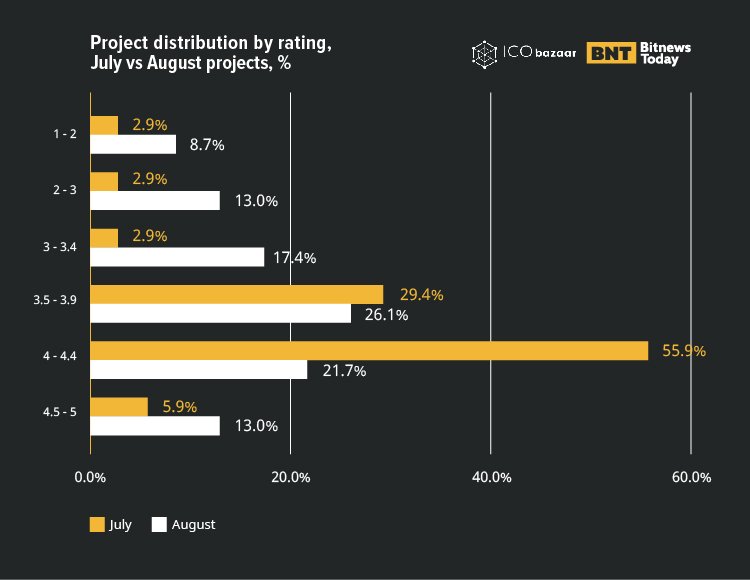

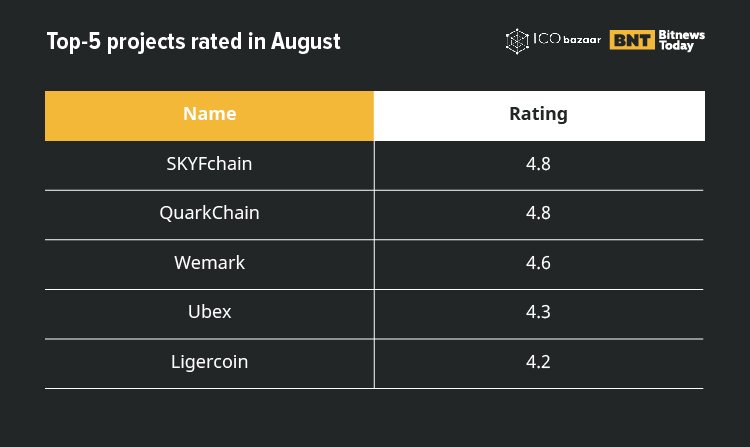

What's behind the rating?

The ICO Bazaar provides the rating for ICOs on the scale from 0 to 5 accessing the overall quality and viability of each project via studying a project idea and whitepaper, team, media, technical implementation, website and an industry expert review. August did not please with the increasing number of the projects with a score below 3 points — growth by 15%. Though this negative twist was a bit compensated by a slight but still gain of 7% performed by the top-rated ICOs. Meanwhile, the number of projects with a score below 4 points decreased by 25%.

In general, the growth of ICO number rated from 4 to 4,4 points was due to stronger technological side of the project. The weakest point for many projects during the last 3 months is media. Often the result of the initial idea evaluation is below the final average rating since now companies are taking a more workable models rather than a striking and difficult to implement ideas and focus more on the project delivery which are supported by strong qualified teams, transparent plans and well-thought-out roadmaps.

Less projects are showing off by declaring big words as “being a game changer” and assuring investors with high profit expectations. Thus, ICO projects are finally shifting towards serious intentions and concentrate capital on business execution of high quality instead of spending tons of resources on PR

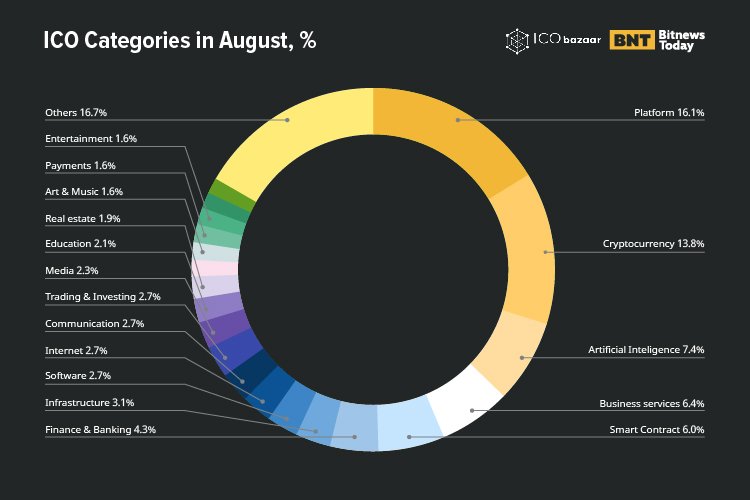

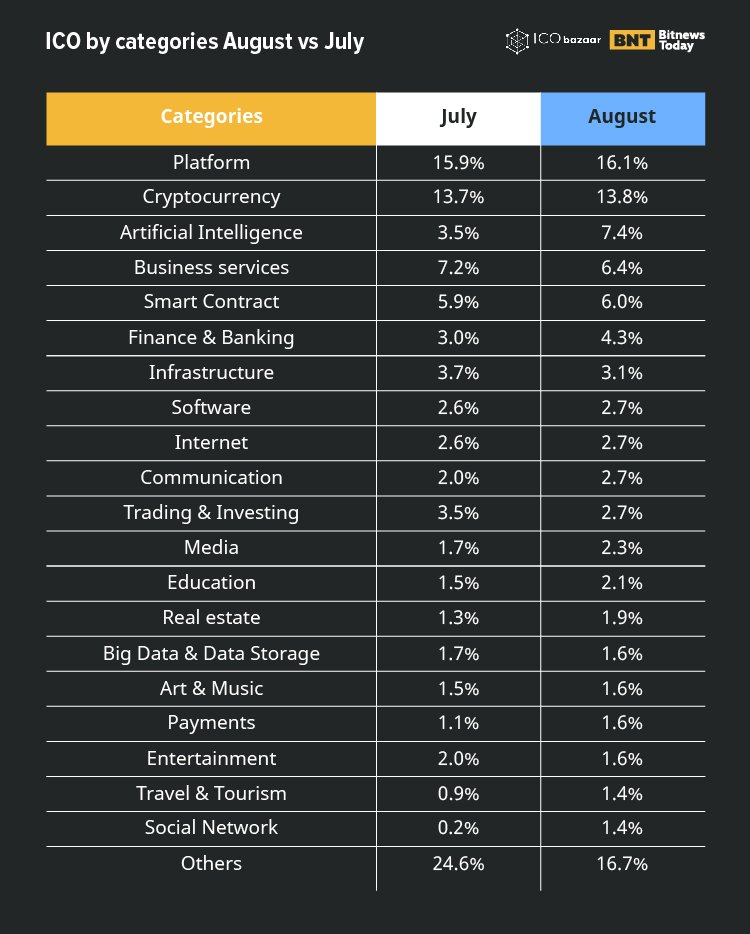

Platforms and cryptocurrencies ICOs holds the biggest interest for investors

Platform and Cryptocurrency projects maintained their leadership by having 30% of the total market share in August. The same ICO categories were the most popular among investors in June and July. Artificial Intelligence came the third strengthening its position by 112% — 7,4% in August comparing to 3,5% in July and 3,8% in June. The closest chasers are Business services, Smart Contract and Finance & Banking which together occupied 16,7% of the ICO market.

Finance & Banking category gained another 40% in respect to July result while Travel & Tourism and Real estate went up by 56% and 49% respectively. The most significant development by 525% was performed by Social Network. However this mind-blowing growth number should not get you twisted because 8 Social Network projects in August replaced the one in July.

A slight decrease were caught in Business services, Infrastructure, Trading & Investing, Big Data & Data Storage as they together lost 8% from the July result.

The overall positive dynamic in terms of a shift towards quality and recovering interest among investors gives hope for future development of the ICO market.

We provide you the profound analysis of the current situation on the ICO market supporting it with relevant statistics. Feel free to share these exclusive visuals with your audience so that they will have a chance to be updated with an ICO roller coaster together with us. And don't forget to put our link.