Forget About Tether: Why New Stablecoins Broke $2.3B in November

While the majority of cryptocurrencies have been consistently declining, which has led to the overall market capitalization decrease by almost 50% in just month and new minimum of $104B this year, there has been one type of digital assets that managed not just resist to this negative dynamic but actually increase their presence on the market. These are stablecoins, which have turned out to be a relative safe haven for zonked investors and traders during current hard times. Let’s figure out whether these coins can indeed guarantee the security of your crypto investments.

The leading position among all stablecoins is still maintained by Tether, which has a lot controversy going on around it. First of all, the issuer of USDTs is managed by the same team as one of the world’s biggest exchanges Bitfinex, which was surprisingly (sarcasm) the first to introduce the coins to the market. Why is it a bad thing? Well, not only backed-stablecoins, including Tether, are centralized at their essence as they must be backed by real underlying assets as fiat, which are usually stored by the issuer, but having the same management team gives Bitfinex power to manipulate the market via USDTs, of course, in their own interest. SEC and The U.S. Department of Justice were the regulators that got major concerns about these state of affairs and therefore began investigation whether it was the case in the winter boom of 2017.

The second issue arises right out of the first one, which is the necessity for an issuer to have and store underlying assets. Tether has quadrupled offer of its coins on the market to over $1,8B after the passed year and there are high doubts that the company has that much US dollars on their bank accounts. Instead of conducting an official audit, it hired not an accounting but a law firm, Freeh Sporkin & Sullivan (FSS), that provided just a verification, confirming the existence of these fiat deposits in the sufficient amount. A verification implies Tether and FSS together decided on the standards of the procedure, while it is impossible during an audit.

Even though Tether claimed that there is no opportunity to obtain audit at this point due to emerging state of the industry and lack of existing accounting standards, another stablecoin issuer called Stasis has recently refuted this statement by hiring an accounting firm BDO Malta, that is expected to conduct quarterly and annual audits.

You may say that it is all because this startup is Malta-based and as we know, Maltese government has been active developing legal framework for the crypto industry and actually promoting the involvement of local audit firms in the new economic sector, while the US state is not in such a law-adopting rush. However, other US-based companies like Winklevoss brothers’ Gemini or Circle or Paxos attracted actual accounting firms, which are top-ranking in the US accounting industry. These firms provided attestations, that requires examination to be conducted in accordance with stricter standards than verification.

So there is a big question of why the stablecoin leader is not at least trying to push the work on the accounting issue to local regulators. Maybe it has indeed significant grounds of not disclosing the state of its financials then, which has an impact on trustworthiness of USDT and therefore its position. Tether has been losing its market share since the beginning of the year, when its dominance accounted to 94% of the stablecoin market. This indicator has dropped to 74% at the end of November.

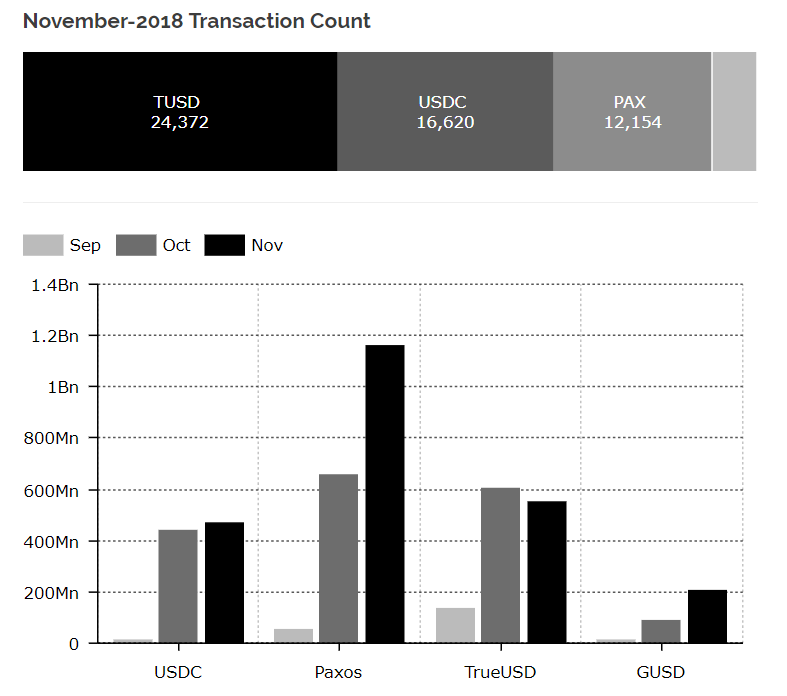

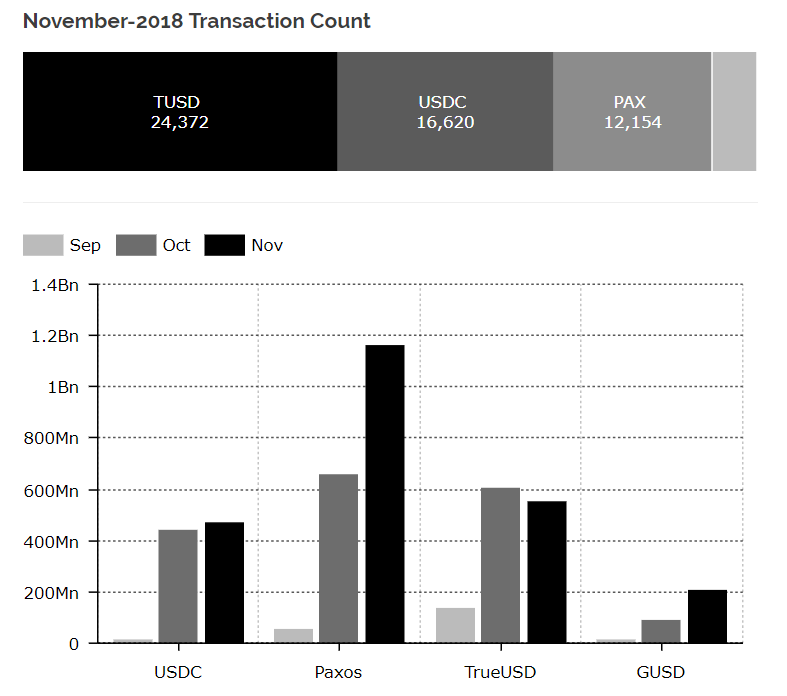

In November number of on-chain transactions with “new” fiat-backed stablecoins jumped by 1032% in comparison with the September indicator, reaching the value of $2.3B. As for four major “new” stablecoins, which are USDC, TUSD, GUSD and PAX, together they have broken the $5B mark within a short 3-month period.

(source: www.diar.com)

Judging by the graph above, the leader in value terms of on-chain transactions among this top-4 is PAX, transactions with which on the Ethereum blockchain came closer to $1.3B in November. Its popularity may be explained by the issuer’s reliability as Paxos Trust Company is a financial institution, which activity is regulated by the New York State Department of Financial Services. Nevertheless, PAX still has not managed to top TrueUSD in terms of the number of on-chain transactions.

TrueUSD’s peculiarity is lying in the fact that the issuer does not actually store fiat backing funds in their bank accounts. TrustToken company uses escrow accounts via partnering with trust companies. The scheme is the following. When an order for purchase of TrueUSD is placed on the TrustToken platform, the system automatically appeals to a trust company to create an escrow account via a smart-contract technology. During the fulfillment of a smart contract TrustToken system transfers fiat to a trust company, while the equivalent of TrueUSDs is sent to the buyer’s Ethereum address. Therefore trust companies directly handle all the backing capital instead of the TrustToken team, that is not anyhow involved in the transfer and storage of fiat funds, which increases the security level of this token and thus its trustworthiness.

Moreover, escrow accounts are also widely used in the traditional financial industry and there is already existing legislation for them, which adds to the TUSD’s trustworthiness. Again we can see how financial instruments from the traditional sector can be become a solution in the emerging crypto industry, where there is still obvious shortage of regulation. However, they are applied by single crypto companies, so compliance and transparency remain the issues for the stablecoin market and therefore potential buyers of these coins should think twice.

Image used in this article is “Judith with the Head of Holofernes”