Ethereum Problems: It Can Probably Get Even Worse

October ended positively for the holders of two top cryptocurrencies. And if for Bitcoin everything isn’t so bad, then Ethereum continues to have some systemic problems.

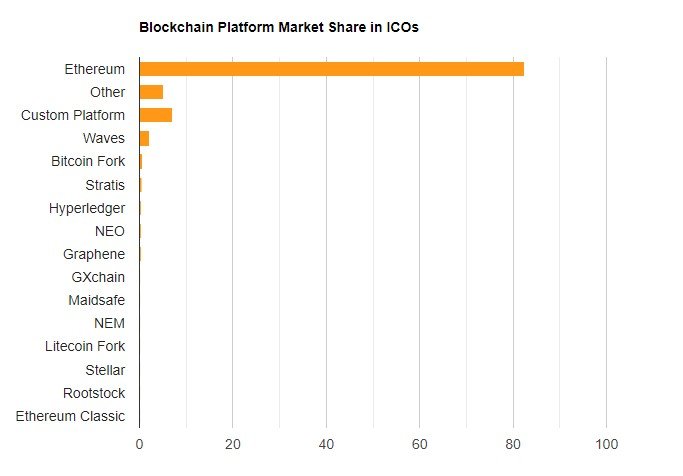

For Vitalik BUTERIN and Ethereum, 2019 is not the best year at all. Though Ether keeps the second place in terms of capitalization and even increased almost one and a half times since from 135 to 182 dollars at the end of October. Looks like good profitability, but if not compared with Bitcoin or with the Ether itself two years ago. In summer 2017, 1 BTC was worth 7 ETH. Now it’s 50. And if that is not enough, the current increase in fiat prices is considered by some as a correction before a further downfall.

Fig. 1. Ethereum price chart (green scale) and trading volumes (gray scale). Source: Coinmarketcap.com

What will help Ethereum, says Charles PHAN, CTO of Interdax:

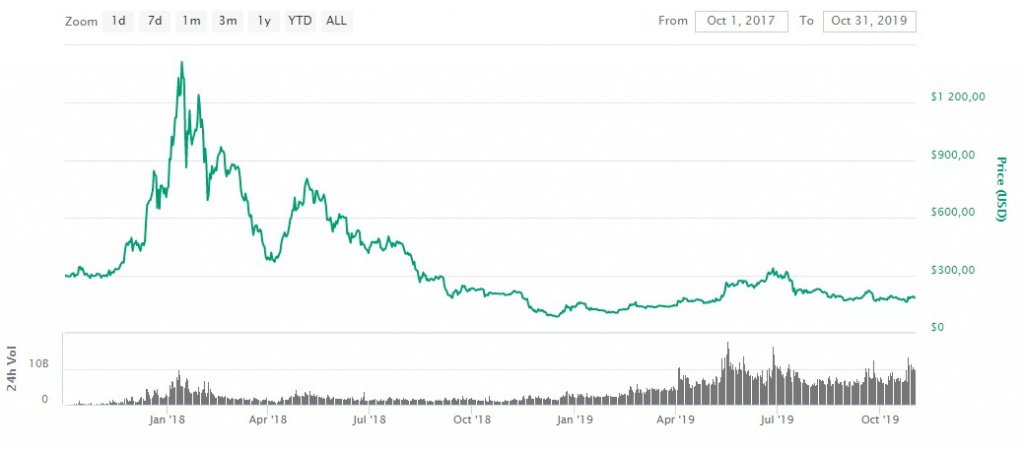

“The main fundamental factors affecting Ethereum’s price include the demand for ether to participate in ICOs and demand for ether to participate in DeFi projects (such as Compound or Synthetix). The supply side factors include miners selling new supply to pay for expenses and treasury liquidations by ICO projects — which both increase the available supply of ETH. The net monthly selling pressure is anticipated to remain negative over the course of 2019 (i.e., there will be more sellers than buyers on exchanges). ICO treasury liquidations are one contributor to this and since the rate of new ICOs has slowed considerably, it is unlikely that they will prop up ETH’s price again in the near future. What has more of a chance of increasing the demand for ETH (and in turn price) is the increased uptake of DeFi projects.”

The expert claims that Ethereum will play the same role of fuel for crypto startups as before. It has no competitors yet, so even a relatively small number of projects will be able to maintain demand for ETH and bring the price to a new equilibrium level. Anyway, most likely, it will not suit those who purchased cryptocurrency in 2017 and still hold it.

Fig. 2. The platforms for ICO fundraising. Source: icowatchlist.com

The conflict between Ethereum and Binance

With the advent of IEO, such as Binance Launchpad platform, alternatives to Ethereum were found. One of the ways to join the Binance exchange is to switch to its blockchain. During the transition, ether tokens are burned and replaced with native exchange tokens. This, in turn, initiates a drop in interest in Ethereum — it just becomes unnecessary. Of course, Vitalik Buterin did not like this alignment, and wished all the centralized exchanges “to burn in hell”.

CEO of Binance Changpeng ZHAO was more restrained and said that there was no conflict, although part of the trading pairs after appearing on the exchange ceased to be listed as pairs to ETH. Be that as it may, the progress cannot be stopped, and Buterin and his team will have to look for options on how to regain popularity with their cryptocurrency — without relying on old methods.

Why Ethereum needs to use new business models is explained by MySupplementStore.Com Digital Marketing Lead John FRIGO:

“A lot of the growth and popularity of Ethereum had to do with the fact it was the onramp to ICO’s. We’ll never see that again, first because most of the things people were invested in back in 2017 today would be considered securities, and also because so many people got burned by ICO’s many people will be hesitant to get involved again, and lastly most people see altcoins as “sh*tcoins” now as opposed to something special or unique or something to invest in.”