Decentralized exchanges, part 2. Projects

The first part of the article was devoted to the principles of DEX, and their strengths and weaknesses. The developers of many decentralized exchanges are trying to make bidders feel better user experience while using new mechanisms and operating principles. Despite this, there are significant differences, and we have to get used to them.

There is another feature that has already been mentioned in the previous part: decentralized orders are not retroactive, transactions cannot be canceled, and private keys to the wallets of decentralized exchanges are not stored on servers so no one can recover them in case of loss or theft, etc.

Small trading volumes on decentralized exchanges and a lack of liquidity are a consequence of their low popularity. The anonymity and irrevocability of transactions lead to the fact that trade is conducted only with cryptocurrencies — as fiat money is under the supervision of regulators who require the introduction of a KYC procedure, which is usually unacceptable for decentralized projects.

Let us review several projects of decentralized exchanges.

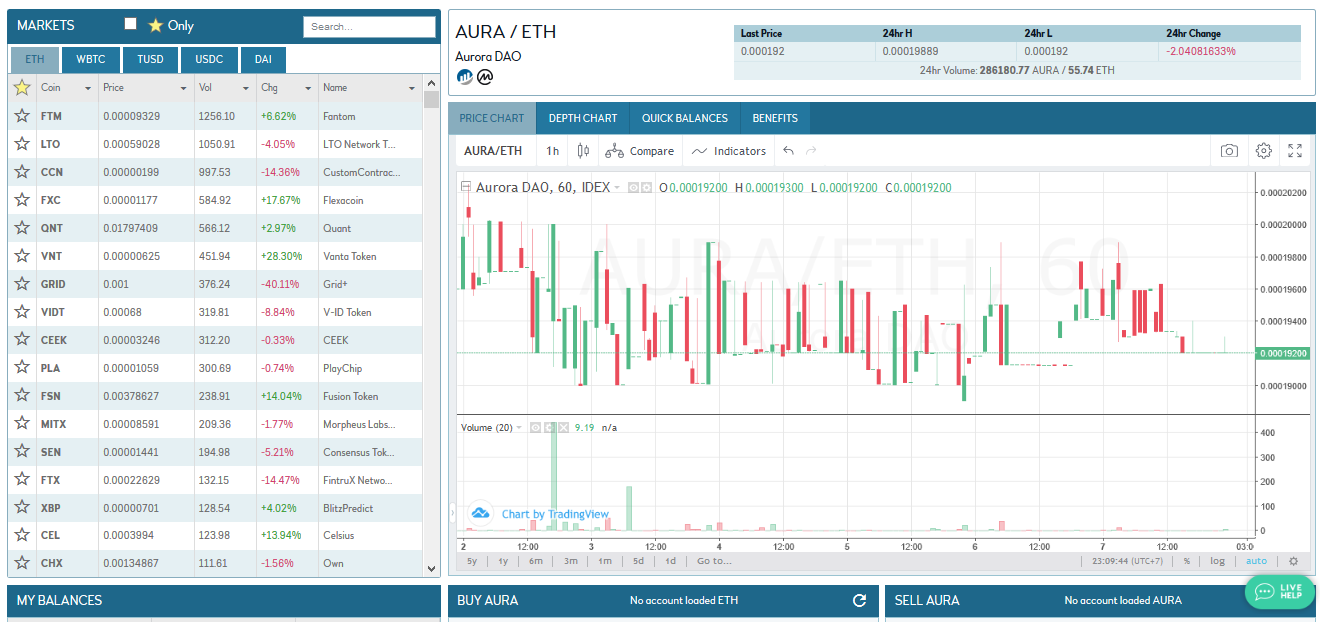

IDEX

Commissions: 0.1% from the user submitting the market-maker, and 0.2% from the user executing the market-taker.

Restrictions: the minimum commission for a market maker is 0.15 ETH (or an equivalent amount), the minimum commission for a market maker is 0.05 ETH (or an equivalent amount). The minimum amount for withdrawal is 0.04 ETH (or equivalent).

Additional charge: Users pay Gas for placing transactions in accordance with the current price of the Ethereum network.

This decentralized exchange operates as DAO. The trading system mechanisms connect orders in accordance with the order queue. All transactions are personally signed by users using their private keys without the participation of the exchange.

IDEX is the brainchild of the Aurora project, which issued two types of tokens: IDXM and AURA. The first ones are project membership tokens, they allow reducing the commission for trading on the exchange. The second are proof-of-stake tokens that allow you to run your own node and get a reward. AURA also allows to receive remuneration for trading on the stock exchange in accordance with the trading volume during the alpha period.

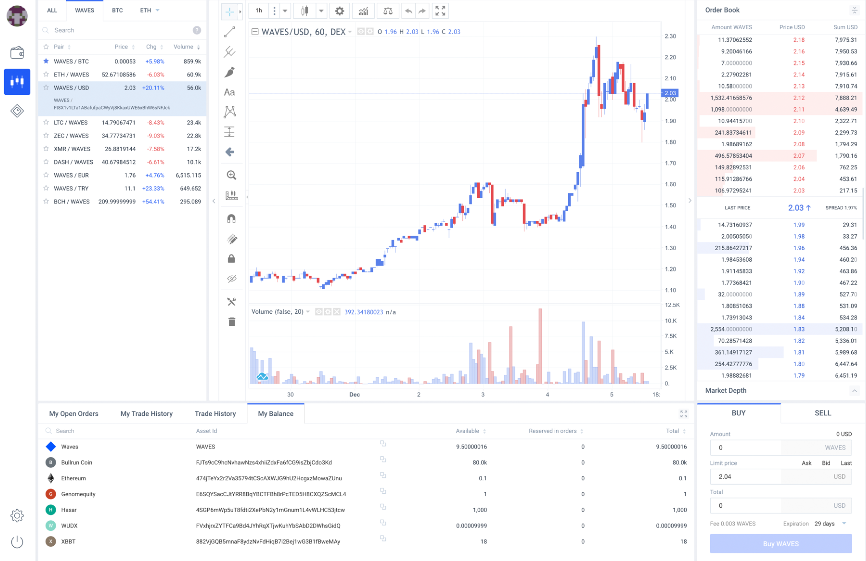

Waves DEX

https://wavesplatform.com/products-exchange

Commissions: Asset / Asset - 0.003 Waves, Asset / Smart Asset - 0.007 Waves, Smart Asset / Smart Asset - 0.011 Waves. Conclusion: 0.001 Waves (Waves is the token of the internal currency of the Waves platform; assets are tokens of other projects; smart asset is an analogue of a smart contract, a token with a script part attached to it).

Additional charge: upon initial purchase (exchange) of Waves, a commission of 0.003 Waves will be charged after purchase. The decentralized exchange Waves DEX operates on its own blockchain platform, and Waves tokens are used to pay commissions and other payments. It is worth noting that data about the commissions of the exchange is securely hidden in the reference section of the platform — in "Frequently Asked Questions: How to get enough Waves to pay the commission."

The exchange uses its mechanisms to coordinates the overlapping orders from its participants, not being a party to trading and not accepting any claims for their content.

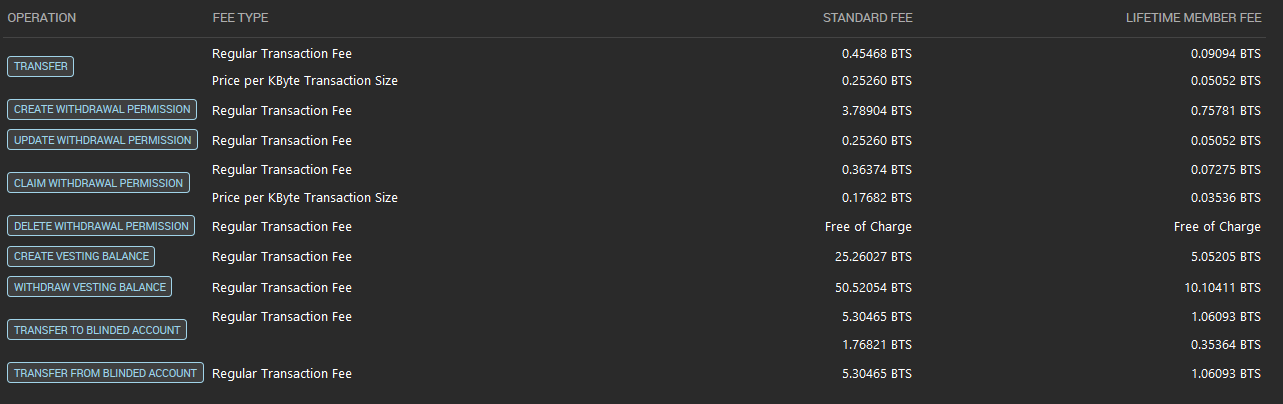

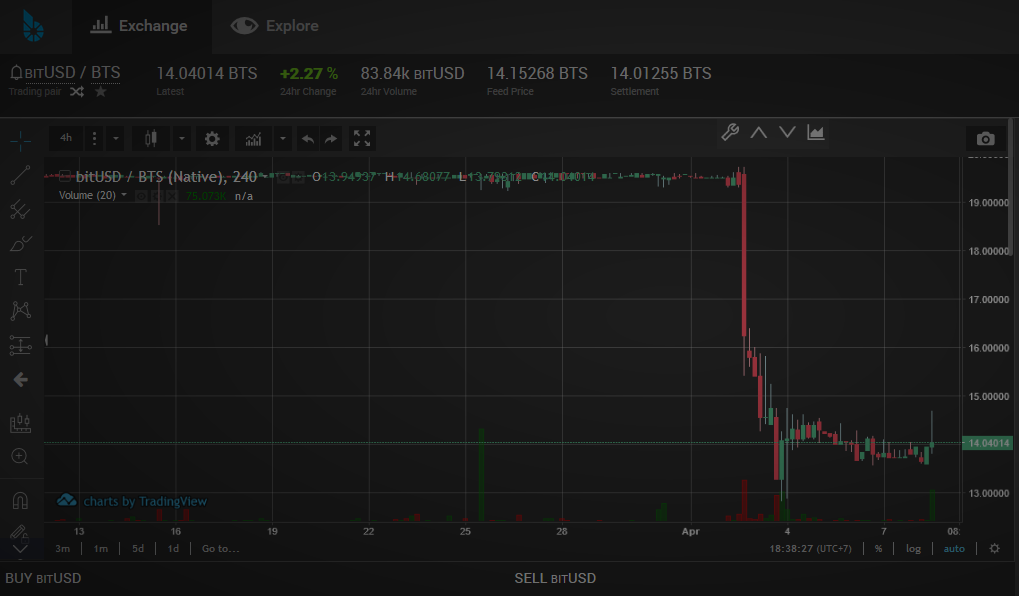

BitShares Asset Exchange

Commissions: appointed by the owners of the underlying asset of the project (BTS) and are subject to change upon their agreed decision. Fees are of two types: for ordinary participants and for owners of life membership accounts.

Additional fee: the exchange has a multipage list of possible transaction fees, in which the final fee depends on the type of asset, its size, type of transaction and many other parameters.

The decentralized exchange allows the use of various platform tools, in particular, to issue and put up for auction any digital assets linked to fiat currencies. In this project, as well as in other decentralized exchanges, an independent system of the mechanisms is implemented: the participants' assets and private keys are used only by the owners.

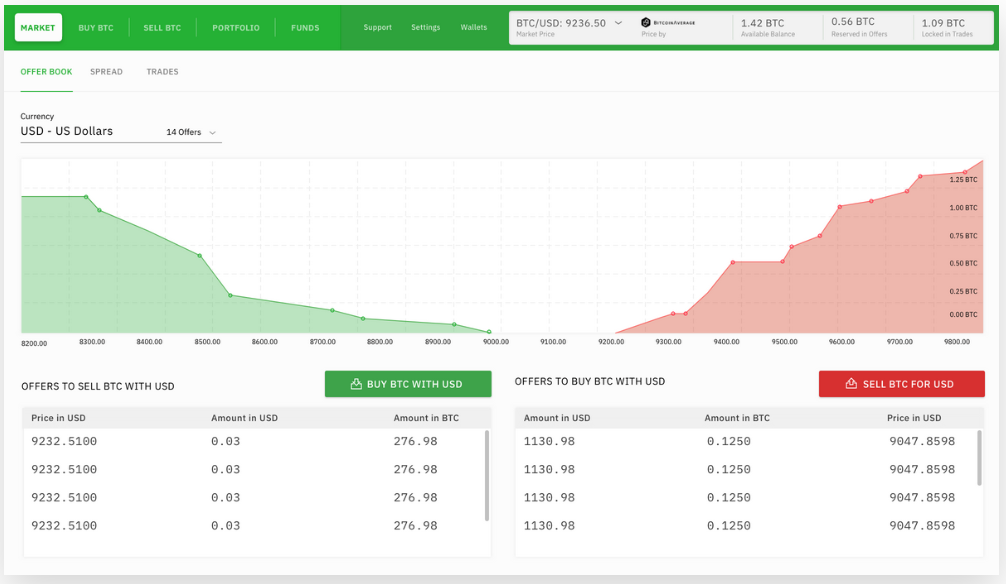

Bisq

Commissions: for placing an order — 0.1%, for a transaction on an existing order — 0.3%. In both cases — not less than 0,00005 BTC.

Additional payment: a bidder who placed an order pays a commission to miners, which depends on the state of the network at any given moment.

Restrictions: the maximum transaction amounts depend on the payment system through which they are conducted. For example, from 0.25 BTC for Revolut, Popmoney and MoneyBeam to 1 BTC for AliPay. During the first 30 days after the first use of fiat currency by the participant, the limit will be 25% of the average limit.

This decentralized exchange was previously known as Bitsquare, but due to copyright problems, it was renamed. An open source project works using p2p operations over the Tor network. For participants in the transaction, a multisignature address is created, and assets are linked to it to secure the transaction. Next is the confirmation of the operation without the participation of the exchange. Bisq doesn’t have access to keys and user assets.

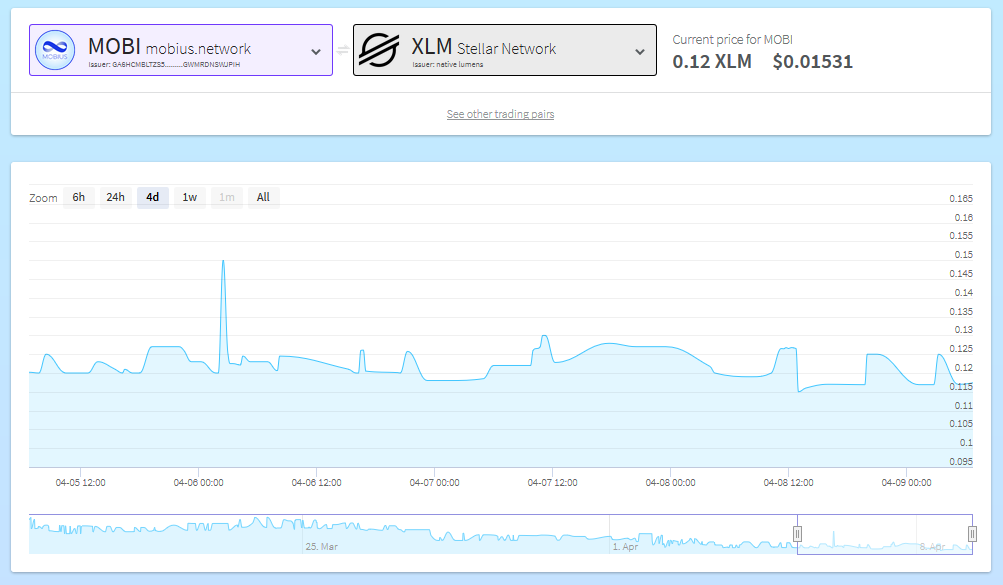

Stellar

StellarTerm

According to the description on the website, the project is run by a group of developers who are independent of the Stellar project. It’s not just an exchange, but only a client for working with the platform’s network.

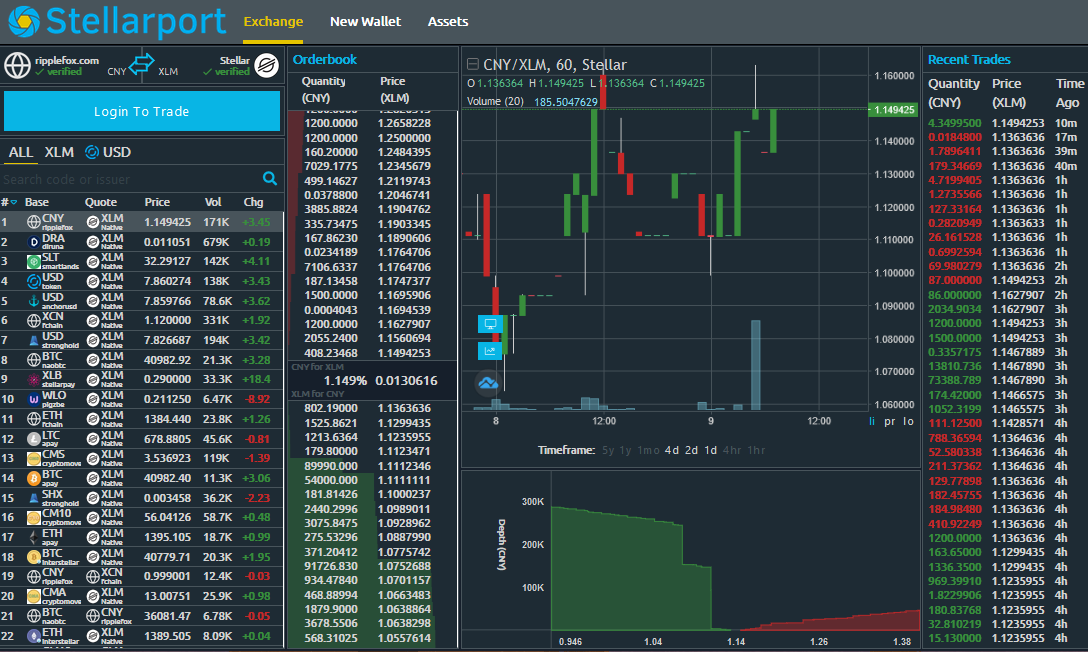

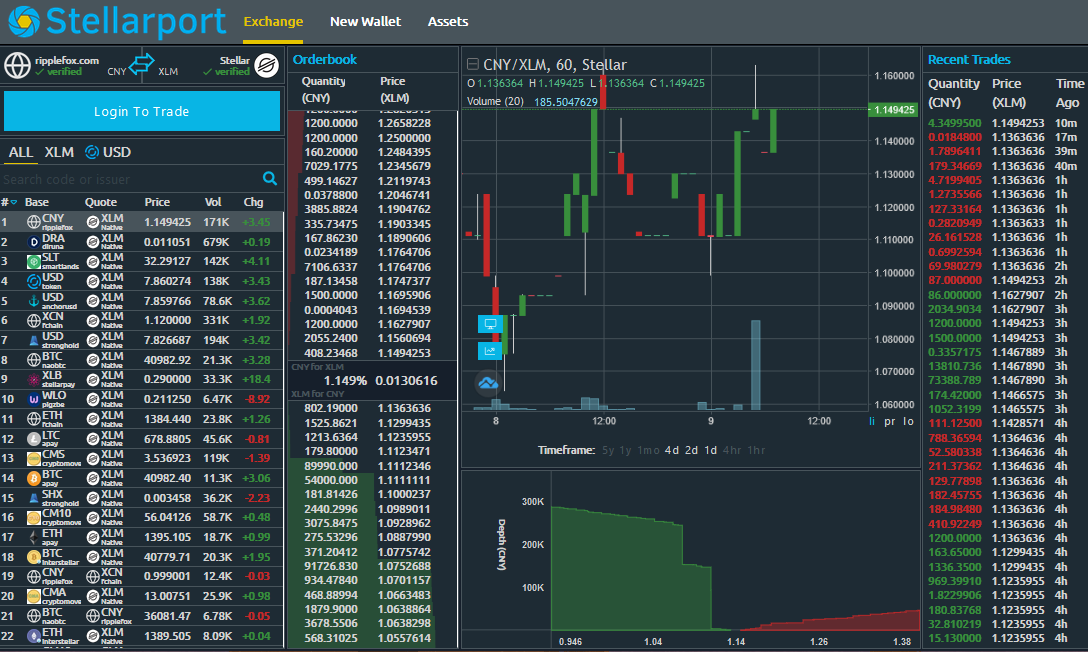

Stellarport

Commissions: consist of two parts. Fixed: BTC - 0.0005, ETH - 0.0025, XRP - 0.25, LTC - 0.005. Percentage - 0.5%.

In the description of this service, there is a statement: “Stellarport is an independent entity and not affiliated with Stellar Development Foundation. It is a sophisticated wallet service which: provides users important analytics pertaining to the Stellar Network.”

Image courtesy of CoinDiary