Crypto Scams: the Consequence of Greed

The world of cryptocurrency is a beehive for a wide variety of cybercriminals. According to a Chainanalysis report, criminal whales hold over $25 billion worth of cryptocurrency in private wallets. Interestingly, these funds are archived in cold wallets and retrieved, luring investors and companies. The massive amount hints at how scams and frauds have become a prevalent issue in the world of cryptocurrency.

To accumulate such a massive amount every year, the cybercriminals develop sophisticated schemes igniting key psychological aspects such as greed, trust and hope to outsmart their targets.

Recently we came across one among the many cryptocurrency frauds which are buzzing across several social media platforms, promising to make users overnight millionaires. We delineate how the scamsters trap the users and lure a massive amount from them in an authentic fashion.

Social Media Platforms – The Initial Round

Suppose you own an account on any popular social media platforms such as Telegram, Twitter, or YouTube. In that case, you might have experienced streams of investment-advice-related messages ebbs and flows around. Though the messages keep changing according to scam campaigns, the basic message remains the same – someone or a group of kind-hearted people message you on channels, groups, or personally and advise you to subscribe to some fictitious digital currency investment platforms.

Often these account holders carry a fake identity and display various proofs of success stories once you become comfortable with them. Very few people get lured by such campaigns. So they come up with new tricks such as offering free trading tips via Telegram or WhatsApp channels.

They would offer you a few free tips backed by authentic chart reading as part of the campaign. They are aware a few investors would just follow without commitment, but a few having a decent bank balance would look for more. So the fraudsters would add you to another group full of other such investors in exchange.

The Game of Opportunity and Pressure (Incentive or Motivation)

The latest campaign would tell you about a cryptocurrency exchange affiliated with other big exchanges such as Binance and WazirX (in this case). Since they primarily target amateurs with a fat wallet, they persuade you to be as authentic as the big ones by asking you to register and complete a KYC before moving on.

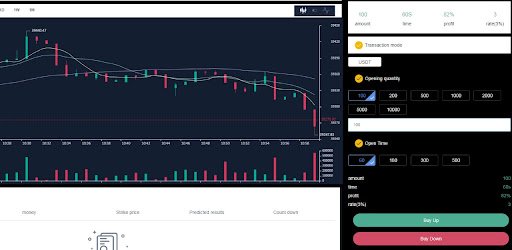

Once the potential victim completes her KYC process, they offer you a one-on-one conversation with a trading expert and unfold a new game of making money. The rules are straightforward –

- You have to transfer the said amount in some stablecoins such as USDT.

- The expert would offer you a tip concerning the Bitcoins movement and ask you to bet on it for a specific time.

- If your prediction concerning BTC rise or fall comes true, you win a massive amount, and the platform would take a cut from your money. Pure gamble, isn't it? But they convince you of the trick as a gem of short trading.

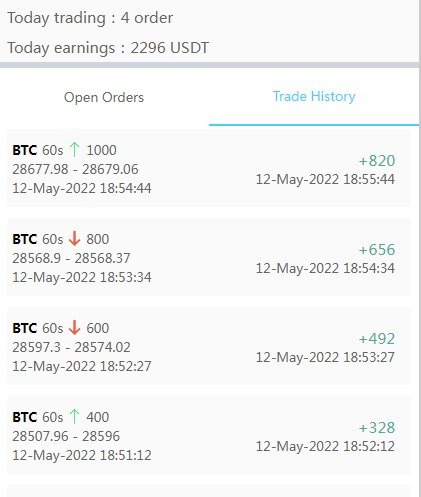

The swindlers are aware that many would have a second thought about the legitimacy of this process, so they play the second trick – pressure. Many fake users would share their success stories about how they made hundreds and thousands of dollars by following the expert's tips and screen grabs to motivate the potential victims.

Rationalization – the third and final stage

Seeing the success stories in the group, the victim places their bet with a small amount. Guess what? They always win in the first few rounds. After that, the expert suddenly stops offering trading tips personally and keeps the victims in an open-ended game. Invest more, win more or leave with your investment minus the exchange cuts.

Figuring out the missed opportunities, the victim asks for more tips from the expert. But other scammers inform them that the tipster won't guide you personally below 5000 USDT or more. So either you can move out of the game with your prized money minus the cut or continue investing more.

If someone doesn't afford to invest more, they reach the last stage of the game. But for now, we would unfold about victims having more money to invest. The more you invest, the more you lose in days.

What if you call it a quit?

The scammers know every victim will call off the game some time and asks to withdraw the prize money, and they have a blueprint ready for such cases.

They would ask you to transfer the 20% cut amount to withdraw your fund, and for that, they won't take it from your fund; you have to send it explicitly. Looking at the fake exchange's swollen wallet, many duped investors transfer the cut to an instructed address. Once done, they would ask for some more in the name of something else. As the actual incident involved an Indian trader, they asked to pay half of the taxes, i.e., 15% of the total amount.

And guess what? Once you claim your fund, they will wait another day and block you from every group they had added you, minus the fake crypto platform. The last step is to ensure the victim thinks her fund is still there and someway she can withdraw it. This way, they hinder any doubt on the victim's mind and thus avoid getting noticed by any concerned cybercrime authority.

Before falling prey – things you should know

- First of all, there is no Bitcoin betting schema that exists on earth. Second, Bitcoin is a truly decentralized platform with no owner. So if someone or some exchange offers such a betting scheme, it's a trap.

- Every affiliate of Binance or any significant crypto exchange has a plethora of proof on Google. So make sure to read some before getting wheedled.

- Any crypto exchange on earth should have a Twitter and a LinkedIn account with a decent follower base. They, too, would have a blog and other resources page. So do check them before putting your money in them.

- Nobody on earth would make you rich without any profit of their own. Anyone offering you tips for free should have a hidden interest in doing so. So be aware of them before getting into them.

- Becoming an overnight millionaire in the crypto world is a myth. Instead, to earn money, you should learn to read charts and patterns and get aware of the used case before investing in something.

- Stop acting over-confident. Discuss anything dazzling surfaces around you. If it really exists, a few must be aware of it.

- Don't trust screenshots. They can be composed or edited. The same happens with the apps of fake crypto exchanges. The fund amount you see is a mere text box for the developers. They can put a billion beside your name without any existence of it.

- Put your money only on trusted and popular crypto exchanges. Read some previous crypto scam stories, such as the QuadrigaCX scam in Canada.

- Invest only what you afford to lose. Never put your entire savings on crypto.

Last Words

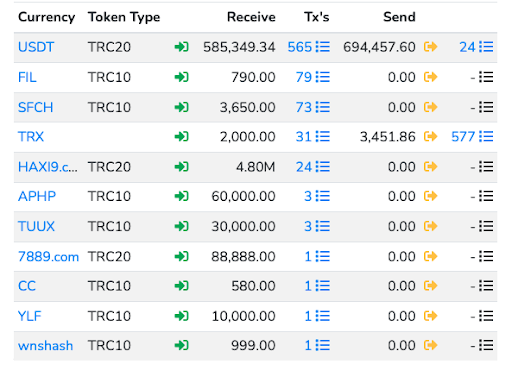

Once I heard the entire story from a friend, I did some on-chain analysis and found the money traveled to one account en route via several ones. The primary account still exists at press time, and I saw thousands of dollars credited to the performance every day. But I am sure they will move the entire amount to a cold wallet once they smell anything fishy. Compose another address and corresponding websites and hoodwink, many like my friend. There is literally no end to it until you become a victim of greed.