Coronavirus and Bitcoin. How COVID-19 Pandemia Affects the Crypto Market

25 March 2020 11:08, UTC

13-03-2020 07:17:26 | News

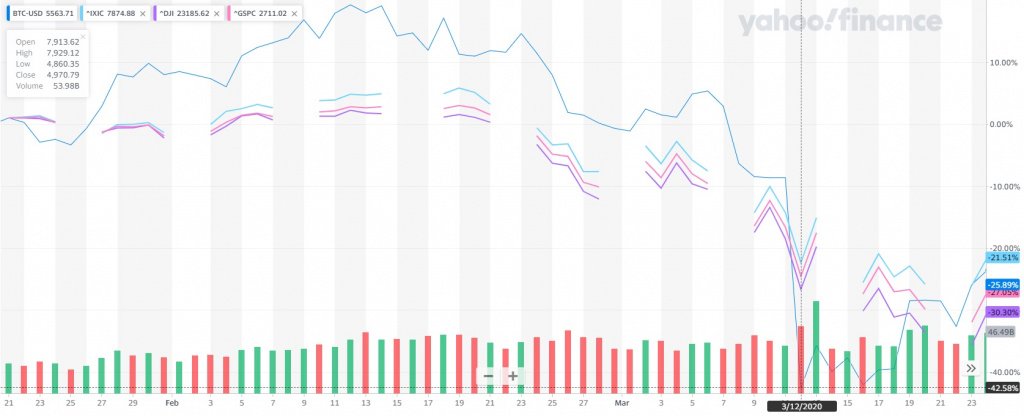

It seems that the existence of a correlation of cryptocurrency rates with stock exchange rates has finally become a confirmed fact. So, the Dow Jones, NASDAQ and S&P 500 fell sharply on March 11-12, which almost coincides with the date of the Bitcoin collapse.

Such events were a surprise for many crypto holders — after all, the idea that Bitcoin is a “safe haven”, new gold, the value of which will only grow in crises, has been a word-of-mouth for a long time. Its supporters pointed to the significant independence of cryptocurrencies from state policy, the lack of a direct connection with the economic condition of a country, anonymity, and other advantages that should have attracted investors fleeing from a panic. However, these hopes obviously failed.

18-03-2020 13:10:08 | Investments

“If there is no utility, there is no reason to hold bitcoin. That’s why you hold gold, or horses, or chickens, or cash,” Interlapse Technologies CEO and Coincurve co-founder Wayne CHEN said in an interview and also added:

“In times of crisis, how are you going to buy toilet paper, or napkins, or food with bitcoin? You can’t. Because they don’t accept it. Then what happens to your bitcoin? You have to sell it and nobody wants it.”

Chen suggested that in the event of a global crisis, the role of barter will increase significantly, and the value of electronic means of payment, on the contrary, will drop sharply.

24-03-2020 16:43:52 | News

“[Bitcoin] was always a confidence game. All crypto is. And it appears global confidence in just about anything has evaporated.”

However, Novogratz still remains optimistic, believing that even several months of high volatility of Bitcoin will not prevent it from fully realizing its potential during the crisis. Indeed, after a few days, the Bitcoin exchange rate began to rise again — by March 20 briefly crossed the line of $6,800, followed by a fall of more than a thousand dollars, which, in turn, was corrected by growth again. At the time of writing, the Bitcoin exchange rate is $6,680.

In such unstable conditions, the future of the market remains vague. Optimists believe that the upcoming halving in May and the desire of people to invest in something more reliable than traditional assets will lead to a repeat of the explosive growth of 2016. Such an opinion, for example, is shared by Samson MOW, Chief Strategy Officer at Blockstream.

09-12-2019 17:43:35 | Analytics

Image courtesy of Insidebitcoins