BTC Hits $43K, Here’s Why RWA will It Drive It to $70K

Bitcoin hits the much awaited price level of $43K. Broader cryptocurrency market looks towards growth of BTC which then triggers price growth of other altcoins. However, there are always factors acting behind pushing BTC prices. For the time being, the chances of spot Bitcoin ETF approval and upcoming Bitcoin halving might be bolstering the price. Meanwhile, tokens from emerging sectors such as Real World Assets (RWA) could be among the potential reasons to pump the price further in future.

Real-world asset (RWA) tokens, showcasing practical applications, go beyond being just a passing trend. The act of digitizing tangible assets like real estate, art, commodities, and intellectual property is gaining substantial traction.

Asset tokenization holds a tremendous growth potential globally. Studies suggest assets worth over $600 trillion in value awaiting digitization. Visionaries in the industry anticipate that the tokenization of illiquid assets on a global scale could evolve into a $16 trillion industry by the year 2030.

How can RWA Tokens be Torchbearer of the Next Bull Run?

Real-world asset (RWA) tokens took the responsibility to be at the fore-front of the next potential bull run. The reason being the unprecedented advantages these tokens bring on the table. In very simpler terms, these tokens are similar to the stablecoins where a cryptocurrency is pegged, or backed, with a particular commodity or fiat currency, RWA tokens have real-estate properties as underlying assets.

The RWA tokens represent the value of a property’s shares. Projects, such as Landshare ($LAND), are involved in digitizing the real-estate properties. Landshare brings the opportunity for people to invest in real-estate without actually owning it. The investors can enjoy the lucrative return-on-investment (RoI) through rental income and increased value of the property in the long run.

Landshare is the first of a kind tokenized real estate asset on the Binance Smart Chain (BNB). The platform introduces two distinct tokens: the LAND Token and the RWA Token.

LAND token acts as the primary governance and utility token, enabling functions such as exchange, voting, payment, and access. And the RWA Token, serving as a security token backed by real estate, representing the value of real-world assets (RWAs).

Landshare RWA token is designed to maintain peg with the real-estate it represents. In simpler terms, the RWA token is backed 1:1 with underlying real-estate property and the token’s value grows proportionally along with the property’s value.

Suppose a property of $100,000 and represented by 100,000 RWA tokens which means 1 RWA = $1. This property also generates a rent of $500 per month.

In this ideal scenario, after one year the value of property grows to $110,000 and the rental income it generated is $6,000. It totals for $116,000. And hence, the value of 1 RWA eventually will be worth $1.16, representing a significant 16% annual percentage yield (APY).

$LAND token on the other hand is a utility and governance token for Landshare platform. The token presents a compelling argument for its practicality and appealing investment returns, considering its remarkably low market capitalization of $7 million and significant potential for expansion.

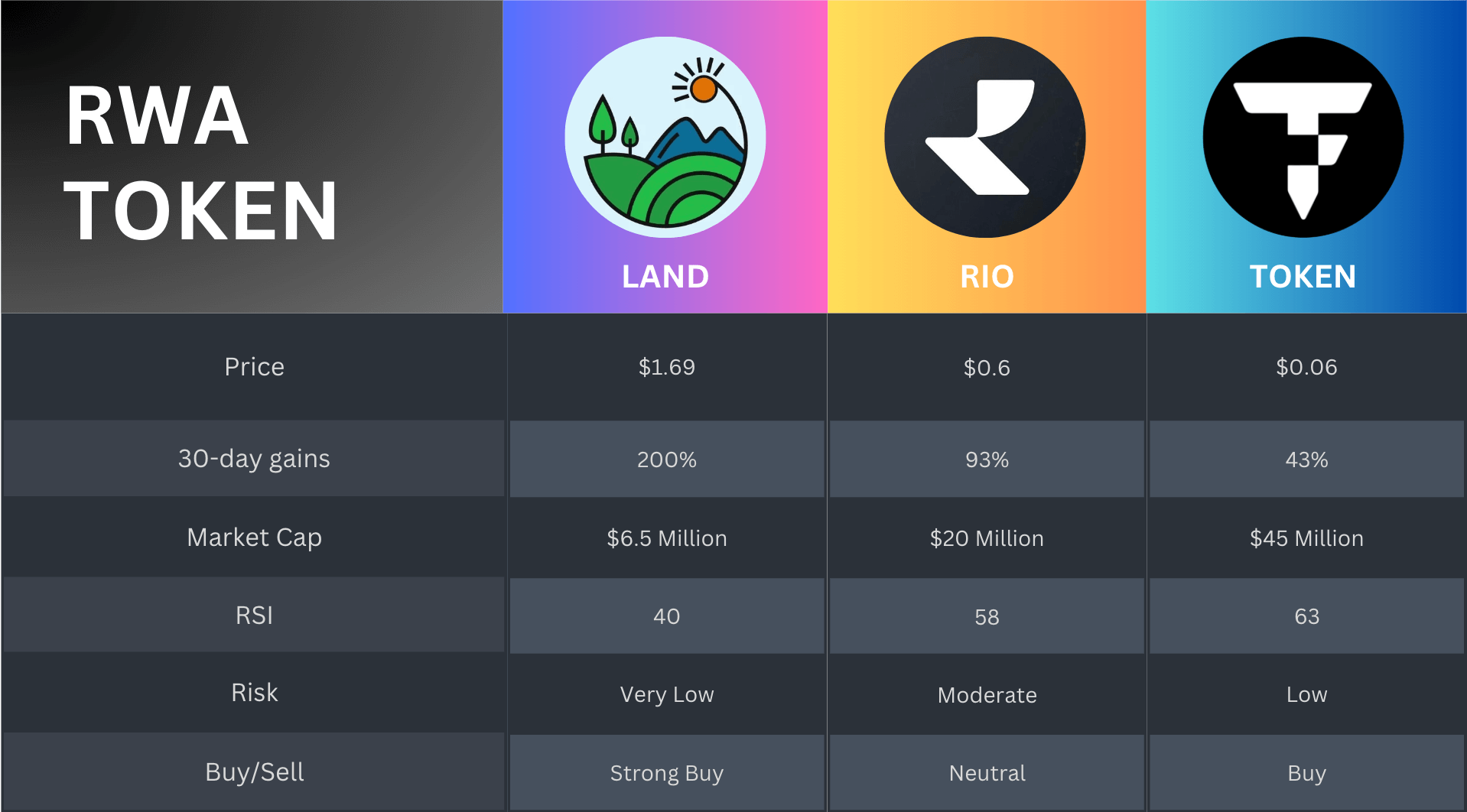

The project is currently undervalued, exemplified by its multifold growth potential in comparison to TokenFi ($TOKEN) and Realio ($RIO), other RWA projects with market capitalization of $45 Million and $20 Million respectively.

Currently the $LAND token is trading at $1.8 increasing over 8% in the last 24 hours. The token has a market capitalization of $7 Million.

Given that $16 Trillion worth assets could be digitized, the project holds a ton of potential and hence the $LAND token is undervalued and could attain billions of dollars in market cap in future.