Bitcoin goes on with “melting”. Altcoins increase in power

Market capitalization

As stated above, the market capitalization of the cryptocurrency market increased by 18.5% over the past week, but the capitalization of some altcoins (excluding BTC) increased by more than a quarter, from $ 192.964 billion to $ 243.878 billion.

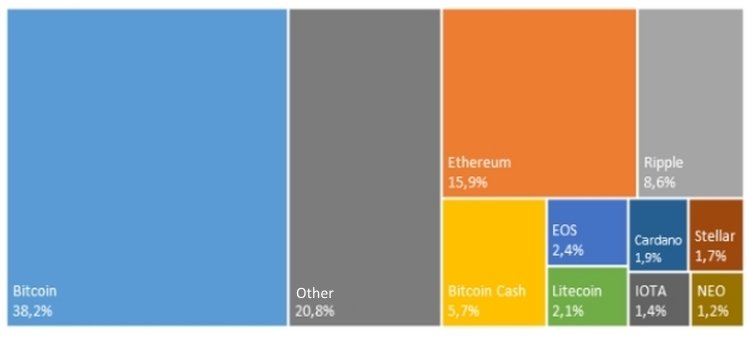

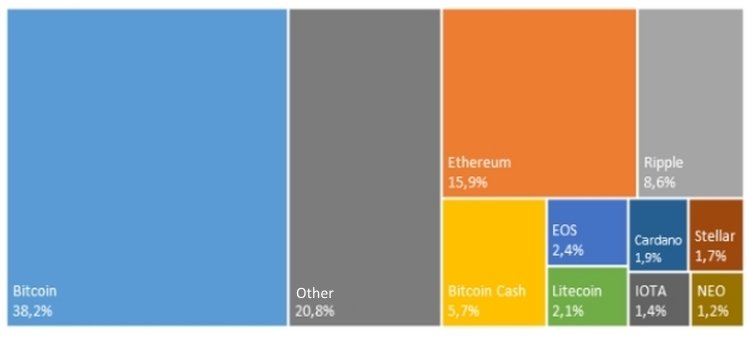

The share of Bitcoin in the total capitalization decreased by 3.84 percentage points (from 42.12% to 38.28%), while the share of Bitcoin Cash increased from 3.97% to 5.36% (1.39 p. p.). Ethereum managed to expand its share in the total value of coins from 15.53% to 15.94%, and Ripple — from 7.93% to 8.81%.

As a result of the week, the TOP-10 significant coins regarding capitalization volume included Bitcoin, Ethereum, Ripple, Bitcoin Cash, EOS, Litecoin, Stellar, IOTA, NEO. They account for more than 79% of the total value of all cryptocurrencies.

Picture. The structure of cryptocurrency market capitalization

Source: Bitnewstoday according to Coinmarketcap

77% of coins showed the growth

Over the past week, the cost of the leading cryptocurrency Bitcoin has grown by more than 9%. On April 22, the price of bitcoin was 8,802 dollars at the market's closing. On Sunday BTC managed to exceed 9,000 dollars. Specialists note that this is a positive sign and soon we should expect the continued growth of Bitcoin cost.

Alexander Kupitsikevich, a financial analyst of FxPro, noted that since the beginning of last week, there had been forming the basis for the Bitcoin moving from a long-term bearish trend to a bullish one. This process was hampered by news that the 13 largest exchanges, including GDAX (Coinbase), Gemini, bitFlyer USA, Bitfinex, received letters demanding information about the participants. The market responded frightenedly, but the willingness of exchanges to make agreement with the authorities calmed down the situation.

The market is being "warmed up" by different statements and researches with a general refrain for "early recovery." For example, Saxo Bank is expected to recover in the second quarter of 2018, associating it to the inflow of institutional money as a result of increased regulation and transparency. Although, at the same time we can note the probability of short-term drawdowns due to unexpected decisions by regulators or sales.

"Interest in cryptocurrencies can grow against a background of the stock market correction, as well as the end of the tax filing season in the US. Meanwhile, the main benefits are security and volatility, after all those exchange thefts and ICO scams. It is likely that big capital holders will evaluate new investments in the sector very carefully," the expert said.

Following the cost of Bitcoin, the price of 77% of altcoins increased. And some of them managed to demonstrate the records growth. So, for example, Greencoin went up 63 times from 0.000280 dollars to 0.017598 dollars. It is noteworthy that this coin has been the growth leader for a second week. LendConnect (capitalization of $ 2.3 million ) managed to increase its value by 20 times — from 0.051361 dollars to 1.02 dollars.

Bitcoin Cash demonstrated the most considerable growth among the TOP-10 last week. Its value has increased by more than 78%. The positive growth of the coin value is due to the statement of Antpool. The mining pool announced that it would burn 12% of the transaction commissions within the framework of the BCH mining. According to experts, this will have a positive impact on the dynamics of Bitcoin Cash. On April 22, altcoin cost 1 201.22 dollars when the market closed.

The cost of EOS and Ripple coins has also increased significantly — almost 42 and almost 31% respectively.

| Coin | Cost | Capitalization | Increase in value (from 16 to April 22 2018) |

| Bitcoin | $8 802,46 | 151,651 billion dollars | +9,07% |

| Ethereum | $621,86 | 59,986 billion dollars | +22,19% |

| Ripple | $0,869995 | 33,912 billion dollars | +30,93% |

| Bitcoin Cash | $1 201,22 | 19,607 billion dollars | +78,32% |

| EOS | $11,35 | 8,956 billion dollars | +41,91% |

| Litecoin | $146,77 | 8,350 billion dollars | +15,61% |

| Cardano | $0,285535 | 7,454 billion dollars | +25,58% |

| Stellar | $0,368139 | 6,967 billion dollars | +28,55% |

| IOTA | $2,01 | 5,341 billion dollars | +28,07% |

| NEO | $73,76 | 4,845 billion dollars | +11,27% |

Chart — Change in value of major coins (value and capitalization are indicated at the close of exchanges on April 22)

Source: Bitnewstoday according to Coinmarketcap

Which coins did not support the positive trend

Despite the growth of the market in general, some altcoins failed to maintain positive dynamics. 23% of the cryptocoins lost in price in the last week. Among them — the Verge coin (the TOP-25 regarding the level of capitalization) has depreciated by more than 27% — from 0.094058 dollars to 0.068507 dollars.

In addition to Verge, a few more relatively major cryptocurrencies lost in price. For example, Electroneum (the TOP-110 concerning capitalization, the total cost is estimated at 155 million dollars) fell from 0.022661 dollars to 0.023675 dollars. The value of THEKEY (capitalization of 80.5 million dollars) fell from 0.018074 dollars to 0.017321 dollars.

Small altcoins have fallen in price most of all: High Voltage (-80%), BitSoar (-71%), RabbitCoin (-69%), ATMCoin (-67%), ClubCoin (-55%).

Big news and resounding statements

There was one high-profile event last week: the demand of the Attorney General of New York Eric Schneiderman to disclose information about his crypto exchanges activities: Kraken, Coinbase, Gemini, Bitfinex, Gate.io, Bittrex, bitFlyer, Huobi.Pro, Binance, Tidex, itBit, and Circle (Poloniex).

Until May 1, trading platforms are required to clarify information on property and management, operations, commissions, trade rules, internal control systems, measures for money laundering prevention, etc.

The prosecutor motivates crypto instruments to become more transparent and to increase their responsibility to clients.

Most of the stock exchanges confirmed that they would cooperate with the authorities, but Kraken was outraged by the "abuse of power" of the prosecutor's office and stated that it was not going to participate in "servility." How will the confrontation between the crypto exchange and the US authorities end? Time will tell.

Last week, the public was put into a flutter by the news about the blocking of Telegram messenger by the Russian authorities. According to one of the FSS (Russian Federal Security Service) employees Roman Antipkin, Telegram is blocked due to the fact that Durov decided to create his own coin, which could lead to the formation of an uncontrolled financial system that would be available to terrorists, illegal traders, etc.

Most experts believe that the positive trends in the cryptocurrency market will continue in the coming week.