Banking half-blood: Ripple’s life after sobering

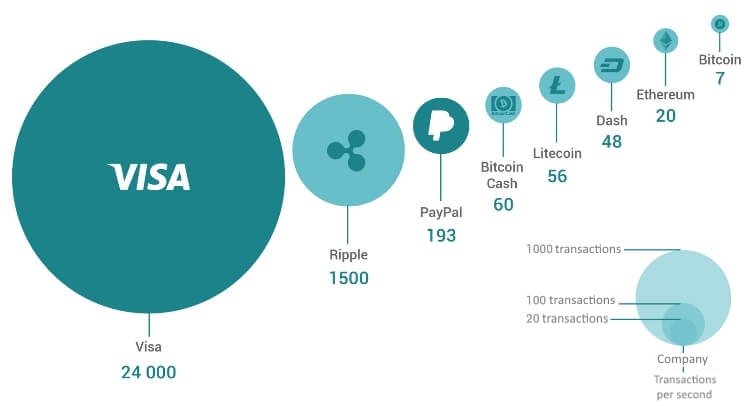

Ripple's blockchain is targeted for large traditional financial institutions. Its extremely low fees and fast transactions intend to upgrade banking totally. Comparing speeds of transactions per a second, even today we put Ripple between Visa and PayPal.

Сryptocurrency Ripple gained fame in November 2017 when American Express and Banco Santander announced their partnership to test Ripple's blockchain platform for non-card payments from the US to the UK. Thus, the trio wanted to replace several-days verification with instant transactions.

How does it work? Ripple as a middleman enables converting dollars to XRP in New York and sending funds to London, where they are converted to pounds. Hearing about this, more companies showed their interest in implementing XRP in 2018. Recently, the list was supplemented with Dallas-based money transfer giant MoneyGram, Mexican bank Cuallix, and a couple of days ago - National Bank Of Abu Dhabi.

Thus, Ripple takes useful liquidity out of integration in the world money system and is not just an object of speculation. Sounds great but there's still a problem that was confirmed even by Ripple CEO Brad Garlinghouse. He repeatedly argued that big banks hold from including his coin as a part of their transactions while it’s so volatile.

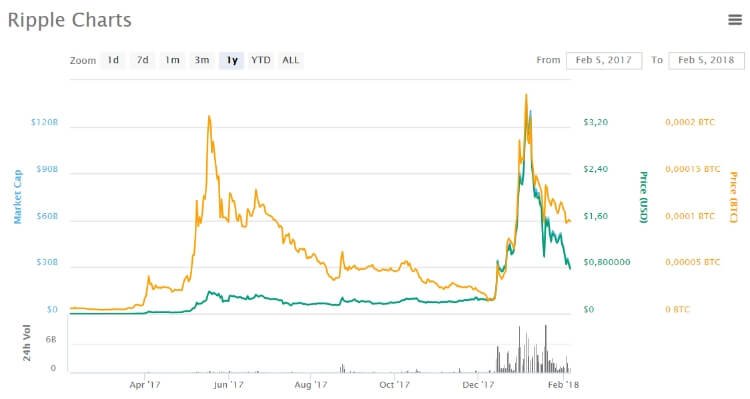

For instance, in the end of 2017, it took entirely two weeks for the cryptocoin Ripple to rise from $0,7 to $3,84 that made it the second most popular cryptocurrency in the world. However, the fall was dramatically the same.

Meanwhile, we completely associate this falling with the whole cryptomarket correction. When the general trend stops pressing Ripple, I'd advise you to have some XRP in your pocket. I won’t be surprised if it will shoot stronger than many once the market changes the direction. The best price for purchasing Ripple could be near $0,5-$0,3.

What to do with your coins if you bought them high, for $1,5 or $2,5? Please ‘hold’ while you can. We all hope that you haven’t sold your house to invest. Sometimes the market has not the best times. This correction should be hard but сryptocurrency Ripple promises good growth during the year. There are several reasons.

Firstly, Ripple is already traded on more than a hundred exchanges. This could provoke Coinbase to list it in the end and confirm the rumors. After that Ripple may actually rise 5x or more.

Secondly, like the other altcoins, Ripple got fame in December 2017, when the new era had come. People finally noticed small coins like TRON (TRX), Cardano (ADA), Stellar (XLM) and Verge (XVG). Ripple was a veteran among them.

Thirdly, Ripple’s team has established itself on the market, using the promising technology combined with strategic partnerships. Ripple has over 75 commercially deploying customers and over 100 in the base. These agreements bring more popularity to Ripple, as well as to counterparties. Rightly so, the stocks of MoneyGram jumped 10 percent after the company announced testing Ripple to move funds. These efforts generate huge organic traffic for Ripple.

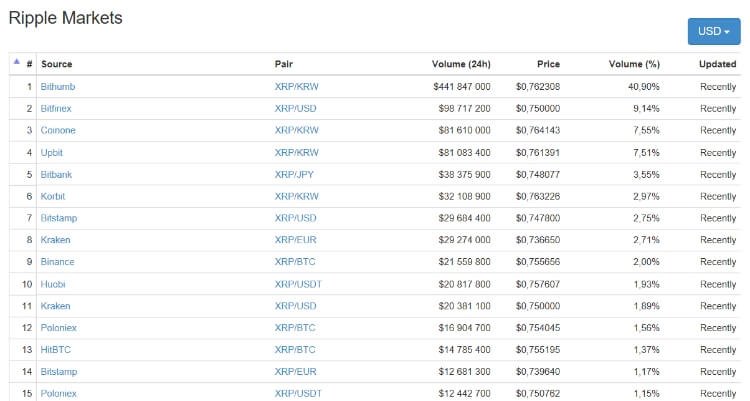

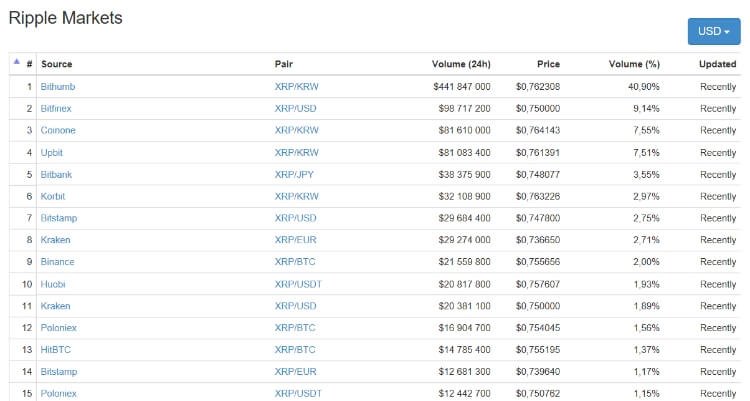

Finally, Asia, offering the most developed cryptomarkets, plays a key role in this strategy. Last year, the company partnered with SBI Holdings to launch SBI Ripple Asia for changing cross-border payments in China, Japan, Korea, Taiwan and ASEAN countries. Forbes Contributor Ken Rapoza even named Asians "going mad" for Ripple.