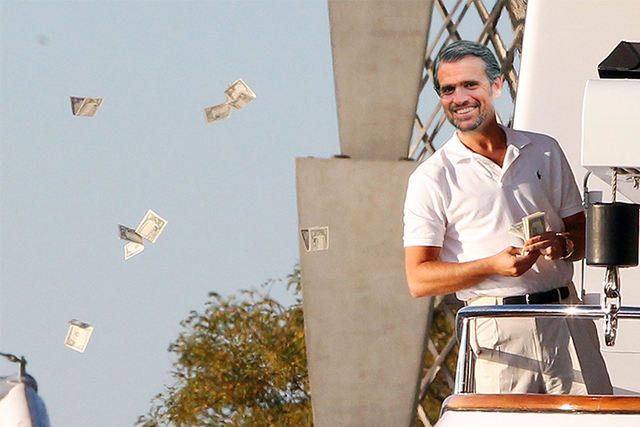

Bankers Talk - Money Walk. TOON #12

The vision of Satoshi Nakamoto was that the participation of financial institutions in the processing and conduct of transactions increased their value, and the proposed peer-to-peer system was to make electronic payments more accessible and eliminate the need for trusted third parties, namely financial institutions. So the idea of decentralization was born, on the basis of which a completely new industry arouse, where, apparently, there was no place for regulators and intermediaries.

But where there is a need for money, there is always a dependence on who has it. And the cryptocurrency market turned out to be no exception. Young startups that supported Satoshi's aspirations to create a free space for the exchange of values were forced to attract funding from the outside for the development of their business models and products. In order to eliminate the need to carry out operations through financial institutions for business and individuals, blockchain projects began to offer their own solutions, developed however at the expense of the capital of institutional investors, including traditional financial institutions, which eventually acquired control over the projects.

They decided not to stop there. As the frontman of the legendary Queen Freddie Mercury sang: “If you can't beat them, join them”. Financial giants decided to follow the wise advice and began to offer their own services to crypto investors and traders, only increasing the influence and control over the initially decentralized sector. It turns out that the rule, when money decides everything, is applicable to all spheres of economic life, whether its participants want it or not.

TOON by Maxim Smagin

New Fidelity Investments Service Or How Trillions Will Come To The Crypto Market

Fidelity Investments, the company with a 72-year history, that manages assets of $7.2 trln worth, launched a new division - Fidelity Digital Asset Services. It will provide custody and trade execution services for digital assets to institutional investors such as hedge funds, family offices and market intermediaries. The new project is a much more serious step in the direction of the crypto market for Fidelity. As noted by the organization itself, the new asset class is of interest for institutional investors (read more)

The Crypto Market Will Pay With Decentralization For Liquidity

It seems that the fiat space has stopped to satisfy their business needs to the fullest extent. Why does the traditional financial business want to get into crypto and what will the crypto community get in turn from their entrance? Will they be able to attract stubborn institutional investors who are still hesitant to put their money in digital assets?

We talked with the Financial Markets Analyst and Consultant Ed MENDEVIL and analyzed together the current situation on the market. The expert’s forecasts say: “Traditional banks will essentially control crypto in the US. Investors will eventually have to become accredited to participate on their platforms. And finally, the blockchain world will be left in a chokehold where 80% of blockchains will have commercial ownership, thereby killing the ‘decentralized’ synopsis of the blockchain technology” (read more)

Illusions: How The Crypto Market Centralized Itself

Most blockchain projects are startups. The development of new technologies and solutions requires significant resources, and young companies have to raise capital from outside in order to have the opportunity to scale their business. In addition to ICO, more traditional fundraising formats are used in the crypto world, which can be much more attractive for institutional investors, because they imply participation in the share capital, and not the purchase of utility tokens, the value of which is often not secured by anything. One of these formats is venture investment. Receiving a share in the capital of a startup, a venture investor, if desired, can influence on the strategy and direction of the business.

On October 18, it became known that the cryptocurrency startup BitGo has completed the series B round and managed to raise $58.5 mln. The last capital input was made by the venture investment company of Mike NOVOGRATZ Galaxy Digital Ventures, and Goldman Sachs. The total investments by both companies amounted to $15 mln.

According to BitGo statements the raised capital will be allocated to the development of the wallet that will store the assets of institutional investors of a total worth of $1 trln. Interestingly, in August, there were rumours that Goldman Sachs itself is developing a custodial service for institutional investors. Perhaps the bank is really working on its product, and now they can spy technological solutions from BitGo. We can assume another scenario in which the financial giant will (read more)

Illusions Perdues: In Economics, The Majority Is Always Wrong

During the recent series E round Coinbase managed to attract investments worth of $300 mln. The leading investor was the hedge fund Tiger Global, that welcomes the company’s attempts to diversify the business and improve compliance with legislation and build a dialogue with regulators. Meanwhile, on October 30, the President and Operational Director of the exchange Asiff HIRJI announced that the company would not offer shares anytime soon, however he added that one day in the future Coinbase should become public.

If the company is doing quite well, then why should Coinbase hold an IPO at some point in the future? The thing is that any startup that attracts venture capital must sooner or later (read more)