Affirm, Kabbage, Tala — The Big Three of Online Loans

Bitnewstoday monitors everything that happens in the world of modern technology, and Fintech is an area where big money and the most advanced technologies are combined.

In the modern world, the rapid growth of start-ups that become“unicorns” in just a few years is a common thing. Many businesses seem to fall into a powerful stream and receive as much attention from investors, the press and customers from the very beginning as they couldn’t ever dream of in the traditional business. But is it as simple as it seems to create a business in FinTech?

Talking about successful startups, Bitnewstoday aims to catch the directions of these streams and understand why these companies become “trendsetters”. This article provides an overview of three promising enterprises in the field of online loans.

Affirm

Affirm is a company that provides payday loans online and at points of sale. To receive an approval decision, a potential Affirm client does not have to wait long — the company's scoring system processes its questionnaire, profiles in social networks and other documents very fast.

With a positive credit rating, money ends up in the borrower's pocket instantly in the form of a virtual card, which can be used at any place where such a payment method is available.

The founder of Affirm is known for one of its previous projects — PayPal, a payment system that has conquered almost the entire world. It was created by Max LEVCHIN along with other celebrity entrepreneurs, such as Peter Thiel and Elon Musk. After eBay bought PayPal for $1.5 bln and it was necessary to look for a new line of business. In 2012 Max came up with the idea of creating a company that would fix the existing unfair and clumsy system of credit ratings and stories.

«And Affirm originally was really a math exercise to see if we can do a better credit-score product»,

said Levchin in an interview. This idea was timely, and the current flourishing of FinTech companies offering online loan services, their success and continued growth confirm this. The scoring system developed by Affirm performs its tasks: automatic online service solves customer problems by providing loans quickly and conveniently at the points of sale.

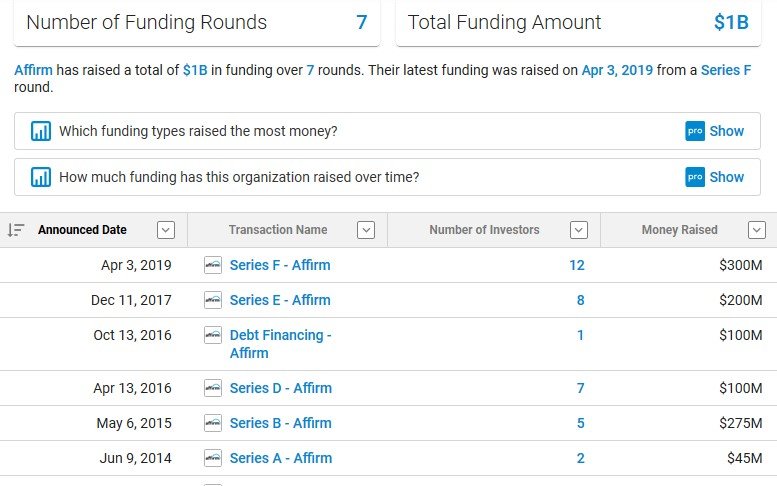

The company is developing. It signs partnership agreements with other enterprises, and the following rounds of financing increase its value. Yes, Affirm is a private company that still operates as a startup and receives investor funding. The recent F tour brought $ 300 mln, and now the firm’s value is $1 bln.

It is difficult to say how much the company's slogan “Improve lives through honest financial products!” corresponds to reality now, because subtle matters of improving life are not easy to measure and evaluate in quantitative terms. You can take a closer look at the customer reviews. Indeed, many borrowers are satisfied with the service and praise the company. There are also negative ones, which for the most part are caused by service failures, but this is a fixable and quite natural thing for a complex intellectual system that works in close contact with customers.

However, it is difficult not to pay attention to the repeated complaints of customers, who experienced a downgrade in the credit bureau rating after closing of the Affirm loan successfully. It seems that the closed account report, which is sent by the company to the bureau is perceived by the latter as a negative action, as a refusal to provide a loan product to the borrower. I would like to hope that such reviews are a mistake, that they are unfair and have no reason. Because at the same time we’d like to believe that Affirm really makes life better.

Kabbage

Kabbage also provides loans online using an automated system. However, the clients of this company are not ordinary consumers, but owners of SMEs. When the founders of Kabbage decided to launch a new project in 2009, there was a gap between personal loans for consumers and credit lines allocated to small businesses in the lending system.

The new company's mission was to fill the gap, providing loans for small businesses and making the application process for future borrowers and the subsequent receipt of funds as much automated as possible. Rob FROHWEIN, Kathryn PETRALIA and Marc GORLIN were busy developing and improving the service until 2011 when its 1.0 version was launched. A funny company name is a colloquial synonym for the word “money” in many languages.

Currently, Kabbage occupies a leading position in its field, and this is largely due to its focus on customers who have problems with a credit rating. Often, when other lenders refuse a business owner with an adverse personal credit history, for Kabbage the real indicators of activity, such as the volume of operations and reserves are much more important than the rating figures.

The automatic service provided by Kabbage comprehensively evaluates a potential client using a variety of parameters: tax payments data, information about transactions, and analysis of the activity in social networks. Such a complex system is unthinkable without modern technologies like big data and machine learning.

The decision to issue funds and their transfer usually occurs without the participation of managers and operators. «99% of our companies have a 100% automated experience», said Kathryn PETRALIA in a 2017 interview.

The interest rate and cost of a loan in Kabbage are very high, and it seems to be the other side of the coin: on the one hand, there’s the availability of borrowed funds for clients with a troubled credit history, and on the other, the speed of receiving money. The lender is forced to insure its risks when lowering the requirements for the borrower (compared to other companies) and speeding up the process of issuing loans (the more the speed — the higher is the likelihood of error).

Kabbage is a $2.3 bln startup.

The startup continues to grow steadily, receive funding and spread its influence. This is also indicated by the recent news about the partnership between Kabbage and the Alibaba Group. Their joint program called Pay Later will be opened for sellers on the Chinese platform, where they will be able to loan up to $150,000.

Tala

Tala is another interesting company that provides hi-tech and automatic loans. In many ways, this startup is similar to the ones described earlier:

- the initial idea of the company’s founder Shivani SIROYA to start her own business was that “the existing credit system works very poorly”;

- to assess the creditworthiness, Tala uses its own scoring system, which examines a set of data about the potential borrower, using machine learning technology and big data;

- the intellectual service works in automatic mode: it investigates, makes a decision, issues loans.

However, some serious differences exist. Tala is a mission-driven, not a profit-driven company aiming to provide access to credit products to those people who are denied by current financial institutions. According to Shivani, only 31% of the world's population has access to loans, and this situation can be corrected, which is what Tala does.

Since the startup is focused on people in emerging markets, the amount of loans is quite small, averaging $ 50. Their potential borrower is any adult who owns a smartphone. To start communication with Tala, you need to download a mobile application, give it permission to access the data and wait for a verdict.

To verify and evaluate the borrower, the Tala service uses smartphone data and creates a kind of “digital cast” of the user, analyzing his behavior when using programs and applications.

Tala is a company founded by a female entrepreneur, mission-driven and focused on the poor market. Оf course, this startup has proclaimed some ethical principles about the information which is not used to evaluate the borrower: gender, race, sexual identity, religion, place of birth, state of health, political views.

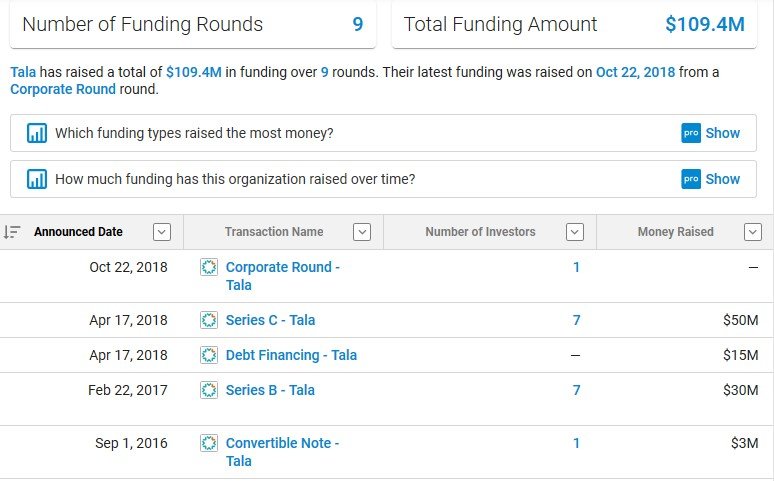

The startup is very attractive for investors, but this is not a “unicorn” like the two described above, but the potential is quite obvious. At the moment, the company is estimated at 109.4 million dollars.

Quoting Tala's founder is best suited as a conclusion, and it seems to explain the reason for the success of many other companies:

«We were the first company to offer unsecured loans via smartphone when we launched our app in Kenya in 2014. We didn’t know exactly how this product would be received — we just had the problem we wanted to solve, and our solution».

Image courtesy of Easyapns