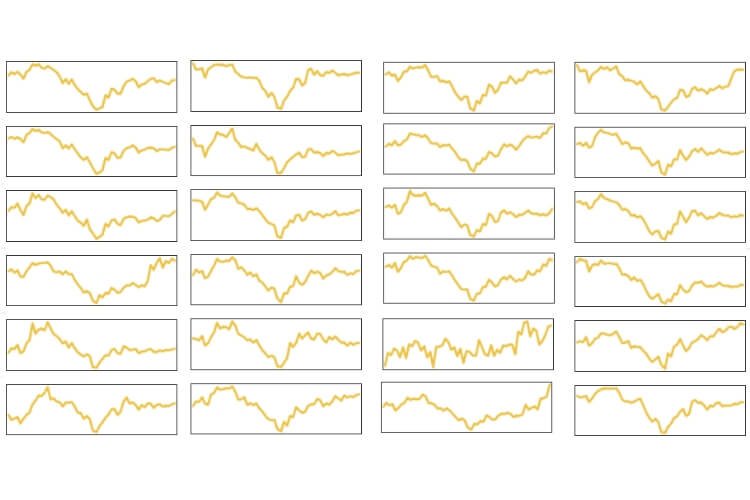

A simultaneous 7-day coin price dip

The whole cryptocurrency market went on a major slope at the beginning of this week and restored to previous values at the end, as clearly witnessed by the statistics provided by Coinmarketcap (see the picture above). Top cryptocurrencies, seemingly independent from each other, act as a single asset, in some occasions even repeating the minor jumps and falls of each other. What does it mean?

This means that the market is so small right now that “independent” projects are actually more dependent of each other that the development teams might want the investors to believe. Also, the similarity of the statistics might indicate the dependency of each coin from the price of Bitcoin - the most capitalized and expensive cryptocurrency as of today.

But this week we have also heard the statement of Steve Strongin from Goldman Sachs about some currencies doomed to fail due to the fact that they act as a single asset, and this is actually one of the most underrated and unnoticed statements of the week. The attention of the public might have been focused on the Senate hearings which, as it seems, helped the market to recover.

For traders “hodling” their assets this week meant nothing - they owned bitcoin/other altcoins which on Monday cost almost exactly as they cost right now. Those who bought Bitcoin at $6000, however, are now in the winning position.