How Crypto Can Help You Reach Financial Freedom?

We all crave financial freedom — who doesn’t? But it can seem impossible with low paychecks and expenses going up. What if you could take the reins and make your money work better for you? That’s the interesting promise of cryptocurrency.

Crypto has potential to deliver freedom — but only if you educate yourself and invest wisely. This beginner’s guide explores how crypto as a store of value, high-yield DeFi perks, and real-world use can assist your money goals.

Yes, crypto comes with risks. Yet smart investing with patience as your guide can unlock huge gains. Read on to see how crypto might just hand you the key to the financial freedom you seek!

Cryptocurrencies as a Store of Value

One major plus of crypto is its power to store value long-term. Bitcoin, the first and most well-known cryptocurrency, is sometimes referred to as “digital gold” for good reason.

For example, both Bitcoin and real gold have limited supplies — only 21 million BTC can ever exist. This scarcity is key to Bitcoin and some other cryptos holding value over years and decades. Just in 2021, Bitcoin’s value leapt up over 300%, way higher than stocks or real estate.

This cements crypto as a legitimate value store for investors seeking shelter from inflation and downturns. Simply having a small crypto stake in your portfolio can potentially protect the wealth you work hard for.

How Crypto Can Help You Reach Money Goals

Americans collectively owe $986 billion in card debt. Investing wisely in crypto and leveraging potential returns can accelerate debt repayment and financial recovery.

Cryptocurrencies like Bitcoin have shown consistent growth over many years. This allows investors to slowly yet surely expand their money by holding crypto assets long-term.

With this steady gains, cryptocurrencies can help investors systematically build up wealth over time. This puts them on track to reach big money goals down the road. For instance, someone could put a portion of their investments into Bitcoin and other cryptos.

This would be part of a long-term plan to save up enough for major things like a house, retirement, or college tuition. Cryptocurrencies can fit well as part of balanced investment portfolio. This combo of assets gives investors an advantage in successfully achieving their financial aims.

The potential for long-term gains is a major plus of crypto. This compares well to assets that lose value or stay flat. Cryptocurrencies also keep purchasing power because of their limited supply. This shields money from being worn down by inflation over many years.

On top of that, cryptocurrencies offer opportunities for investments to gain serious value. This allows portfolios to rapidly yet reliably multiply over time. These special features make cryptocurrencies a prime option to steadily build wealth. This wealth empowers hitting personal money goals.

The way cryptocurrencies have expanded in value over long periods shows their power. They can maintain and grow wealth for those with patience and vision.

Access High-Yield Opportunities with DeFi

Beyond just storing value long-term, cryptocurrencies also open doors to grow wealth in exciting new ways. This is thanks to decentralized finance, or DeFi for short. DeFi uses blockchain to offer financial services like lending or trading crypto — all minus traditional middlemen like banks.

One popular DeFi activity is called yield farming, where you earn interest by lending your crypto. In 2021 alone, over $100 billion got invested this way, with some users seeing crazy 20%+ annual returns — way higher than old savings accounts. Tapping into DeFi allows your crypto to work for you, shooting up passive income.

Employ Strategic Investment Approaches

Rather than just buying and holding crypto, savvy investors also leverage more active tactics to maximize gains:

-

Long-term holding (“HODLing”) — Patiently holding top cryptos like Bitcoin often pays off over years as prices tend to go up long-term.

-

Trading — For risk takers, actively trading crypto to profit off short-term price swings can be extremely lucrative. Some even make dozens of trades daily!

-

Staking — Another choice is staking certain crypto assets to earn rewards, similar to interest often around 5-10%.

|

Strategy |

Holding Period |

Risk Level |

Potential Returns |

Time Commitment |

|

HODLing |

Long-term |

Lower |

High |

Minimal |

|

Trading |

Short-term |

Higher |

Highly Variable |

Extensive |

|

Staking |

Long-term |

Moderate |

Stable |

Moderate |

Weighing factors like risk appetite, time, and income needs pinpoints the best crypto tactics for your situation. Blending elements of each strategy often balances risk and rewards.

Real-World Crypto Applications Are Emerging

Beyond investing, cryptocurrencies also create real-life value by powering useful innovations:

-

El Salvador made history in 2021 becoming the first country to adopt Bitcoin as legal tender — this shows crypto’s potential.

-

For sending money worldwide, crypto offers a fast and cheap alternative. Transfer fees are just 1-5% with crypto versus 7-20% traditionally — huge savings!

-

Cryptocurrencies also expand financial access for underbanked people globally. About 1.7 billion adults worldwide lack banking — crypto can fill this gap.

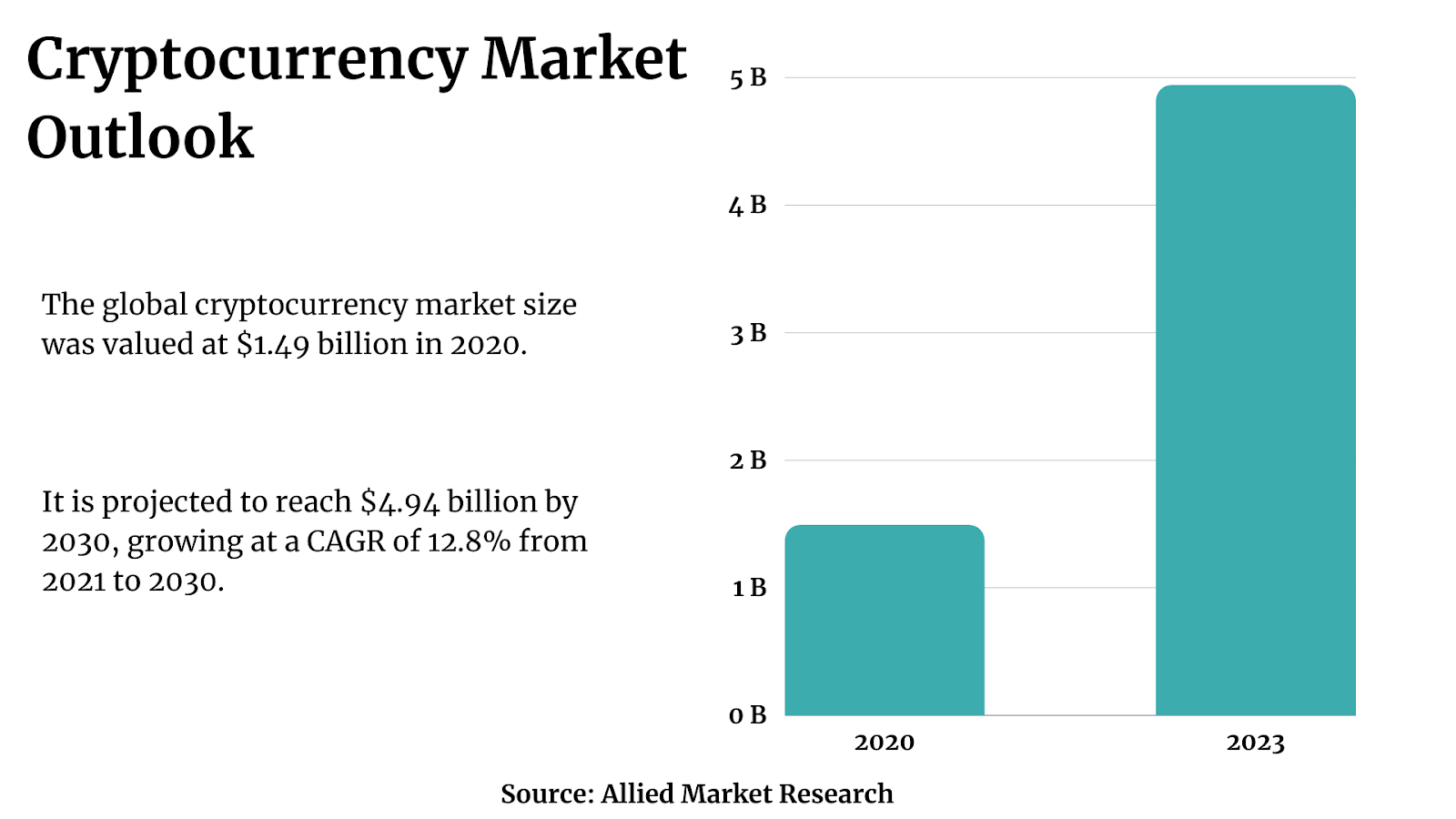

The following chart will help you to grasp the global adoption of cryptocurrency. It shows the market size outlook of global cryptocurrency by 2030.

These practical uses prove crypto is already improving finances and lives. Though risks exist, the opportunities are game changing!

Understanding Crypto Rules and Risks

While crypto opens exciting opportunities, it also comes with key considerations around taxes and evolving government oversight:

-

Tax laws vary globally, but cryptos are usually treated as property. In the U.S., you may owe tax when selling crypto at a profit — know the rules!

-

Regulations change quickly as governments work to monitor these new assets. Following compliant practices is crucial — over 80 countries now have crypto laws or guidelines.

The landscape is complex, so research is key to successfully navigate markets. Consulting financial and legal experts is smart.

Crypto assets also have unique risks to know, such as:

-

Extreme price swings: Crypto markets bounce around wildly daily, with 10% price jumps in a day common. This brings chances to profit but also potential trouble.

-

Security threats: As digital assets, crypto can be lost or stolen if not properly secured. Using cold storage hardware wallets are considered the safest protection method.

-

Speculation and scams: The crypto space still has plenty of hype and even outright frauds, so caution is wise, especially for new investors. Only risk what you can afford to lose.

These risks may seem scary. However, taking careful steps can effectively minimize the hazards. As with any investment, never risk more money than you could part with.

Gaining Financial Freedom With Crypto

Cryptocurrencies offer a real chance to break from restrictive traditional money management. You can take control of your financial destiny! By smart investing, using innovative apps, and staying compliant, crypto can provide that key to unlocking freedom.

Yes, it takes diligent learning, calculated risks, and a long-term view. But for many, it’s a rewarding journey. With prudence and patience, you can leverage crypto to achieve the financial independence you’ve always desired!

The time to start is now! Research top assets, explore DeFi protocols, practice good security, and brace for an exciting ride to financial freedom!

Crypto FAQs

1. What are the main things that make cryptocurrency have such potential to help people gain financial freedom?

There are a few big pluses that give crypto its financial freedom promise. First is its power to store value and appreciation over super-long terms compared to regular currencies. Second is the high-yield rewards possible through decentralized crypto finance tools. Finally, real-world crypto use cases like cheap global money transfers and more bank access illustrate crypto innovations in action.

2. Is it realistic for average families to achieve financial independence just through prudent crypto investing?

While not guaranteed, prudent long-term investing in established cryptocurrencies does indeed have the potential to make the average household financially freer over 5-10 years. By slowly building crypto holdings as part of a balanced investment approach, families can steadily build wealth the same way past generations did in stocks.

3. What is the best way for a beginner crypto investor to get started with managing risks properly?

For beginners, the best practice is “dollar cost averaging” — slowly building a crypto position over months by investing an equal small set amount weekly or monthly. This allows the average buy price to smooth out versus investing one large lump sum. Patience and holding long-term instead of panicked selling during volatile downs are also key!