Credit Cards for Bad Credit: How to Choose the Right One

Having bad credit is frustrating. You may find many doors closed to you. You may need help getting approved for loans mortgages or services like utilities. A bad credit score also limits your choices for credit cards. But thankfully there are a few credit cards made to help people with bad credit get back on track with their finances. Picking the right card is very important if you want to improve your credit.

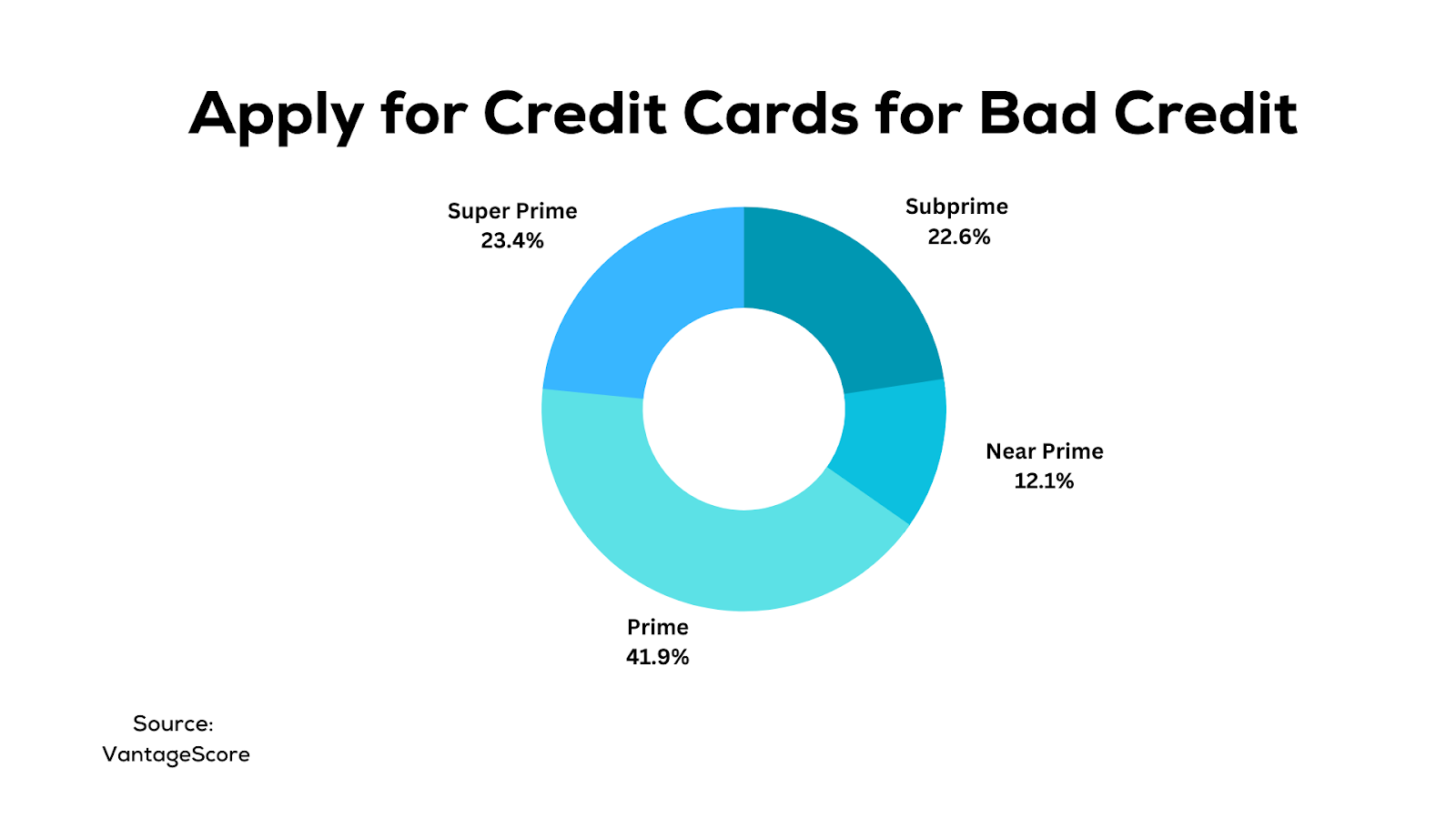

Based on recent information, over 40 million Americans have subprime credit scores below 670. This shows just how many people need help to rebuild their credit effectively.

The Importance of Picking the Right Card

With the average American owing more and more money on their credit cards, choosing the wrong card can trap you in debt. The average credit card balance rose to $5,910 in the third quarter of 2022. By the end of 2022, the total amount owed on credit cards reached $986 billion. That’s almost a trillion dollars!

The stakes are high, but the right card can help you regain control of your money situation and take big steps toward improving your creditworthiness which is how trustworthy you seem to lenders. You need a score greater than 760 to increase the likelihood of being approved for the best deal lenders and credit card issuers have to offer.

The wrong card, however, can sink you even deeper into debt. Watch out for cards with extremely high fees, high-interest rates (APRs), and poor customer service. Read all the Terms & Conditions very carefully to avoid nasty surprises later.

Top Recommended Credit Cards for Bad Credit

Finding the right card starts with understanding what’s available. Here are some top picks based on the benefits they offer:

Discover it Secured Credit Card

This “secured” card helps build credit by letting you make a refundable security deposit that serves as your credit limit. Discover matches deposits for the first year to grow your available credit faster. Rewards like 2% cashback on gas and dining and no late fees make it a strong “starter” card. Users can upgrade to unsecured cards in as little as 7 months.

Capital One Quicksilver Secured Cash Rewards Credit Card

This secured card stands out because it has no annual fee and offers access to a higher credit limit than similar competitors after making a security deposit. The unlimited 1.5% cashback also makes this a good pick. Regular credit line reviews can help you eventually get an unsecured card.

OpenSky® Secured Visa® Credit Card

OpenSky approves people regardless of their credit history. Your credit limit is based on how much you deposit as security. There’s no hard credit check, but on-time payments do get reported to the major credit bureaus. The card charges a $35 annual fee after the first free year.

Chime Credit Builder Visa® Credit Card

The Chime Credit Builder card helps users build credit history by automatically reporting on-time payments. It charges no annual fee but does have a monthly membership plan. Chime offers easy account and payment management through its mobile app.

Self Visa® Secured Card

This newer card from Self Financial offers a unique way to build credit. Instead of a deposit upfront, it lets you build savings as you pay down the card. After about two years, the savings convert to an unsecured line of credit.

Mission Lane Visa® Credit Card

Mission Lane issues secured cards to borrowers with bad credit using bank data instead of credit scores. It allows people to build credit without requiring an upfront security deposit. This card has no fees.

Features to Look for in Credit Cards for Bad Credit

When comparing bad credit cards, there are a few key features to evaluate:

Credit Bureau Reporting

Choose a card that reports your on-time payments to Equifax, Experian, and TransUnion. These are the major credit bureaus. This reporting helps build your credit profile by showing you make payments on time. The average credit card interest rate now exceeds 20%. So every on-time payment that gets reported helps improve your “credit utilization ratio.” This compares how much credit you’re using to your limit.

Low Fees

Avoid cards with extra fees like high-interest rates (APRs), monthly servicing charges, account fees, etc. Fees can quickly pile on debt. Opt for fee-free cards from issuers like Discover or Capital One.

Credit Score Tracking

Rebuilding credit requires checking your progress often. So pick a card that lets you access your latest scores through their website. Tracking monthly progress gives visibility and accountability.

Upgrade Pathways

Some secured cards let you upgrade to unsecured credit lines after showing responsible usage for several months. Checking for upgrade options ensures long-term value, not just short-term benefits.

How to Apply for Credit Cards for Bad Credit

Now that you know what to look for, here are tips for smart applications:

Check Your Credit Score

Checking your score lets you target cards you’ll likely get approved for. Those below 600 will likely need secured cards. 600-650 opens options from more issuers.

Understand the Security Deposit

For secured cards, your deposit equals your limit. Know this deposit is fully refundable when you close the account after building credit. Some newer cards like Self Financial don’t require this.

Watch Out for Hard Checks

Too many applications can lead to lots of hard checks on your credit report. This further dents your score. First, compare pre-qualified offers. Then apply to no more than 3 cards within a month. This avoids too many hard checks.

Tips to Improve Your Credit Score

Using your card responsibly is as important as choosing the right one. Here are some expert tips for rebuilding credit faster:

Use the Card Regularly

Using the card rarely can lower your score. Make regular small purchases. But keep use under 30% of the limit.

Pay Balances in Full

Pay on time and in full every month. Carrying balances leads to interest and credit damage.

Don’t Max Out Your Limit

Letting balances exceed 30% of your limit can hurt your score. Try to keep it under 10% of the limit.

Check Reports Regularly

Check your issuer account weekly. Quickly dispute any errors to limit the damage. Stay on top of all credit activities.

FAQs

1. Why is picking the right credit card so important if I have bad credit?

Picking the right credit card is super important if you have bad credit. The right card can help rebuild your credit by reporting your on-time payments. However, the wrong card can make things worse with high fees and interest rates. Do your homework to find one that fits your situation.

2. What should I look out for when comparing bad credit cards?

When you compare bad credit cards, watch out for fees! Avoid cards with monthly fees, annual fees, or high-interest rates that pile on debt. Also, make sure the card reports to all three credit bureaus. And check if it offers ways to upgrade to better cards later as you build credit.

3. How many credit cards should I apply for when trying to rebuild my credit?

When rebuilding credit, quality matters more than quantity! Applying for too many new cards can hurt your score. Limit applications to no more than 3 cards within one month. Pre-qualify first to find your best options without damage from hard credit checks.

4. If I always pay my bad credit card balance on time, how long until my credit improves?

Paying your credit card bill in full and on time every month is essential! If you use the card lightly and pay on time monthly, you may start to see score improvements in as little as 6 months. But big credit rebounds can take years. Stay patient, diligent, and responsible in your everyday credit usage!

Bottom Line

Rebuilding damaged credit takes commitment over time. But the right tailored card can accelerate financial recovery. Research to find features ideal for your credit situation. Apply carefully. With responsible daily usage, you can boost your credit health. This unlocks better financial opportunities again. But it requires diligence and time.

Some final tips:

-

Check for pre-qualified offers to avoid too many hard credit checks

-

Use your card regularly for small purchases

-

Always pay on time and keep balances very low

-

Monitor your credit report weekly and dispute errors quickly

-

Rebuilding credit takes diligence, but the right card can help

-

Focus on responsible everyday usage

The road back after credit mistakes is long, but you can get there! Stay committed.