ASICs vs GPUs: Understanding The Great Crypto Mining Debate

Some see a great debate where others see a simple business decision.

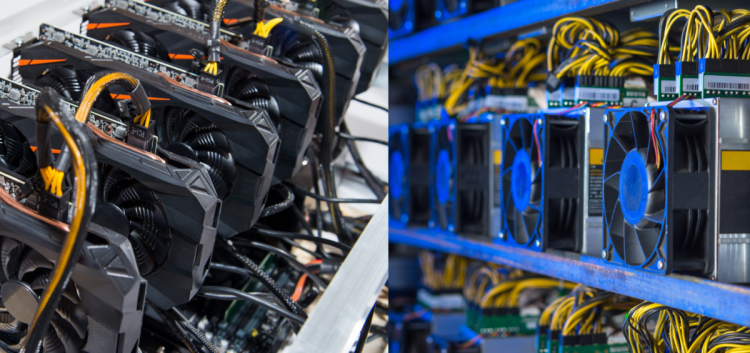

Crypto mining boils down to solving complicated math problems faster than anyone else, and collecting a financial reward in the process. Miners have two categories of tools at their disposal in their quest to collect that reward first: multi-purpose GPUs (graphics processing units) and purpose-built ASICs (application-specific integrated circuits).

In both cases, miners depend on electricity, efficiency, and raw computing power to mine effectively. But the choice between ASIC and GPU mining hardware has become polarizing and political within the crypto community. Even though both work to solve the exact same problems, ASICs represent a significant improvement over GPU technology — hobbyists running their own GPU mining rigs are being left behind by businesses that use more-powerful ASIC hardware at an industrial scale.

There’s a mismatch of goals between businesses and developers

The crypto community has technical people who enjoy developing and furthering technology, as well as business-minded people in search of profit. For every miner passionate about decentralization and the overarching philosophy behind cryptocurrency, there’s another one out there simply looking for a way to squeeze a few more dollars out of this sector.

The technical crew has historically been the one to push this technology forward and drive its adoption. They enjoy hands-on problem-solving and ushering in a new era of financial technology. The business crowd, by contrast, tends to have a bottom-line profit-seeking mindset. That’s why they deploy supercharged ASIC mining hardware, nudging the smaller players aside in the process.

But mining tends toward ASIC hardware regardless

Crypto mining businesses must seek out every efficiency they can if they’re going to generate viable long-term revenue. This means they’re going to universally favor powerful hardware that’s fed by cheap electricity. The purpose-built ASICs are simply too good at their jobs, so businesses seeking a profit can’t responsibly ignore them.

Communities across different cryptocurrencies have made efforts in the past to push back against ASIC mining’s formidable firepower. Ethereum’s core development team has most recently moved forward with plans to release a new ASIC-resistant proof of work algorithm that will bring existing Ether-mining ASIC hardware to a screeching halt. But this isn’t a simple solution to the problem — let’s talk about Monero for a moment.

But this return to normalcy was short-lived — still-newer ASIC chips emerged that compensated for this so-called “ASIC-resistant” algorithm, and GPU miners were left behind once again. This dance between GPU and ASIC dominance has continued as long as Monero’s been available. That’s why there’s a semi-annual hard fork to protect the GPU miners this currency was designed for. There is a perpetual tug of war between ASIC-resistant algorithms and the ASICs that emerge to successfully handle them.

So how do you bridge this gap?

Yes, cryptocurrency mining depends on solving complex math problems in pursuit of profit, but getting started in this space isn’t necessarily complicated. Would-be miners can start their own GPU-based operation at home, go industrial-scale with lots of ASICs, or find a happy medium by renting processing power from a cloud mining company.

It should be an easy decision, not a heated debate.

By Philip Salter, head of mining operations at Genesis Mining

Image courtesy of: Cudo Miner