From Unicorns to Octopuses. The PwC Report Signals About New Trends

Whether the market will need blockchain and crypto start ups in 2020 — is an unresolved issue. As a rule, in a crisis period (it is seemingly impossible to rationally evaluate the scale or the timing of the current one) investments in startups, prototypes and new technologies are declining.

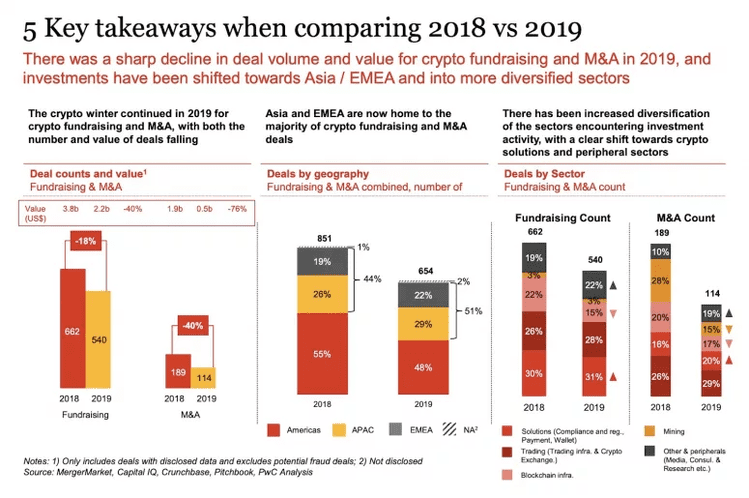

The total number of mergers and acquisitions noted in the report fell from 189 in 2018 to 114 last year, and the value of M&A fell by as much as 76% from $1.9 billion to $451 million. Investment deals decreased by 122, their total number was 540. The total volume of fundraising amounted to 2.24 billion US dollars in 2019.

Accordingly, the percentage of participants from “inside the industry” has grown. So, “crypto-purchased-crypto” deals accounted for 56% of the total volume in 2019, compared with 42% in 2018. The blue ocean of the crypto industry? Leave it to the decentralization dreamers and perfectionists, the market is now smelled of blood. Larger companies were able to eat those that provided services, which, in essence, are ancillary to their own. Henri ARSLANIAN, the Global Crypto Lead at PwC, noted this particular trend in an interview with CoinDesk:

“I think we should expect some of the big players to get bigger, but not by buying direct competitors. Not by becoming vertically bigger but by becoming horizontally bigger. Unicorns are becoming more like octopuses where they have their hands in various areas of the crypto ecosystem.”

What changes are occurring in the market

The report shows that the growth of the crypto market in Q2 and Q3 of 2019 did not prevent a decrease in financing in the industry; thus, there is no correlation. But there are also positive trends. Last year, the participation of corporate venture capital doubled, which accounted for 6% of transactions. As a clear regulatory framework develops in Europe and Asia, more institutional players are turning their heads to the industry, for example, family offices with long-term investment strategies.

The type of projects receiving investments is also changing right in front of our eyes. In 2018, most of the financing of venture capital funds went to infrastructure projects, while in 2019, most of the investments were directed towards development in the field of compliance and regulation.

From a geographic point of view, deals flow from North and South America to Asia and Europe. In 2019, most fundraising and M&A transactions took place outside the United States. Companies seeking institutional clients flock to Hong Kong, and retail-oriented companies are considering Singapore's evolving regulatory framework.

Image courtesy of Handelsblatt