Explained: Why These 3 IDOs Can Generate Multiple Fold Returns

Year-to-date, about 1337 public token sales have taken place, out of which over 77% have been IDOs or Initial DEX Offerings. Meanwhile, 21.2% have been IEOs (Initial Exchange Offerings) and only 1.5% have been ICOs (Initial Coin Offerings). This clearly proves the hype IDOs are experiencing currently.

There’s a stark contrast between IDOs and ICOs/IEOs that makes the former more appealing to investors and developers alike, and in fact also adds long-term value beyond the initial hype. While IDOs are held on decentralized exchanges away from intermediaries and are therefore more transparent and cost-efficient, ICOs and IEOs are centralized.

A majority of the crypto market expects a bull run soon, possibly by the end of 2024. IDOs are one of the sections of the crypto market expected to lead the rally, alongside popular narratives like RWA, AI, memecoins, and more. Altcoins seem to be taking charge this time as Bitcoin passes on the torch: the OG cryptocurrency now takes a backseat and seems happy with supporting instead of leading the market.

As the next crypto bull run approaches, which IDOs should you keep an eye on? We list three of them you should know about!

Top 3 IDOs to watch out for

Here are the top 3 IDOs the wise investors have their eyes on this year, in no particular order:

-

Pencils Protocol ($DAPP)

Currently ranking at number 4 on the list of trending token sales on Cryptorank, the $DAPP token was launched on Tokensoft very recently on September 18, and the IDO will go on until September 22.

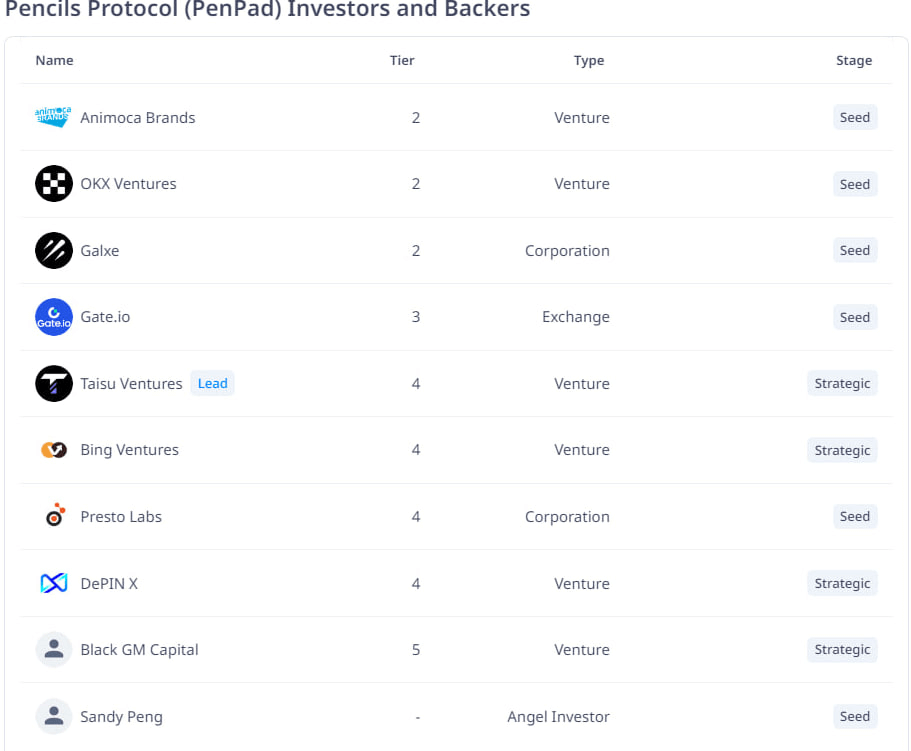

However, the hype doesn’t seem to be unreal; Pencils Protocol, introduced in March 2024, already has over 476K users and $320 million+ in TVL. What’s more, names like OKX Ventures, Animoca, Presto Labs, Gate Labs, and Sandy Peng (co-founder of Scroll) have invested in the project. In fact, the project is all set to be listed on OKX Cryptopedia by September 23.

Partnering with the zkEVM Scroll, Pencils Protocol is a next-generation decentralized platform offering auction services for both blockchain-native assets and RWAs or real-world assets. There are additional products and services like staking, farming, and vaults on offer, with DeFi lending and more services yet to be added. Pencils Protocol is not only the #1 DeFi project on Scroll at the moment, it is also one of the top three DeFi farming protocols in the ecosystem.

Pencils Protocol’s $DAPP launch on Tokensoft was oversubscribed by about 7x, indicating listing gains for investors. Plus, about 60% of projects listed on OKX Cryptopedia head to OKX Exchange, showing investors good potential for further exposure and increased trading opportunities. Having reportedly provided a +1000% ROI this far in the year already, and expected to generate a +5000% ROI by 2025, Pencils Protocol promises a good run.

The currently active IDO on Tokensoft puts 6,666,666 $DAPP tokens on sale at around $0.8 each.

-

GIGCO ($GIG)

In an IDO on RazrFi for which the timeline is yet to be announced, GIGCO plans to raise $120.00K. Part of the web3 music industry, GIGCO empowers artists, venues, and fans by removing entry barriers and eliminating high fees. The all-in-one mobile app built for the platform is user-friendly and built on Solana, with the goal to simplify and decentralize music streaming, artist meets and greets, tickets and venue booking, and more.

Through GIGCO, artists and users get control and ownership of music, gigs, merch, tickets, and song-based NFTs, and trades take place peer-to-peer to ensure all profits go to the artist instead of multiple intermediaries. $GIG is the native token on the GIGCO platform. The token is expected to be used as a digital voucher of sorts that can be swapped for goods or services a user wants.

The initial DEX offering for the project is expected to take place soon. 800,000 $GIG tokens will go on sale at around $0.15 each.

-

AutoLayer ($LAY3R)

Another very hyped project with an ongoing IDO on Ape Terminal (to run between September 12 and 30), AutoLayer works with liquid restaking, on its way to become a LRTfi hub on Arbitrum. The DeFi services on offer include staking and one-click liquid restaking. Users are at liberty to stake or restake multiple assets at a time and compound their yields.

With over 66k users so far, AutoLayer integrates with several major DeFi protocols like EigenLayer, UniSwap, SushiSwap, Renzo, and Balancer, allowing yield maximization through strategies like auto-compounding and token liquefaction.

The currently active IDO on Ape Terminal puts 461,538 of $LAY3R tokens on sale, at the price of $0.65.

Which IDO is the best pick for me?

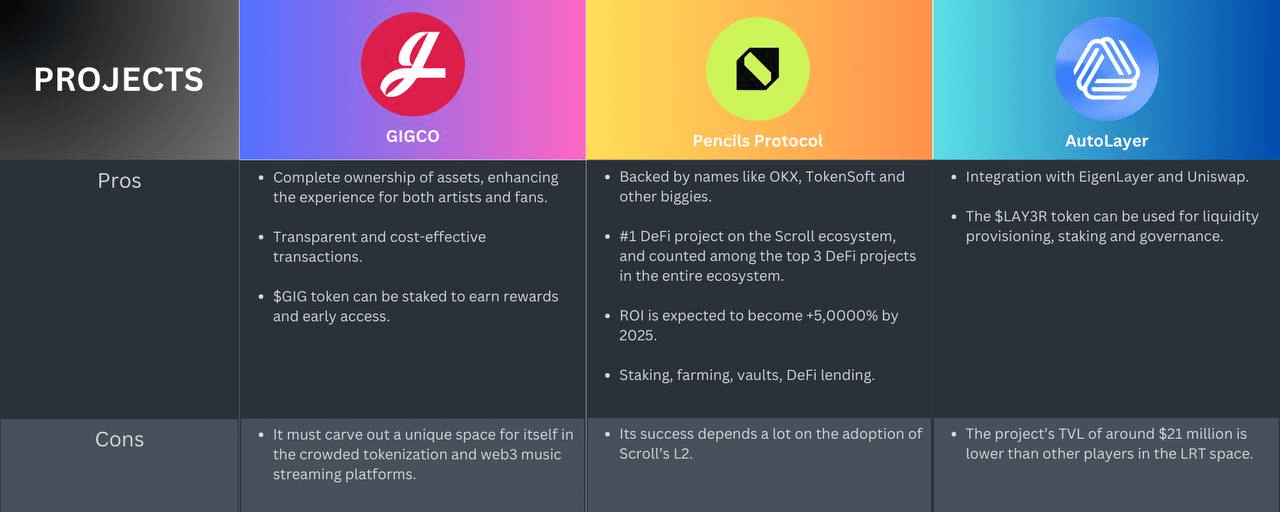

Now, this one’s a difficult question to answer: investment decisions should only be made after you conduct thorough research on your end. What we can do, however, is give you a direct comparison of the pros and cons of the three projects we have mentioned above, so you have an easier time making a decision.

We hope this comparison helps you make the right decision. While Pencils Protocol is the safest when you consider factors like TVL and growth potential, remember to take note of the interesting use cases of the other two as well. And as always, DYOR!

Happy investing!