Ethereum and the Gartner Hype Cycle

“The Hype Cycle is not a new phenomenon, but can be seen throughout history as each new innovation captures the human imagination.”

— Gartner Inc.

The Innovation Trigger — A World Computer with Smart Contracts

The Innovation Trigger occurs when a new technological breakthrough kicks off a proof-of-concept that captivates minds around the world, usually fueled by media coverage. In the age of digital media, hype cycles occur much faster and more violent than in previous historical instances.

In 2013, Vitalik Buterin released the Ethereum White Paper that invented the concept of a World Computer. It would be owned by no one and accessible to anyone. This World Computer would utilize Smart Contracts to not only revolutionize many existing industries but to create a seemingly unlimited number of new use cases. A few use cases originally cited were Decentralized Applications, Token Systems, Stable-Value Currencies, Identity Systems, Decentralized File Storage, and even Decentralized Autonomous Organizations (DAOs).

In 2016, The DAO was built on Ethereum. The DAO raised over $250 million which allowed projects to pitch their ideas and potentially receive funding for their development. This was a novel creation and in essence was the first decentralized Venture Capital firm in the world.

In 2017, the Enterprise Ethereum Alliance (EEA) was founded by Microsoft, Intel, J.P. Morgan, ING and other corporate giants. This newly formed collaboration was designed to drive industry best practices focused on security, privacy, scalability, and interoperability.

While this revolutionary technology was only just a few years old, the world took notice as the Ethereum Hype Cycle started to increase exponentially.

Peak of Inflated Expectations — Initial Coin Offerings

The Peak of Inflated Expectations commonly occurs when publicity peaks due to a number of success stories. The peak of the Ethereum Hype Cycle forced the world to desperately watch as nearly every news channel around the globe urged them to buy Ether (ETH).

Ethereum was causing many investors to get hilariously rich while late respondents desperately tried to re-create the magic. This produced one of history’s most participated in speculative bubbles, which launched the price of Ethereum to $1,400 per Ether (ETH).

Spoiler: You will likely see the start of an entirely new Ethereum Hype Cycle coinciding with the launch and further development of Ethereum 2.0. The price of Ether (ETH) will likely follow. This can be seen by the dashed green line in the Gartner Hype Cycle image.

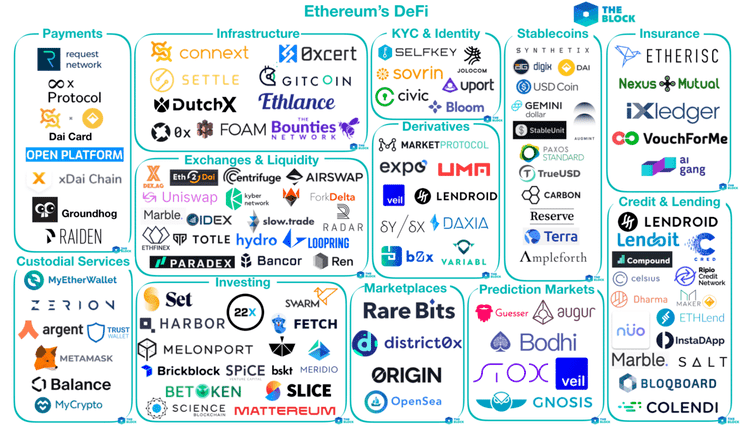

Trough of Disillusionment — Decentralized Finance

Source: www.TheBlock.com

From 2018–2019, while the world wasn’t paying attention, the Ethereum community was able to build an entirely new Open Financial System — known as Decentralized Finance (DeFi). This included new money and new infrastructure, while being open and accessible to anyone in the world. The Ethereum community knew that “ETH is Money” and made plans to educate the world about this new Open Financial System.

Ernst and Young (EY) — the #1 Professional Services Firm in the world — can be seen as the best example of an organization that did its premier building on the way down toward the Trough of Disillusionment. They dedicated millions of dollars and more than a year’s work building the first Public Domain Enterprise Privacy Implementation — Nightfall.

Slope of Enlightenment — Enterprise Adoption

We are currently on the Slope of Enlightenment which occurs when a technology has clear benefits for both consumers and enterprises. This is when you find trend setting enterprise pilots while conservative companies remain cautious.

In March 2020, Ernst and Young (EY) and Consensys announced Baseline — a partnership with Microsoft, AMD, Chainlink and other behemoths to build the future of enterprise on Ethereum. Baseline is focused on allowing Ethereum to be used as a common frame of reference for ERP, CRM and other internal systems, which have been plagued by a lack of synchronization and interoperability.

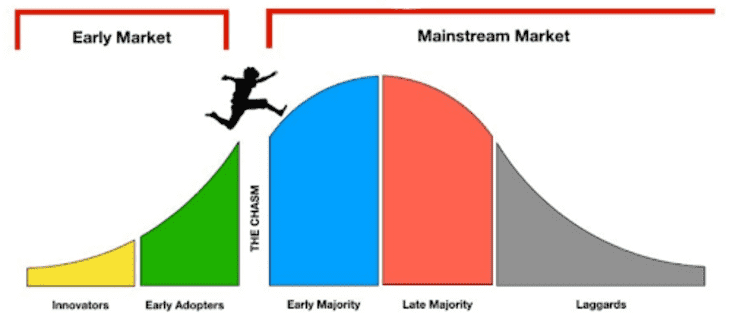

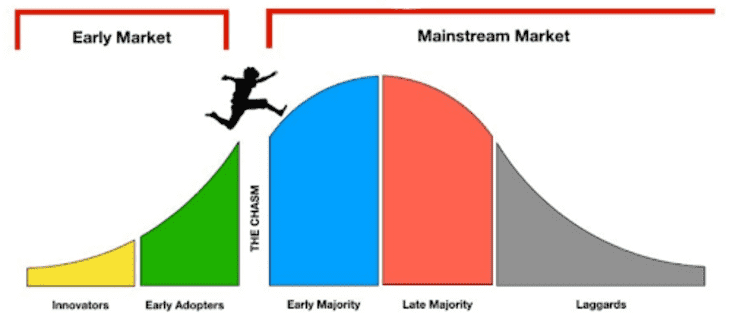

Plateau of Productivity — Crossing the Chasm

Ethereum has yet to reach this stage and will undoubtedly be challenged to Cross the Chasm within the coming years. This is when early adopters will be vindicated as the early majority steps in and starts utilizing products and services built on Ethereum.

Luckily for Ethereum, there are many different beachhead markets that will be attacked simultaneously. These markets include Neobanks, Video Game Virtual Goods, Fine Art Investing, Music Royalties, Fractional Real Estate Investing, Sports Memorabilia and much more.

Once Ethereum crosses the chasm, it will quickly become mainstream and positively impact many industries. This will likely cause its native money Ether (ETH) to surpass its previous all-time high valuation of $1,400 and conquer much higher levels. For me, it is not a matter of if, it is a matter of when.

About the Author

Anthony Bertolino is dedicated to educating the world about Ethereum and the future of finance. He studied Blockchain Technology at U.C. Berkeley and currently lives in Los Angeles, California. If you want to learn more or have any questions, reach out to him on Twitter.