On the 28th of March 2022, Grant Thornton, the liquidators of failed cryptocurrency exchange Cryptopia, released an update to stakeholders and claimants. The accounting and financial services firm reports that stage 2 of the claims process is still ongoing after being executed around 6 months ago in October 2021.

There are four stages to the Cryptopia claims process:

1. Claims registration- This allows the registration of account holders' details and for holders to make claims for their account balances.

2. Identity verification- Verifies account holder identities to the necessary verification standard.

3. Claim acceptance- Provides account holders with the opportunity to agree that Cryptopia records represent the amount due.

4. Asset transfer- Instigates asset transfers to account holders.

Grant Thornton explains in their update that stage 2 — Identity Verification — has been a staggered process because Cryptopia users are domiciled across 183 different countries. They do, however, report that they have made ‘good progress’ so far.

As of the update, the Grant Thornton Customer Support team has supported 82,000 users through the identity registration process. The Liquidator says it is continuing to build this team to assist users to complete the claims and asset transfer process. As of the report, Grant Thornton states that 82.3% of users have interacted with the claims process in some way. The percentage includes account holders who may have simply opened the email or clicked the email, but are not yet actively engaged in registering the claim.

Before stage 3 can begin, more users need to participate in stage 1, however. Because the claims process has involved 900,000 users from 183 different countries, the registration and support process has been drawn out.

Grant Thornton also clarifies in the report that before stage 4, an input and approval process goes through the court system. They say they will begin the process in the next few months and it will require — Approval for a distribution process, Confirmation of what will be done with unclaimed funds, and setting a cut-off date for claims.

On the cryptopia subreddit, reddit.com/r/cryptopia, user u/jimham162 complains of additional requests for personal identification months after initial submission, issues with the claims portal, and long wait times for customer support. Other users have created posts complaining about the long wait times laid out by Grant Thornton.

Grant Thornton also reports that they have received orders permitting them to convert NZ$5 million worth of DOGE (held by Cryptopia).

# A former Cryptopia employee was ordered to pay US$150,000 in reparations by a New Zealand court

Former Cryptopia employee, Michael Glaser, was sentenced to nine months of home detention for stealing over US$150,000 worth of cryptocurrencies, as well as customer data. Glaser pleaded guilty to charges of theft by a person in a special relationship, and theft of more than US$1000.

According to the summary of facts from the case, while Glaser was an employee of Cryptopia he raised concerns about the security of private keys held by the exchange that gave access to the numerous digital asset wallets holding company funds.

One of Glaser’s roles at the company was the management of a software interface that controlled the wallets held by Cryptopia. This role offered him access to all the keys held by Cryptopia. At some point during his employment, he made unauthorized copies of the wallets’ private keys, stored them on a personal USB device, and then uploaded the highly confidential data to his own computer.

Glaser had no connection to the hack that took down the exchange. Police officers carefully went through his accounts with a “fine-tooth comb” and found that he had no connection to the hack.

After the hack, during the liquidation process, all Cryptopia workers' contracts were terminated but Glaser kept his copy of the exchange’s private keys. This gave him access to assets worth US$100 million.

Glaser’s access to the keys was discovered by chance. In September, a previous Cryptopia client reported accidentally depositing bitcoin to an old Cryptopia deposit wallet. This led to a review of the Cryptopia wallets by Grant Thornton, which led to a discovery that 13 bitcoins had been withdrawn by an unauthorized party in a series of transactions. Some of the bitcoin had gone through a mixing service designed to hide the identity of the withdrawer.

In a somewhat bizarre turn of events, Glaser emailed the Grant Thornton team to reveal he was the BTC thief and also admitted to stealing NZ$10,000 worth of other cryptocurrencies. He told the liquidators he repaid some of the BTC and would return the rest soon. The next day he offered to return the remainder of the lifted funds, 6 BTC, in exchange for not being charged with theft or being accused of any wrongdoing. He returned the 6 BTC later that day.

Court documents reveal that Glaser was motivated to carry out the theft because he was frustrated with his Cryptopia employers. He also believed he could get away with it as he thought no one would ever check the old deposit wallets. In court, Glaser blamed his crimes on Cryptopia’s negligence.

When he caught wind through an inside source that the liquidators were reviewing the deposit wallets, Glaser decided to confess and offer the return of the stolen crypto.

Glaser was not granted name suppression. Crown prosecutor Sean Mallett explained that name suppression may cast suspicion on other Cryptopia employees “who were working hard to do right by investors”.

“White-collar crime of this type can be very difficult to discover, it needs to be clear to well-educated, employed, middle-class people that if they are going to embark on fraud offending of this type they run the risk of their name and reputation being made public,” Mallett told the court.

The judge explained that before Glaser’s name was revealed, suspicion fell on other Cryptopia employees which led to them receiving abuse that caused emotional damage. The judge also said Glaser had caused “incalculable” pain to his family and friends and had shown “little remorse”.

On top of the home detention order and the denial of name suppression, Glaser was ordered to pay NZ$21,225 in reparations to cover the liquidator's cost.

Cryptopia liquidation background

The latest developments from reporting from New Zealand news site Stuff on February 18th that more cryptocurrency was stolen from a Cryptopia related wallet on February the 1st this year. Stuff says $62,000 worth of the XSN cryptocurrency was removed from a wallet owned by US company Stakenet.

The company says it was surprised to see the transaction as it was under the impression these wallets were in the control of Grant Thornton. Stuff says Grant Thornton has not commented on the missing funds but it understands the police have been alerted.

The troubling news followed the December email from Grant Thornton to Cryptopia account holders inviting them to begin an account holder claims process. The email, which directed users to a claims portal site, asked users to provide sensitive account and KYC information. This caused confusion amongst Cryptopia account holders as the portal was launched with no notice from Grant Thornton, or any other official party. However, on December 9th, Grant Thornton confirmed the legitimacy of the portal.

_Content of the Cryptopia emails_

_The newly opened Cryptopia claims portal_

Grant Thornton addressed Cryptopia account holders in a public statement that confirmed the beginning of a claims process. “We invite you to register on the Cryptopia claims portal. This marks the launch of the Cryptopia claims portal to start the process of returning account holders' property,” said the statement. The statement asks account holders to “Please follow the instructions to register as an account holder. We are asking you to confirm certain details of your Cryptopia account so as to ensure that only verified account holders can register in the claims process.”

The emails came after a September 2020 post where Grant Thornton issued details around their progress on the case, explaining that they were finalizing the preliminary claims process and upon completion it hoped to launch a claims portal “by the end of 2020”. In the post the firm told users “We will advise account holders via registered Cryptopia email and our official channels when we are ready to receive account holder claims.”

The emails were sent by no-reply@cryptopia.co.nz, an address that had been used for official communications to users dating back to before the exchange was closed. However, since the emails arrived to radio silence from official channels, some commentators questioned whether an email server could have been compromised and recommended users wait for verification from other channels before offering personal information.

One of these channels is the Cryptopia exchange Twitter account (@Cryptopia_nz). It did provide an update to its over 237,000 followers on December 9th at 1:36pm New Zealand time, tweeting a link to the official Grant Thornton announcement released on the same day. The post was met with a replies from users complaining that they were unable to verify their accounts.

Issues stem from the difficult nature of some of the questions used in the verification process. For example, some users have been asked to provide a date that they performed a specific action on the exchange, or a blockchain transaction ID for a trade or withdrawal. For many users this information is difficult to retrieve due to the length of time that has passed since the exchange was shut down.

Teething difficulties aside, the launch of the claims portal and the beginning of the verification process suggests a Cryptopia refund is at least possible for account holders who register through the portal.

The unauthorised third party

In November 2020 Grant Thornton issued a warning to Cryptopia account holders after a New Zealand court mistakenly released Cryptopia customer data to an “unauthorised third party”.

In an announcement on its website the liquidator said that court staff at the Christchurch High Court mistakenly provided what it describes as “confidential and sensitive” information to an unauthorised third party. The receiver says it is concerned the information may be used to “mislead and influence” the decision making of Cryptopia account holders. Grant Thornton says the third party concerned is associated with a project called “Cryptopia Rescue.”

On its website, Cryptopia Rescue says its purpose is to “form a united front to obtain the return of all coins to participating account holders.” Typically referred to as a ‘class action’, such an action would be permissible under clause 4.24 of New Zealand’s High Court Rules, although class actions are very rare in New Zealand.

According to agreement documents provided by Cryptopia Rescue, any Cryptopia account holders wishing to take part in this group action would need to give their Power Of Attorney to Accendos Group NZ Limited - a company established in New Zealand on the 17th of September 2020. The company’s shares are 100% owned by Hong Kong resident Joseph Pereira. Pereira is also a director of the company, along with Christchurch based Thomas Cattermole and Deon Swiggs, and US based Charles Harman.

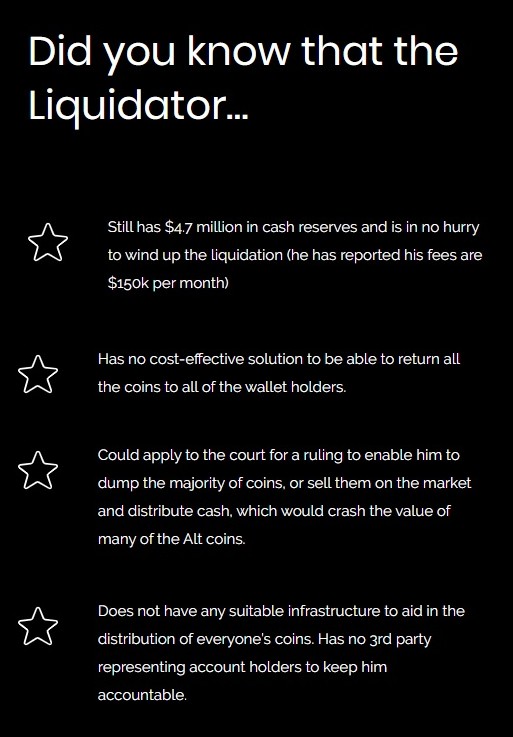

According to New Zealand news site Stuff, Cattermole has had a colorful business career in New Zealand and the Otago Daily Times describes Swiggs as a former Christchurch city councillor “who was ousted from his council seat in last year’s local body elections following allegations he sent ‘grossly inappropriate’ messages to youths.” On its website, the Cryptopia Rescue project makes several allegations about Grant Thornton’s competence to conduct the Cryptopia receivership (see below).

Source: Cryptopia Rescue

For unexplained reasons, the Cryptopia Rescue Agreement also bizarrely states that Cryptopia account holders who sign it will also “be registered free of charge as a citizen of the Principality of Cogito" - which is described as a “decentralized libertarian state.” For its part Grant Thornton says it has taken steps to “restrain the misuse of this confidential information and to recover it from the third party”.

In September, Grant Thornton released information relating to a timeline for returning lost investor's funds. They said the process would involve three steps.

1. Claims registration - Allowing account holders to register their details and to make claims for their account balances.

2. AML/CFT verification - Account holders' identities will be verified to the standard required for New Zealand's antimoney money laundering and counter financing of terror laws.

3. Asset transfers to begin to account holders

Grant Thorton says the claims registration process will occur by year's end and there will be no ability for account holders to reclaim their assets unless they have successfully completed the AML/CFT process. Account holders will be notified when claims registration is available via the email address they were using on Cryptopia, or they can check the Grant Thorton website for updates on when the claims registration portal will be active (is not active yet).

Grant Thornton says that given Cryptopia had 900,000 active accounts trading over 900 different cryptocurrencies at the time of liquidation, the vetting of claims will take significant time, and it expects to return to court in New Zealand for direction over the course of the return process. It says where possible, the actual cryptocurrencies will be returned, not a fiat value equivalent. Grant Thornton confirms that the Cryptopia exchange will not reopen and that its next statutorily required report in the exchange's liquidation will be released in December 2020.

The Cryptopia Rescue statement from Grant Thornton is not the first unusual event since the receivership began and follows the revelation in July that disgruntled Cryptopia victims had hired blue chip New Zealand law firm Chapman Tripp to take on the receiver for what it said had been a failure by Grant Thornton to comply with its duties as a liquidator under the New Zealand Companies Act.

Acting on behalf of machine learning blockchain project GNY, Chapman Tripp lawyers said the liquidators have failed to comply with their duties to accept or reject claims as soon as practicable, to act impartially in the interests of the whole body of creditors, to treat parties with differing interests even-handedly, to protect, realise, and distribute Cryptopia’s assets in a reasonable and efficient manner, and to conduct the liquidation with due care and skill.

Of particular interest to victims of the Cryptopia hack was Chapman Tripp’s observation in its notice to the liquidators, that although Grant Thornton had been able to secure approximately NZ$11M of Cryptopia’s funds since beginning the liquidation process, it had spent NZ$6.7M of that on fees and expenses. Included in the outgoings was NZ$1.7M in fees to Grant Thornton, NZ$1.2M in legal fees, NZ$649,187 for server hosting, NZ$714,143 in salaries to Cryptopia employees and NZ$489,104 in GST payments to NZ’s Inland Revenue department.

Although victims of the exchange failure have questioned if the liquidators have been selling down user's account balances to pay for the liquidation, Grant Thornton has confirmed that a NZ Court has ruled the cryptocurrency in user's accounts is "property" and is to be held in trust. "The liquidation is currently being funded with company assets. Allocation of costs of returning account holders assets will be subject to further direction from the Court. To clarify the account holders’ assets are not recorded in the Receipts and Payments statement, found in the Liquidator’s reports." Grant Thornton has released an updated FAQ on the matter.

What is the Cryptopia exchange?

Cryptopia was a digital asset exchange operated by Rob Dawson and Adam Clark between 2014 and 2019. The exchange was based in Christchurch, New Zealand. Dawson and Clark were better known to customers by their online usernames “Hex” and "sa_ddam213". Dawson has said that he and Clark were compelled to build Cryptopia after negative experiences with other exchanges, and “a desire to build the website that we ourselves wanted to use.”

After two years of operating, Dawson and Clark both quit their jobs in order to run Cryptopia full time. The platform peaked in popularity following the 2017 market-wide bull run, when the value of Bitcoin (BTC) and other cryptographic assets skyrocketed. By 2018, Cryptopia had more than 80 staff members and a user base of ~1.4 million.

On January 15th, 2019 the Cryptopia Twitter account announced that the trading platform had suffered a major security breach resulting in “significant losses.” Trading services were suspended and a police investigation was launched that night. This led to a lockdown and a physical investigation of the company’s headquarters the next day.

The hack saw over 70,000 wallets compromised and over US$23 million in Ethereum (ETH) and ERC-20 tokens stolen. A second hack occurred on January 28th, where an additional US$284,000 from 17,000 wallets was captured. In May 2019 it was announced that the Christchurch based exchange had gone into liquidation. An investigative report by a local media outlet Stuff suggested that there were personal conflicts and tensions between the Cryptopia founding members and executive teams. To date, no one has been charged over the theft.

David Ian Ruscoe and Malcolm Russell Moore, of Grant Thornton New Zealand Limited, were jointly appointed as liquidators of Cryptopia Limited. Grant Thornton New Zealand released its Liquidators’ Third Report on the State of Affairs of Cryptopia on June 12th.

The Report says that customers did not have individual wallets, and it would be impossible to determine individual ownership using just the cryptographic keys registered within the Cryptopia wallets. Cryptopia operated as a centralized exchange and customer trades occurred on the exchange's internal ledger, without any confirmation on blockchains like Bitcoin or Ethereum.

Grant Thornton also stated that a detailed reconciliation process between the customer databases and the crypto-assets held in the Cryptopia wallets has never been completed by the operators of the exchange. The liquidators closed its third report into the Cryptopia failure by stating “at this stage it is not practicable to estimate a completion date for the liquidation.”

On 8th April 2020, the High Court of Christchurch issued a judgment stating that the liquidators estimated Cryptopia had cryptocurrency currently worth about NZD 170 million at the time of the hacks. Somewhere between nine and 14 percent of its cryptocurrency was stolen, according to the court document.

This ruling also gave Moore and Ruscoe the permission to begin the process of reconciling assets lost by Cryptopia. Before the ruling, there was a lack of clarity surrounding whether the digital assets residing in Cryptopia’s wallets were held in trust for account holders.

Judge Gendall says the courts had to clarify concerns around the legal nature and status of the digital assets and potential equitable interests in them. Whether digital assets could be considered property and if Cryptopia’s account holders had rights to this property.

The decision was firstly driven by the fact that cryptocurrency is “property” for the purposes of the Companies Act 1993. And secondly, that the account holders' cryptocurrency is held in a trust by Cryptopia on behalf of users. A separate trust exists for each type of cryptocurrency the exchange held.

In his decision, Judge Gendall explained that it is his view that cryptocurrency was property as it met, “some degree of permanence or stability,” which is a requirement of Section 2 of the Companies Act. This means that the cryptocurrencies are owned by the account holders, and will not form part of the pool of assets available to unsecured creditors.

As per the new liquidator’s report, “this is the first final judgment on a fully contested basis that has considered whether cryptocurrency satisfies the legal definition of property at common law.”

bravenewcoin.com

bravenewcoin.com