Things are going from bad to worse for Coinbase’s Base layer-2 network. Just weeks after $23 million in BALD token liquidity was rug-pulled, Magnate Finance has exit scammed with $6.5 million.

Initial reports from security firm PeckShield claim that Magnate Finance used price oracle manipulation of DAI and wETH to pull off the heist.

Magnate Finance Becomes the Next Base Bad Guy

Its total value locked metric has fallen from around $6.51 million to just under $14,000 at the time of publishing.

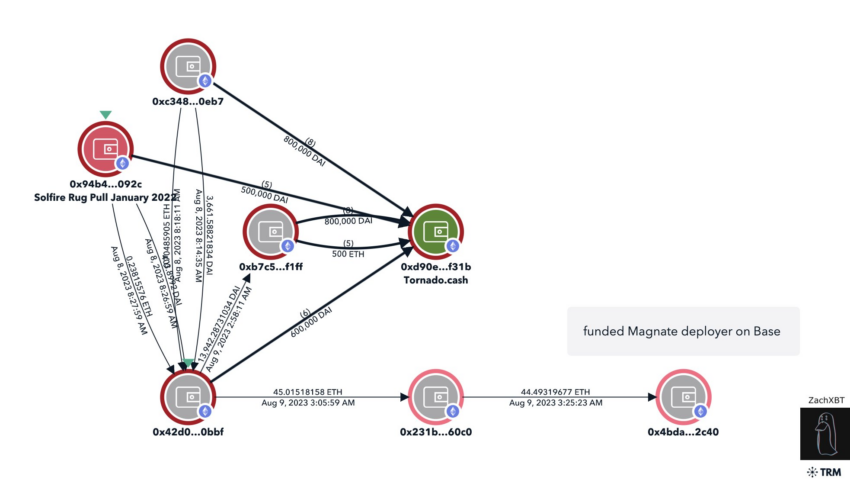

On-chain detective ZachXBT highlighted that the platform website is offline, and the Telegram group has been deleted. The analyst disclosed that the deployer’s address has a direct connection to the Solfire $4.8M exit fraud.

In January 2022, it was discovered that Solfire.Finance swindled more than $3 million. Following the scam, the platform removed its website and social media accounts.

Magnate promoted itself as a lending and borrowing platform. Its tokenomics claimed to rely on layer-2 revenue sharing and a dynamic interest rate model.

The crypto sector has seen its fair share of advancements, but it also faces numerous challenges. Just last week, the crypto community was in uproar after RocketSwap lost 472 Ethereum due to a private key compromise.

Scammers Thriving on Base L2

After Coinbase introduced its Base layer-2 network, it sparked the creation of several decentralized applications. Base promised to create a more scalable, user-friendly Ethereum network. But it didn’t take long for the platform to become a breeding ground for bad actors looking for easy targets.

Among the many projects launched, Encryption AI stands out as a cautionary tale after a ruthless rug pull resulted in a $2 million loss.

Solidus Labs identified more than 500 scam tokens deployed on the blockchain before it even went live. The analysis also revealed that nearly 300 of the deceptive tokens had concealed functions in their smart contracts, allowing infinite coin minting. The report noted that another 70 smart contracts concealed transaction fee changes, and developers structured over 60 as honeypots.

The report also detailed another major Base rug pull that occurred at the end of July. They named the token BALD, after the smooth-shaven head of Coinbase CEO Brian Armstrong.

BALD promoted its meme token on Twitter and recorded massive gains in just 24 hours. Solidus details how BALD manipulated its price and volume on LeetSwap, an L2 network decentralized exchange, and walked away with a staggering $5.2 million.

beincrypto.com

beincrypto.com