OneCoin, a known pyramid scheme which swindled its investors out of $4 million, may be facing some retribution as one plaintiff has filed a lawsuit against the firm after losing $750,000, CCN reports.

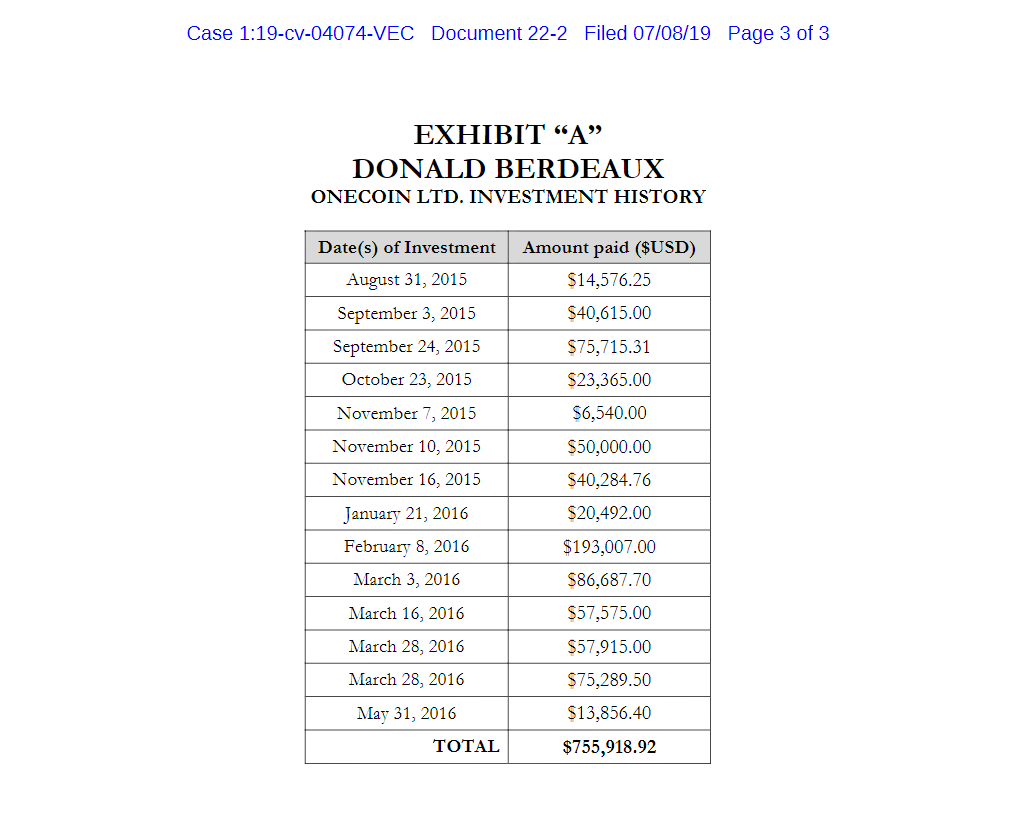

According to documents submitted in a Manhattan court on July 8, proposed lead plaintiff Donald Berdeaux invested around $755,918.92 in OneCoin between August 2015 and May 2016. Between August and November 2015, Berdeux invested $252,096.32 into OneCoin. The next year he added $504,822.60.

Christine Grablis, Bordeaux's proposed co-lead plaintiff, also lost as much as $100,000 to OneCoin. As per the court documents, Grablis invested $64,813 between August and November 2015. She then invested a further $38,715 between January and August of 2016, meaning she lost a total of $103,578.

Grablis began the lawsuit proceedings two months ago. Her and Bordeaux have both indicated that “to the best of their knowledge, there are no other applicants with a bigger financial interest who are seeking to be the lead plaintiffs.”

According to prosecutors, the OneCoin scam generated about $3.8 billion from Q4 of 2018 and Q3 of 2016.