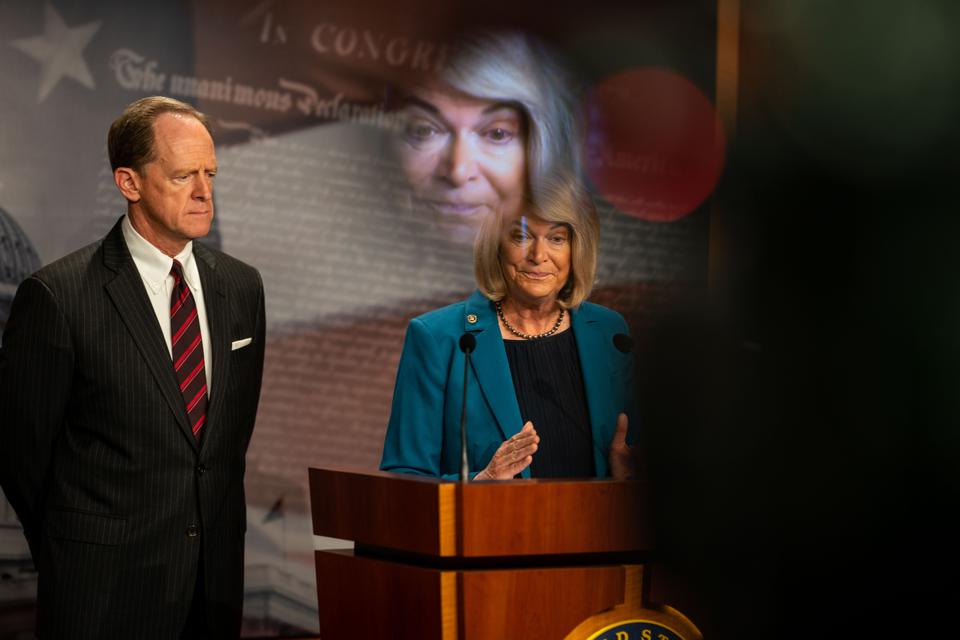

The 118th Congress has reached a milestone of seeing 50 bills and resolutions that have been introduced so far which cover the crypto regulatory landscape in a variety of ways. The number of bills does not even include draft legislation on stablecoins from either Senator Pat Toomey (R-PA) or Representative Josh Gottheimer (D-NJ), nor a much-discussed but not yet public bill that would cover the entire digital asset regulatory sphere from Senators Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY).

These numbers may be eye-popping but by no means surprising. The amount of legislation currently introduced in Congress reflects the passing of the Infrastructure and Investment Jobs Act that became law in 2021, representing the first time a new law that directly impacted the crypto industry was passed. With the surge in the crypto markets that continued after that bill became law last year up until the recent crash, much has also been reported in the media regarding a surge of crypto lobbying efforts as well as attempts to influence politicians with significant campaign fundraising as well.

In addition, the types of policy impacts that digital assets touches from foreign relations, monetary policy, consumer protection, and interpretations over how digital assets are considered, whether as securities or commodities for the industry has broadened attention among a larger pool of policymakers. Combine multiple policy impacts with emerging technologies such as decentralized finance and NFTs, makes the exploration of new legislation for the industry a fascinating and complex path for D.C. policymakers.

Not only is the innovative technologies of digital assets and distributed ledger technologies disruptive, but also has created new policy scenarios such as ransomware where Bitcoin is requested as payment and sanctions when Ukraine has been able to leverage crypto donations to benefit both its military and aid in the humanitarian crisis of war, while the U.S. seeks to sanction Russia and not allow cryptocurrency to be used as a back door to their efforts.

Based on research completed at the Value Technology Foundation (VT

I. Crypto Taxation

H.R. 3684 became public law on November 15, 2021, and is required to be implemented in terms of the crypto tax reporting requirements by January 1, 2023. The Infrastructure Investment and Jobs Act provided a definition of digital assets and created a new definition for a ‘broker’ as the IRS would consider someone for purposes of required tax reporting, as, “...any person who (for consideration) is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person.’’

The crypto industry took exception as to how this wording could potentially include cryptocurrency miners, stakers, and programmers, who would not have access as a cryptocurrency exchange would to the information necessary to report to the Internal Revenue Service (IRS) and be in compliance with the law. While the U.S. Treasury is promulgating how the industry will need to comply, there have been no less than five bills introduced in an attempt to modify or reverse the impact of the legislation.

Senator Ron Wyden (D-OR) introduced S. 3249, a bipartisan bill with Senator Cynthia Lummis (R-WY), in an attempt to change to language that had been agreed upon for the original bill; however due to the ways Amendments were permitted to be introduced during the debate on the Senate floor, the language was prevented from making its way into the final text. Senator Ted Cruz (R-TX) sought with the introduction of S. 3206 to repeal the provisions of H.R. 3684 entirely.

In the House of Representatives, Representative Patrick McHenry (R-NC) sought with the Keep Innovation In America Act (H.R. 6006) to “...expand the definition of broker, for purposes of tax information reporting, to include any person who (for consideration) stands ready in the ordinary course of a trade or business to effect sales of digital assets at the direction of their customers.” This new definition on who is a broker would clarify the language and is a bipartisan bill with 19 co-sponsors in the House, with Representative Tim Ryan (D-OH) leading on the Democratic side. Congressman Darren Soto (D-FL) also made two attempts to help clarify the language in the bill with H.R. 5082, the Cryptocurrency Tax Clarity Act, and H.R. 5083, the Cryptocurrency Tax Reform Act.

Aside from what is now Public Law 117-58 and the bills described to change the way tax reporting is handled for digital assets, Congressman Tom Emmer (R-MN) had introduced previously the Safe Harbor For Taxpayers With Forked Assets Act of 2021 (H.R. 3273) which would exclude from gross income, for income tax purposes, any amount received as forked convertible virtual currency. It also would establish a safe harbor period to suspend any penalties to a taxpayer who receives a forked convertible virtual currency until the IRS issues regulations or guidance, or legislation is enacted, to make clear what is required. Congresswoman Susan K. Delbene (D-WA) with Congressman David Schweikert (R-AZ) introduced the bipartisan Virtual Currency Tax Fairness Act of 2022 (H.R. 6582) that would exempt personal transactions made with virtual currency when the gains are $200 or less. Delbene stated that not having a de minimus exemption, “...makes the everyday use of virtual currency near impossible, discouraging people from using it and inhibiting the growth of our digital economy.”

II. Central Bank Digital Currency (CBDC) Bills

The Central Bank Digital Currency Study Act of 2021 (H.R. 2211) was introduced by Congressman French Hill (R-AR) with Congressman Bill Foster (D-IL), who were the original Representatives that prodded the Federal Reserve about the potential need for a CBDC. This bill would require the Board of Governors of the Federal Reserve System, (Fed) in consultation with the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), the Department of the Treasury (Treasury), the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC), to study the impact of the introduction of a CBDC. The Report would focus on inclusion, accessibility, safety, privacy, convenience, speed, and price considerations for individuals and small businesses, impacts to monetary policy and systemic risks to the global financial system, among others. The Executive Order on Digital Assets issued by President Biden on March 9th captures many of the considerations in this bill by making the study of and potential implementation of a CBDC as urgent.

The 21st Century Dollar Act (H.R. 3506) was also sponsored by Hill and co-sponsored by Congressman Jim Himes (D-CT) where a holistic approach to how to keep the U.S. dollar as the world reserve currency is presented, which of course does include the idea of a CBDC. The Automatic Boost to Communities Act (H.R. 1030) would require that as part of stimulus payments during Covid-19, a form of payment in a new ‘digital dollar’ would be made available, including the ability to use a digital dollar wallet to receive the funds. Senator Bill Hagerty (R-TN) introduced (S. 2543), a bill with nine co-sponsors in the Senate that seeks to study in depth the national security implications of China creating a CBDC of its own, which is commonly known as e-CNY.

Emmer introduced H.R. 6415 in the House, which Cruz introduced as a companion bill in the Senate (S. 3954) that limits how the Fed can interact with the American public with respect to any new CBDC that may be introduced. The bill says, “... a Federal reserve bank may not offer products or services directly to an individual, maintain an account on behalf of an individual, or issue a central bank digital currency directly to an individual.” Meanwhile, the E-Cash Act (H.R. 7231) was introduced by Representative Stephen Lynch (D-MA) that focuses the U.S. Treasury on creating a digital dollar to replicate cash that diverts from the notion of a CBDC that would be created by the Federal Reserve.

This Congress also saw for the first time a CBDC introduced based on an existing digital asset, in this case bitcoin in El Salvador. With El Salvador making the digital currency legal tender, Senator James Risch (R-ID) and Senator Ed Menendez (D-NJ), the Ranking Member and Chair of the Senate Foreign Relations Committee respectively, introduced the Accountability for Cryptocurrency In El Salvador Act (ACES) Act (S. 3666). This bill expressed concern about the decision of El Salvador to take such a step in its monetary policy and would prompt the U.S. Department of State to study a variety of potential implications to the U.S. and the global financial system.

III. Clarity on Regulatory Treatment of Digital Assets and Digital Asset Securities

The Blockchain Regulatory Certainty Act (H.R. 5045) was introduced by Emmer and offers protection for ‘non-controlling’ blockchain services And software developers. This would prevent any blockchain developer or provider of a blockchain service from being treated as a money transmitter or financial institution unless, “...the developer or provider has, in the regular course of business, control over digital currency to which a user is entitled under the blockchain service or the software created, maintained, or disseminated by the blockchain developer.”

The Token Taxonomy Act (H.R. 1628) as introduced by Representative Warren Davidson (R-NC) sought to address the challenges the SEC has had in providing clear guidance around what are digital asset securities and digital assets. McHenry introduced the Clarity for Digital Tokens Act of 2021 (H.R.5496) that would make into law a safe harbor for tokens that had originally been introduced by SEC Commissioner Hester Peirce.

The Digital Asset Market Structure and Investor Protection Act (H.R. 4741) was introduced by Congressman Don Beyer (D-VA) soon after the Infrastructure Act became law that covered regulations for the entire digital asset industry. The Securities Clarity Act (H.R. 4451) was introduced by Emmer that sought to clarify that, “...an investment contract asset (for example, a digital token) is separate and distinct from the securities offering that it may have been a part of.” The approach of the Securities Clarity Act was technology-neutral, and applies equally to all assets offered and sold, whether tangible or digital. The Eliminate Barriers to Innovation Act of 2021 (H.R. 1602) sponsored by McHenry, was bipartisan and co-sponsored by Lynch. The bill passed the House of Representatives and sought to create a SEC and CFTC working group to help provide regulatory clarity to digital assets.

Soto introduced two bipartisan bills including the U.S. Virtual Currency Consumer Protection Act of 2021 (H.R. 5100) that directs the CFTC to describe how price manipulation could happen in virtual markets and make recommendations for regulatory changes to improve the CFTC's price manipulation prevention procedure. The Virtual Currency Market and Regulatory Competitiveness Act of 2021 (H.R. 5101) would direct the CFTC to report on virtual currency markets and U.S. competitiveness. In addition, the Digital Taxonomy Act (H.R. 3638) would direct the Federal Trade Commission (FTC) to report to Congress on actions related to digital tokens. Parts of the Digital Taxonomy Act were included in the Consumer Safety Technology Act (H.R. 3723) that passed out of the House of Representatives.

A follow-up story will be published tomorrow that will include a discussion of bills introduced to support blockchain technology, bills addressing issues of sanctions and ransomware, and access and limitations on use of digital assets by U.S. elected officials. The full report on the legislation for the 118th Congress will be released later this year and available on www.valuetechnology.org.

forbes.com

forbes.com