The US congress’ Financial Service Committee has undertaken a hearing on stablecoins, discussing their benefits, risks, and applications with figures from the crypto industry. The investigation will have six crypto executives present the case for cryptocurrencies. Those expected to testify include Brian Brooks (Bitfury Group), Sam Bankman-Fried (FTX), Alesia Haas (CFO Coinbase), Jeremy Allaire (Circle), Denelle Dixon (Stellar) and Charles Cascarilla (Paxos).

The hearing was designed to help members of the committee determine its next line of action regarding stablecoins and other crypto issues. It is also part of a crypto fact-finding mission that precedes potential legislative efforts for the US.

Crypto Regulation, Top of The Agenda

Surprisingly, the hearings did not feature much discussion of Tether, despite it commanding a $76 billion market cap and being a vital part of the crypto industry’s trading infrastructure.

The hearings reflected a desire for members of Congress to learn more about cryptocurrencies amidst growing calls for greater regulatory clarity. The unclear regulatory framework in the US is seen as a significant reason for the brain drain in the industry, leading to concerns that if left the way it is, the US may have to play catch up to the rest of the world.

The crypto proponents at the hearing will urge Congress to provide more precise rules for the booming $3 trillion industry. Instead of forcing the industry to comply with existing regulations, carefully tailored rules should be enacted. Alesia Haas, Coinbase’s Chief Financial Officer spoke on this.

“Without tailored legislative solutions that are openly debated with public participation, the United States risks unnecessarily onerous and chilling laws and regulations.”

The increased support for more regulation from politicians and other members of Congress seems to have hastened the process. However, Congress is unlikely to enact new crypto rules anytime soon as they regarded the hearing as a fact-finding exercise. Chairwoman of the panel, Maxine Waters, who pledged to examine the crypto industry thoroughly, seems to be doing just that.

Meanwhile, lawmakers have lauded executives for paving the way for what could be a game-changing technology for the financial system. Congressman Pete Sessions said he was tremendously impressed with the ingenuity and entrepreneurial spirit shown and called for more support.

Join our Telegram group and never miss a breaking digital asset story.

Stablecoins Come Under Scrutiny

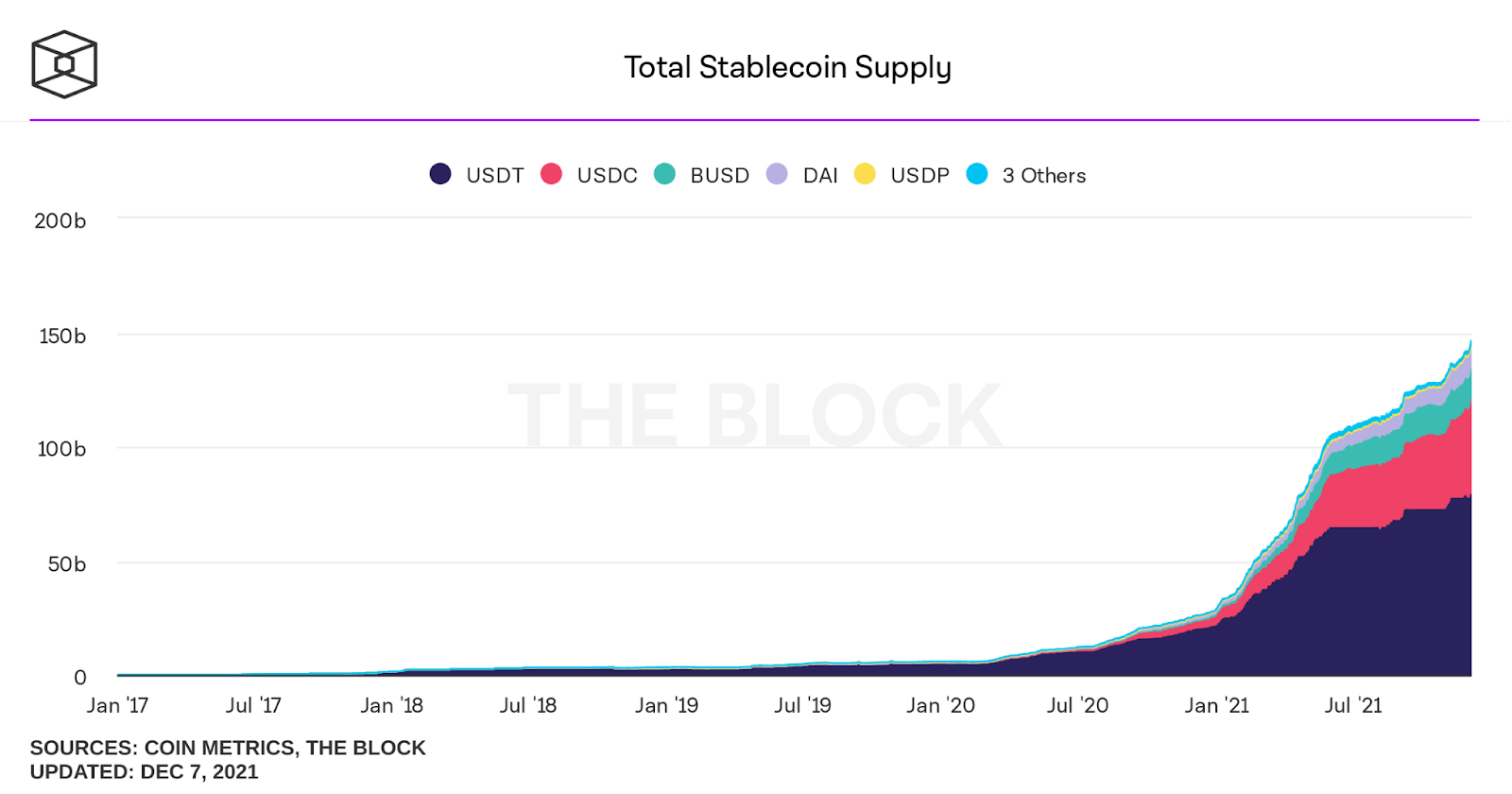

Data provided by The Block shows that stablecoins have experienced a boom in supply and market capitalization. This rapid growth has piqued regulators’ interest, with concerns that the financial system may become jeopardized if its not adequately monitored. Given its global importance, top government officials have already made calls to regulate the growing subsector.

In 2021, the market capitalization of stablecoins issued by the most prominent issuers surpassed $127 billion. This figure represents a nearly 500% increase over the previous year. As seen in the chart below, a few larger US dollar-pegged coins dominate the current market.

Some policymakers, including Senator Elizabeth Warren and Securities and Exchange Commission Chair Gary Gensler, have shown concern. They believe that the products could be used for illegal purposes or to exploit unsuspecting users. In November, a working group led by the US Treasury recommended that Congress pass laws regarding pegged coins. The legislation requires stablecoins to be issued only by companies with insured deposits, such as banks. Especially as some of these coins have not been sufficiently proven to be backed as their issuers claim. This situation could lead to a digital bank run that threatens the broader economy,

Executives at the plenary have reiterated that while regulatory clarity could help the industry expand, overly restrictive rules could be counterproductive. The sector’s rapid growth demonstrates a strong investor appetite for digital assets, which should be supported rather than stifled. However, the complexity and volatility of cryptocurrencies and widely disparate standards for disclosure, reserves, consumer protection, etc., have alarmed lawmakers.

Do you see the US being left behind if proper regulations are not made for the crypto industry? Let us know in the comments below.

tokenist.com

tokenist.com