From crypto skeptic to advocate, popular TV host and investor Kevin O’Leary finds safe harbor from inflation with stablecoin staking.

O’Leary Says He Is a Circle Customer

Over the past couple of months, it has become clear that the Fed’s projections on inflation were wildly off the mark. Although the term “transitory inflation” was initially used, it seems that investors are now starting to prepare for inflation to stay around for a while longer.

TV personality and investor Kevin O’Leary is estimated to have a net worth of $400 million. Having received his nickname ‘Mr. Wonderful’ in the first season of Shark Tank, he is a public figure that has shifted his position on cryptocurrency.

In 2019, O’Leary called Bitcoin “garbage“. Even this January, he dubbed it as a “gain-nothing burger“. Since then, O’Leary has not been investing 3% of his portfolio in Bitcoin but is now experimenting with stablecoins. In an interview with CNBC’s Halftime Report, he revealed he is staking USDC:

“The inflation is over 2%, I’m losing a lot even in a 12-month period. They said ‘why don’t you stake USDC stablecoin…you can make 4.7% to 6% in a 90-day period.’ “

O’Leary then relayed that his compliance officers and accountants responded with

“What, are you out of your mind? You can’t do that“.

However, it is not clear how much USDC he is staking. Mr. Wonderful merely called it a “small experiment” — a relative concept for someone purportedly worth $400 million.

Does It Make Sense to Stake USDC?

At the end of O’Leary’s appearance on Halftime Report, he noted that inflation is now the major reason why there is more institutional pressure than ever to get into crypto:

“This is where the world is going. This has to get resolved because people with cash have to have some kind of protection against inflation. The only place you can find it is in crypto, how crazy is that?”

Just last week, we had noted that every 30 days, the dollar’s purchasing power slips by 1%. Nonetheless, stablecoins are merely collateralized cryptocurrencies, pegged to the USD in a 1:1 ratio. Meaning, $1 USD equals 1 USDC. The question then is, why would a stablecoin offer better yields than fiat money?

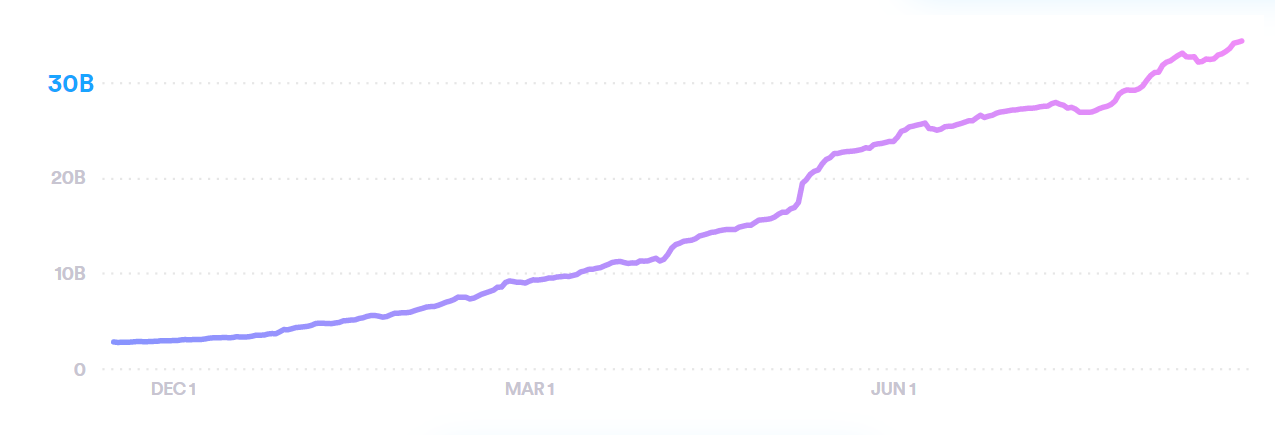

Being cryptocurrencies backed by reserves, stablecoins have always been a great asset for crypto traders, as demonstrated by a 59% transaction volume increase from Q1 to Q2 2021. They provide fiat money stability while removing crypto volatility. Whether we are talking about BlockFi or Coinbase, the reason they can offer high APY (annual percentage yield) comes from high demand.

Join our Telegram group and never miss a breaking digital asset story.

The Reason for High Stablecoin Yields Explained

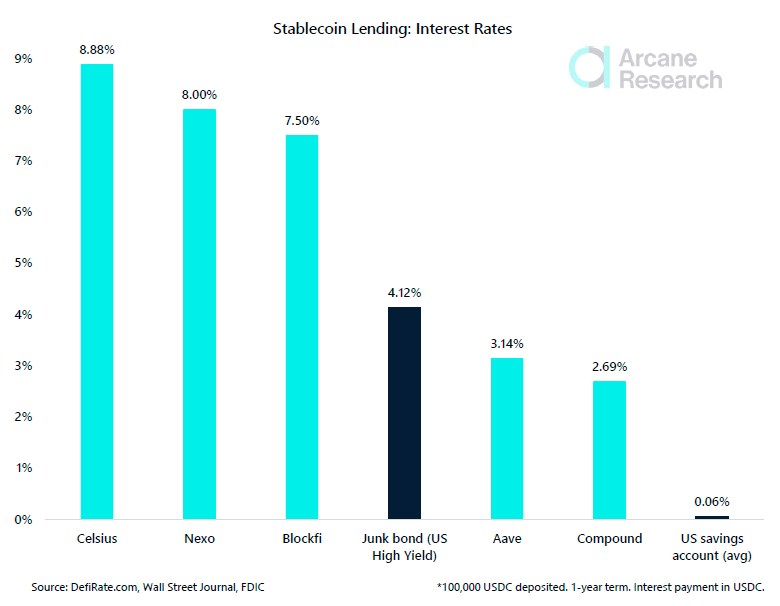

Presently, banks don’t view ‘true’ cryptocurrencies, such as Bitcoin or Ethereum, as sufficient collateral for lending due to their volatility. This represents a handicap to access the credit market, making stablecoins a highly-sought asset. In turn, companies can translate that demand as higher interest rates.

Image credit: Arcane Research

Case in point, if someone had bought ETH last July for under $300, it could now be sold for 15x gain. Obviously, this would be a good time to sell and take profits. However, what if the investor thinks ETH could go even go higher and doesn’t want to sell?

This is where stablecoins come in as a solution. Instead of selling ETH itself, an investor could go to a crypto service like BlockFi and ask for a loan, worth half as much as their ETH holdings. The borrower would have to pay around 4.5% APR depending on the amount of ETH staked. At the same time, stablecoin stakers would gain between 8- 9%.

This spread difference is how crypto banks offering high stablecoin yields make their money. Essentially, this means that the more the stablecoin market is regulated, such as FDIC insurance, the quicker the stablecoin yields are likely to drop.

Why Would O’Leary Pick Circle and USDC?

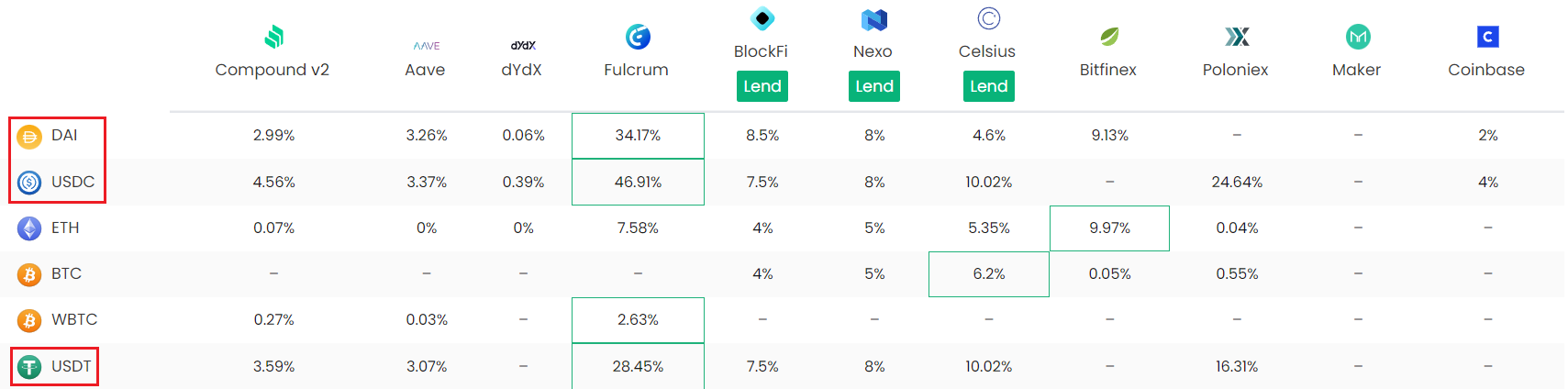

When it comes to picking the right stablecoin, big considerations are crypto exchange liquidity and transparency. Of the top four stablecoins – DAI, USDT, USDC, and PUSD — the latter two are the most regulated, holding transparent listings of their reserves.

Circle, headed by Jeremy Allaire, is following in the footsteps of Coinbase by going public on the NYSE through a $4.5 billion SPAC deal. Interestingly, USDC is within the top 10 cryptos; just above Dogecoin (DOGE) with a $34.4 billion market cap.

As far as Circle’s staking program goes, the longer the period USDC funds are locked, the higher the yield. At one month, it is only 7.1%, while 12 months yield 7.85%. Peculiarly, the FinTech company markets its staking in contrast with the Federal reserve, describing it as having no collateral.

This is quite odd given that both US treasuries and USDC essentially rely on the same repurchase agreement (repo) as the backbone of the US financial system. Considering that the stability of USD is being eroded, other solutions are already being explored, such as algorithmic stablecoin Ampleforth.

$10k in a crypto bank at a rate of 7.85% would yield $785 per year. Do you think the lack of FDIC insurance would be worth it? Let us know in the comments below.

tokenist.com

tokenist.com