A single mining pool was seen to gain more than half of the total mined blocks on the entire Bitcoin Cash's network some time today.

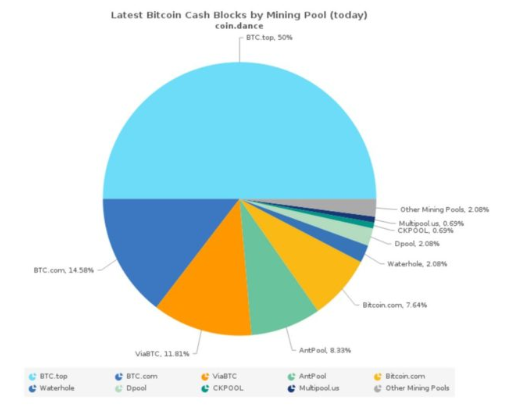

Mining pool, BTC.TOP is reported to have reached more than half of the total Bitcoin Cash (BCH) hash rate some time today, according to the data from Coin Dance.

As reported by CCN, the China-based mining company “successfully” gained 50.2% of the entire BCH network, making them the biggest among the other mining pools in the Bitcoin Cash network.

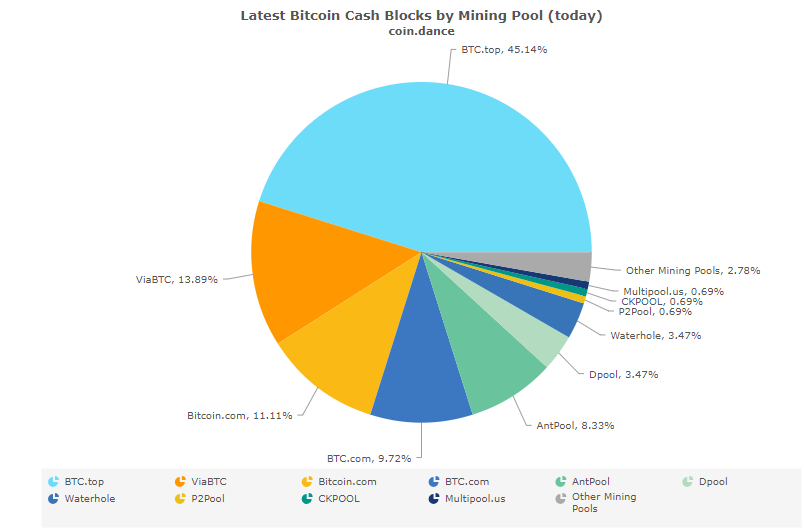

Although as of writing time, it already shows a reduced percentage of the amount of mined BCH blocks at 45.14%.

BTC.TOP’s mining power is way above the other pools, with 679 Peta-Hash per second against, ViaBTC’s 215 PH/s, BTC.com’s 257 PH/s, Bitcoin.com’s 187 PH/s, and AntPool’s 125 PH/s.

While it could happen due to various factors, it did show how the BCH network is actually very prone to a 51% attack scenario as well as how centralized it is.

Previously, the Roger Ver’s network also received a critic from Bitpico, an anonymous developer for failing a “stress test”. Bitpico revealed the evidence that showed how BCH is highly-exposed to seizures and security threats due to the fact that 98% of all BCH nodes were sitting on the same server rack.

Moreover, Microsoft’s identity chief, Alex Simons once said that BCH’s increasing their block size has actually made them a threat to the decentralization concept, even more than scalability solutions like the Lightning Network.

Moving forward, it is quite obvious that the Bitcoin Cash team should upgrade their capability to ensure their network can’t easily be controlled by a single entity.

Since in a worst-case scenario, if mining pools decide to combine their hashrate output, they will be powerful enough to reverse confirmed transactions, prevent transactions’ confirmation or perform double spending, as how it happened with Bitcoin Gold last year.

As a reminder, Bitcoin Gold’s network experienced a 51% attack for a couple of days, during which the attackers successfully stole around $18 million worth of BTG tokens.

In another case, a mining pool that crossed the 50% barrier unintentionally, like GHash.io decided to reduce their computing power to 40%, following the community’s adverse reactions.

How would the BCH community react and what steps will be taken? Stay tuned on Chepicap for updates.